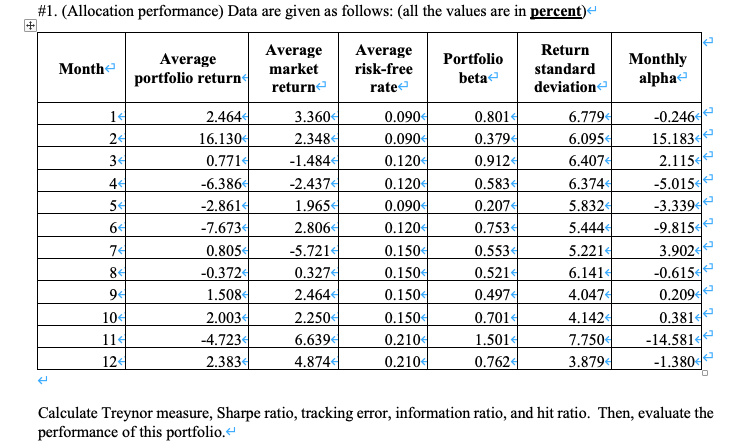

Question: #1. (Allocation performance) Data are given as follows: (all the values are in percent) Month Average portfolio return Average market return Average risk-free rate Portfolio

#1. (Allocation performance) Data are given as follows: (all the values are in percent) Month Average portfolio return Average market return Average risk-free rate Portfolio beta Return standard deviation Monthly alpha 14 24 34 44 54 6 74 84 94 10 114 12 2.464 16.130 0.7714 -6.386 -2.8614 -7.673 0.8054 -0.372 1.508 2.003 -4.7234 2.3834 3.3604 2.3484 -1.4844 -2.4374 1.9654 2.8064 -5.7214 0.3274 2.464 2.2504 6.6394 4.87441 0.090 0.090 0.120 0.120 0.090 0.120 0.150 0.1504 0.1504 0.1504 0.2104 0.2104 0.8014 0.379 0.912 0.5834 0.2074 0.7534 0.553 0.5214 0.4974 0.701 1.5014 0.7624 6.7794 6.0954 6.4074 6.374 5.8324 5.444 5.2214 6.141 4.0474 4.1424 7.750 3.879 -0.24642 15.1834 2.1154 -5.01542 -3.3394 -9.8154 3.9024 -0.6154 0.209 0.3814 -14.5814 -1.380 Calculate Treynor measure, Sharpe ratio, tracking error, information ratio, and hit ratio. Then, evaluate the performance of this portfolio. #1. (Allocation performance) Data are given as follows: (all the values are in percent) Month Average portfolio return Average market return Average risk-free rate Portfolio beta Return standard deviation Monthly alpha 14 24 34 44 54 6 74 84 94 10 114 12 2.464 16.130 0.7714 -6.386 -2.8614 -7.673 0.8054 -0.372 1.508 2.003 -4.7234 2.3834 3.3604 2.3484 -1.4844 -2.4374 1.9654 2.8064 -5.7214 0.3274 2.464 2.2504 6.6394 4.87441 0.090 0.090 0.120 0.120 0.090 0.120 0.150 0.1504 0.1504 0.1504 0.2104 0.2104 0.8014 0.379 0.912 0.5834 0.2074 0.7534 0.553 0.5214 0.4974 0.701 1.5014 0.7624 6.7794 6.0954 6.4074 6.374 5.8324 5.444 5.2214 6.141 4.0474 4.1424 7.750 3.879 -0.24642 15.1834 2.1154 -5.01542 -3.3394 -9.8154 3.9024 -0.6154 0.209 0.3814 -14.5814 -1.380 Calculate Treynor measure, Sharpe ratio, tracking error, information ratio, and hit ratio. Then, evaluate the performance of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts