Question: 1. Alphas Net Future Worth (NFW) at EOY5. 2. Gammas Net Present Worth (NPW) at EOY10. 3. Alphas NPW at EOY0. 4. Betas Annual Equivalent

1. Alphas Net Future Worth (NFW) at EOY5.

2. Gammas Net Present Worth (NPW) at EOY10.

3. Alphas NPW at EOY0.

4. Betas Annual Equivalent Worth (AEW).

5. Gammas AEW over 20 years (it was repeated)

Please answer using Discrete compound interest factor tables for 10%.

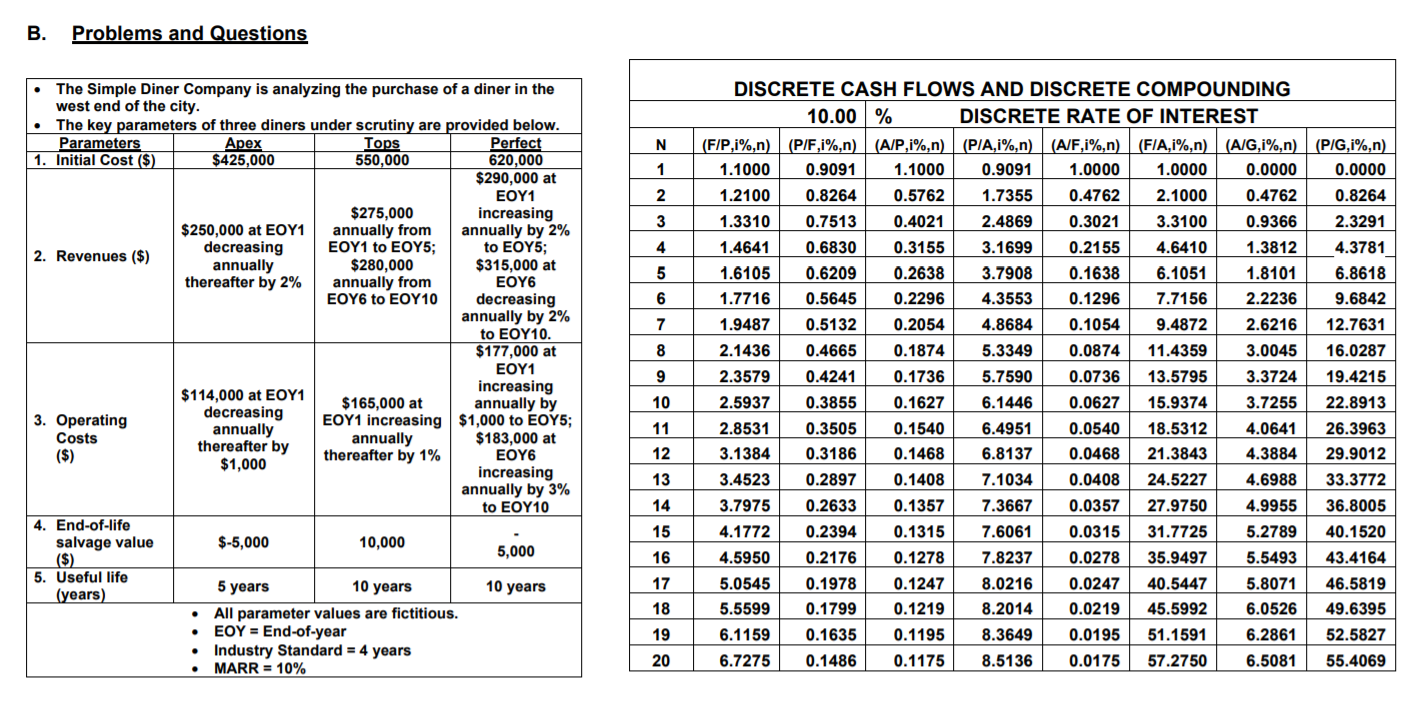

B. Problems and Questions 1 2 3 4 5 6 7 8 The Simple Diner Company is analyzing the purchase of a diner in the west end of the city. The key parameters of three diners under scrutiny are provided below. Parameters Apex Tops Perfect 1. Initial Cost ($) $425,000 550,000 620,000 $290,000 at EOY1 $275,000 increasing $250,000 at EOY1 annually from annually by 2% decreasing EOY1 to EOY5; 2. Revenues ($) to EOY5; annually $280,000 $315,000 at thereafter by 2% annually from EOY6 EOY6 to EOY10 decreasing annually by 2% to EOY10. $177,000 at EOY1 $114,000 at EOY1 increasing $165,000 at annually by 3. Operating decreasing EOY1 increasing $1,000 to EOY5; annually Costs thereafter by annually $183,000 at ($) $1,000 thereafter by 1% EOY6 increasing annually by 3% to EOY10 4. End-of-life salvage value $-5,000 10,000 5,000 ($) 5. Useful life 5 years 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard 4 years MARR = 10% 9 DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00 % DISCRETE RATE OF INTEREST (F/P,i%,n) (P/F,1%,n) (A/P,i%,n) (PIA,i%,n) (A/F,i%,n) (FIA,i%,n) (A/G,i%,n) (P/G,i%,n) 1.1000 0.9091 1.1000 0.9091 1.0000 1.0000 0.0000 0.0000 1.2100 0.8264 0.5762 1.7355 0.4762 2.1000 0.4762 0.8264 1.3310 0.7513 0.4021 2.4869 0.3021 3.3100 0.9366 2.3291 1.4641 0.6830 0.3155 3.1699 0.2155 4.6410 1.3812 4.3781 1.6105 0.6209 0.2638 3.7908 0.1638 6.1051 1.8101 6.8618 1.7716 0.5645 0.2296 4.3553 0.1296 7.7156 2.2236 9.6842 1.9487 0.5132 0.2054 4.8684 0.1054 9.4872 2.6216 12.7631 2.1436 0.4665 0.1874 5.3349 0.0874 11.4359 3.0045 16.0287 2.3579 0.4241 0.1736 5.7590 0.0736 13.5795 3.3724 19.4215 2.5937 0.3855 0.1627 6.1446 0.0627 15.9374 3.7255 22.8913 2.8531 0.3505 0.1540 6.4951 0.0540 18.5312 4.0641 26.3963 3.1384 0.3186 0.1468 6.8137 0.0468 21.3843 4.3884 29.9012 3.4523 0.2897 0.1408 7.1034 0.0408 24.5227 4.6988 33.3772 3.7975 0.2633 0.1357 7.3667 0.0357 27.9750 4.9955 36.8005 4.1772 0.2394 0.1315 7.6061 0.0315 31.7725 5.2789 40.1520 4.5950 0.2176 0.1278 7.8237 0.0278 35.9497 5.5493 43.4164 5.0545 0.1978 0.1247 8.0216 0.0247 40.5447 5.8071 46.5819 5.5599 0.1799 0.1219 8.2014 0.0219 45.5992 6.0526 49.6395 6.1159 0.1635 0.1195 8.3649 0.0195 51.1591 6.2861 52.5827 6.7275 0.1486 0.1175 8.5136 0.0175 57.2750 6.5081 55.4069 10 11 12 13 14 15 16 10 years 17 . 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts