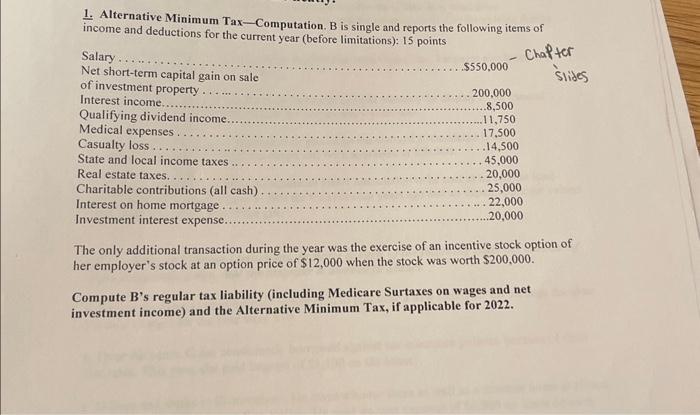

Question: 1. Alternative Minimum Tax-Computation. B is single and reports the following items of income and deductions for the current year (before limitations): 15 points The

1. Alternative Minimum Tax-Computation. B is single and reports the following items of income and deductions for the current year (before limitations): 15 points The only additional transaction during the year was the exercise of an incentive stock option of her employer's stock at an option price of $12,000 when the stock was worth $200,000. Compute B's regular tax liability (including Medicare Surtaxes on wages and net investment income) and the Alternative Minimum Tax, if applicable for 2022. 1. Alternative Minimum Tax-Computation. B is single and reports the following items of income and deductions for the current year (before limitations): 15 points The only additional transaction during the year was the exercise of an incentive stock option of her employer's stock at an option price of $12,000 when the stock was worth $200,000. Compute B's regular tax liability (including Medicare Surtaxes on wages and net investment income) and the Alternative Minimum Tax, if applicable for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts