Question: 1. All else being equal, the bond with sinking fund has higher coupon rate than the bond without sinking fund. II. Inverted yield curve suggest

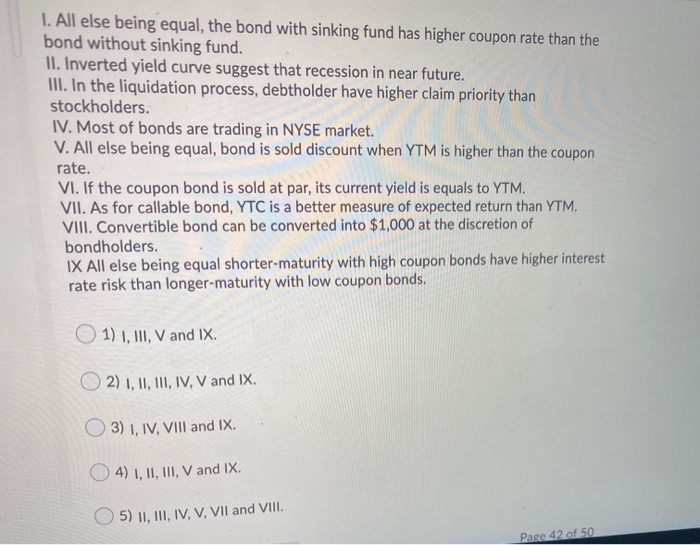

1. All else being equal, the bond with sinking fund has higher coupon rate than the bond without sinking fund. II. Inverted yield curve suggest that recession in near future. III. In the liquidation process, debtholder have higher claim priority than stockholders. IV. Most of bonds are trading in NYSE market. V. All else being equal, bond is sold discount when YTM is higher than the coupon rate. VI. If the coupon bond is sold at par, its current yield is equals to YTM. VII. As for callable bond, YTC is a better measure of expected return than YTM. VIII. Convertible bond can be converted into $1,000 at the discretion of bondholders. IX All else being equal shorter-maturity with high coupon bonds have higher interest rate risk than longer-maturity with low coupon bonds. 1) I, III, V and IX. 2) I, II, III, IV, V and IX. 3) I, IV, VIII and IX. 4) I, II, III, V and IX. 5) II, III, IV, V, VII and VIII. Page 42 of 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts