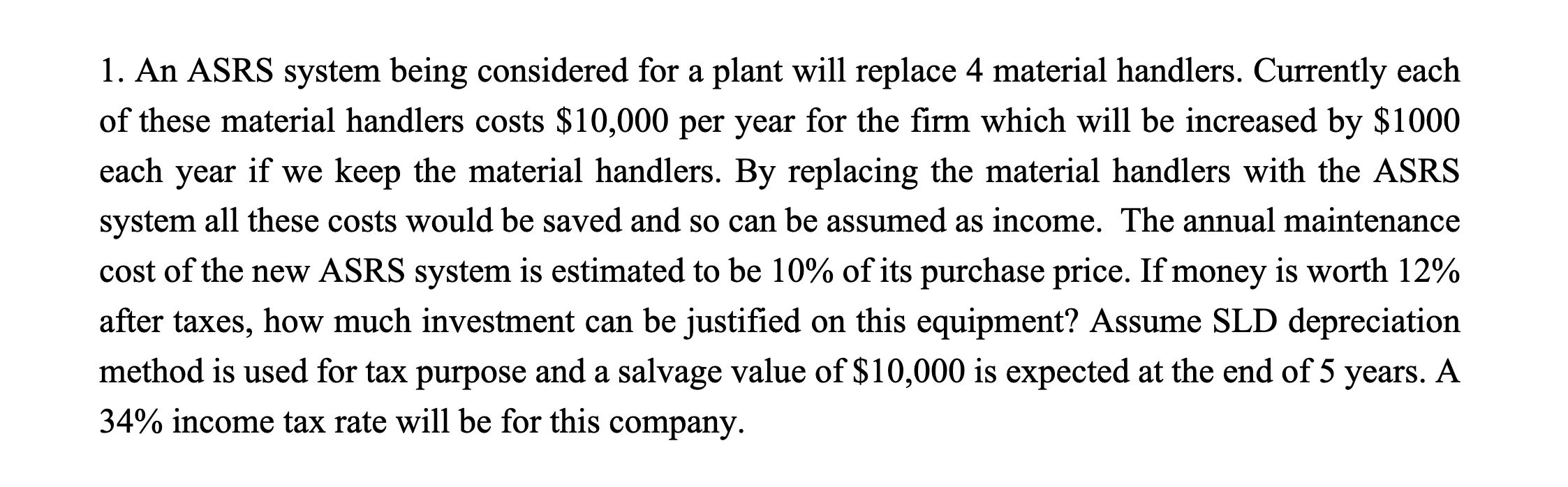

Question: 1. An ASRS system being considered for a plant will replace 4 material handlers. Currently each of these material handlers costs $10,000 per year for

1. An ASRS system being considered for a plant will replace 4 material handlers. Currently each of these material handlers costs $10,000 per year for the firm which will be increased by $1000 each year if we keep the material handlers. By replacing the material handlers with the ASRS system all these costs would be saved and so can be assumed as income. The annual maintenance cost of the new ASRS system is estimated to be 10% of its purchase price. If money is worth 12% after taxes, how much investment can be justified on this equipment? Assume SLD depreciation method is used for tax purpose and a salvage value of $10,000 is expected at the end of 5 years. A 34% income tax rate will be for this company. 1. An ASRS system being considered for a plant will replace 4 material handlers. Currently each of these material handlers costs $10,000 per year for the firm which will be increased by $1000 each year if we keep the material handlers. By replacing the material handlers with the ASRS system all these costs would be saved and so can be assumed as income. The annual maintenance cost of the new ASRS system is estimated to be 10% of its purchase price. If money is worth 12% after taxes, how much investment can be justified on this equipment? Assume SLD depreciation method is used for tax purpose and a salvage value of $10,000 is expected at the end of 5 years. A 34% income tax rate will be for this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts