Question: 1. Alphas Net Present Worth (NPW) (rounded to the nearest $100) of a) $22,800; b) $24,500; c) $27,000; d) $29,700. 2. Betas NPW (rounded to

1. Alphas Net Present Worth (NPW) (rounded to the nearest $100) of

a) $22,800; b) $24,500; c) $27,000; d) $29,700.

2. Betas NPW (rounded to the nearest $100) is

a) $59,000; b) $61,300; c) $64,100; d) $78,100.

3. Gammas Net Future Worth (NFW) (rounded to the nearest $100) after 5 years is

a) $312,900; b) $325,600; c) $412,900; d) $415,300.

4. Alphas Annual Equivalent Worth (AEW) (rounded to the nearest $100) is

a) $7,800; b) $8,500; c) $9,300; d) $9,500.

5. Gammas AEW (rounded to the nearest $100) over 30 years (it was repeated several times) is

a) $10,900; b) $11,200; c) $11,600; d) $13,800.

6. The best tractor based on the NFW method is

a) Alpha; b) Beta; c) Gamma.

7. Based on the simple payback method, Alphas recovery period (to the nearest half or full year) is

a) 2.5; b) 3.0; c) 3.5; d) 4.0.

8. Based on the simple payback method, Betas project balance after 2 years (rounded to the nearest $100) is

a) $-220,100; b) $-119,900; c) $54,100; d) $79,100.

9. Based on the discounted payback method, Betas recovery period (to the nearest half or full year) is

a) 7.0; b) 7.5; c) 8.0; d) 9.0.

10. Based on the discounted payback method, Betas project balance after 2 years (rounded to the nearest $100) is

a) $-296,300; b) $-285,800; c) $-89,400; d) $36,800.

11. Based on the simple payback method, Gammas recovery period (rounded to the nearest half or full year) is

a) 3.5; b) 4.5; c) 6.0; d) 7.0.

12. Alphas benefit/cost (B/C) ratio (second decimal; no rounding) is

a) 0.88; b) 1.03; c) 1.12; d) 1.18.

13. Gammas benefit/cost (B/C) ratio (second decimal; no rounding) is

a) 0.96; b) 1.01; c) 1.04; d) 1.17.

14. The incremental B/C ratio (second decimal; no rounding) between the Alpha and Beta tractors is

a) 0.95; b) 1.07; c) 1.12; d) 1.16.

15. The incremental B/C ratio (second decimal; no rounding) between the Beta and Gamma tractors is

a) 0.67; b) 0.94; c) 1.02; d) 1.15.

16. Alphas Internal Rate of Return (IRR) (first decimal; no rounding) is

a) 12.9%; b) 13.5%; c) 14.1%; d) 14.5%.

17. Betas Internal Rate of Return (IRR) (first decimal; no rounding) is

a) 12.7%; b) 13.4%; c) 13.8%; d) 14.1%.

18. The incremental Internal Rate of Return (IRR) between the Alpha and Gamma tractors (second decimal; no rounding) is

a) 10.29%; b) 10.52%; c) 11.47%; d) 12.23%.

19. Alphas External Rate of Return (ERR) (second decimal; no rounding) is

a) 13.47%; b) 14.13%; c) 14.77%; d) 15.19%.

20. Gammas External Rate of Return (ERR) (second decimal; no rounding) is

a) 8.67%; b) 9.67%; c) 10.45%; d) 11.44%.

21. The incremental External Rate of Return (ERR) between the Alpha and Gamma tractors (second decimal; no rounding) is

a) 10.43%; b) 10.85%; c) 11.49%; d) 12.18%.

22. The incremental External Rate of Return (ERR) between the Beta and Gamma tractors (second decimal; no rounding) is

a) 9.55%; b) 9.85%; c) 10.17%; d) 11.75%.

23. The best tractor based on the Simple Payback method is

a) Alpha; b) Beta; c) Gamma.

24. Must the annual equivalent (AE) and the simple payout methods come to the same conclusion as to the acceptance of a project?

a) Yes; b) No.

25. If the companys farm tractor budget is $700,000, which tractor(s) should it purchase assuming that tractors are independent investments?

a) Gamma only; b) Alpha and Beta; c) Alpha and Gamma; d) Beta and Gamma.

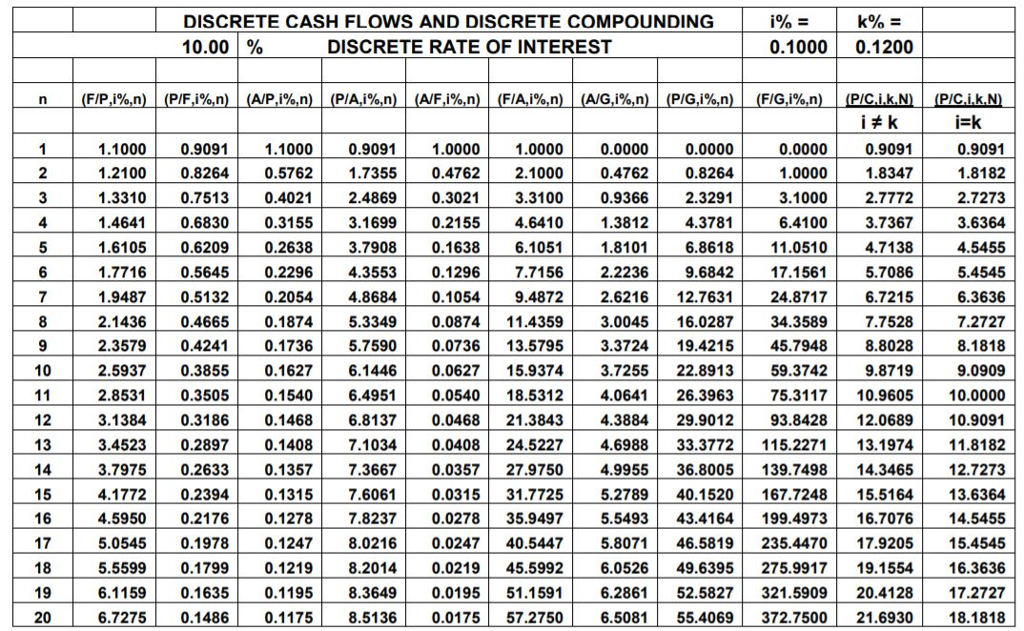

26. Joan plans to make a bank deposit of $500 on December 31, 2018 increasing annually thereafter by 10% until December 31, 2022. Which of the following answers would provide the balance in her savings account on December 31, 2022 if the bank offers a 12% rate of interest compounded annually?

a) FW=500(F/A,12%,5) where FW = Future Worth

b) FW={500/(0.1-0.12)}{1-[(1+0.10)/(1+0.12)]5 }

c) FW=5(500)/(1+0.10)

d) FW={500/(0.1-0.12)}{1-[(1+0.10)/(1+0.12)]5 }(F/P,12%,5)

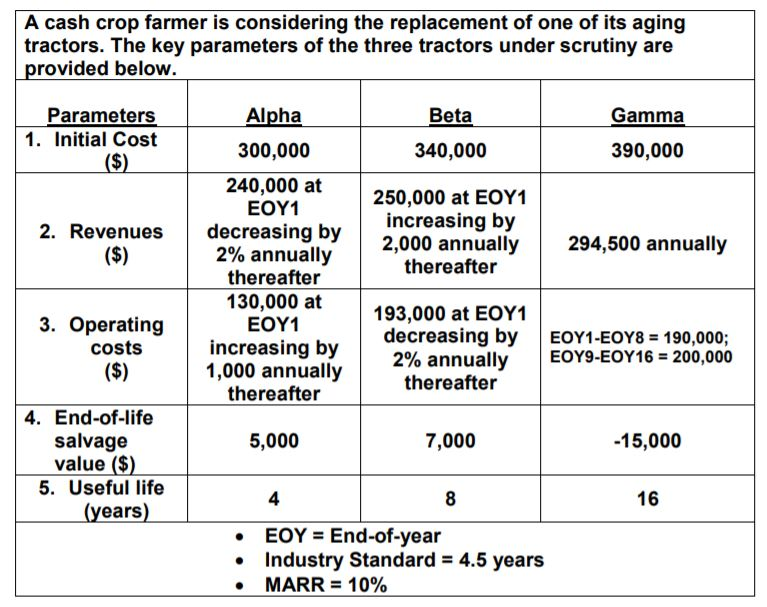

A cash crop farmer is considering the replacement of one of its aging tractors. The key parameters of the three tractors under scrutiny are rovided below. Beta 340,000 Parameters Alpha Gamma 1. Initial Cost 300,000 390,000 240,000 at EOY1 250,000 at EOY1 increasing by thereafter 193,000 at EOY1 2. Revenues decreasing by 2.00 0 annually 294,500 annually 2% annually thereafter 130,000 at EOY1 increasing by 1,000 annually thereafter 3. Operating decreasing by EOY1-EOY8 190,000; 2% annually | EOY9-EOY16-200,000 costs thereafter 4. End-of-life salvage value ($ 5,000 7,000 15,000 5. Useful life 4 8 16 ears . . EOY End-of-year Industry Standard = 4.5 years MARR =10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts