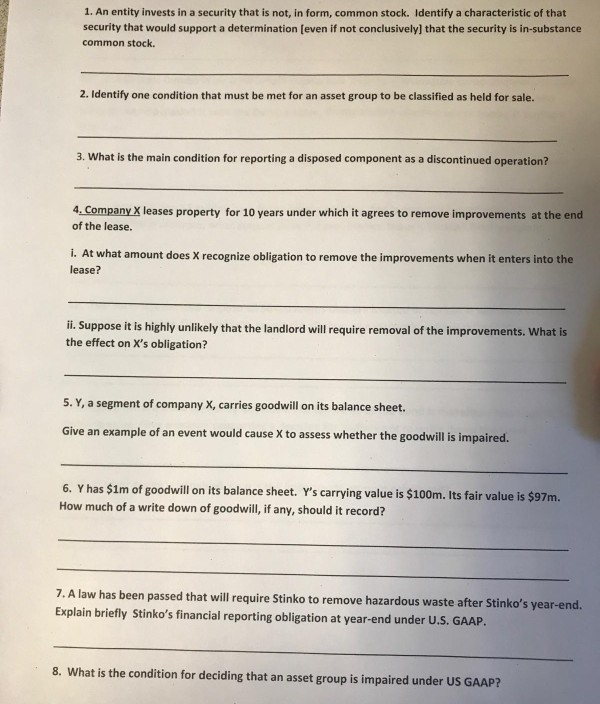

Question: 1. An entity invests in a security that is not, in form, common stock. Identify a characteristic of that security that would support a determination

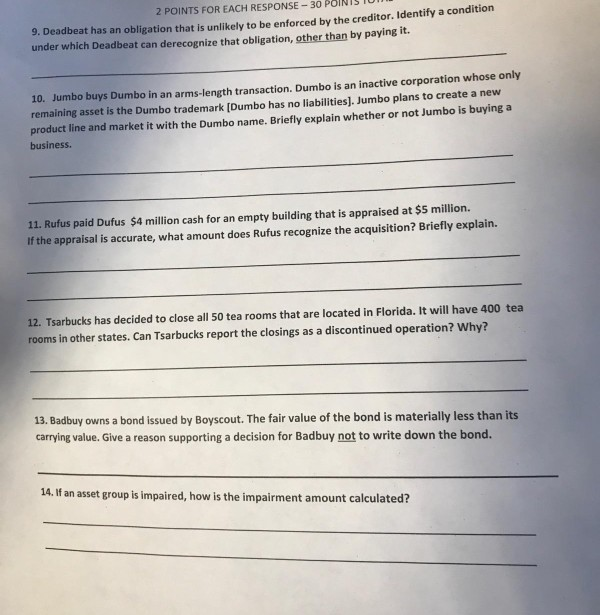

1. An entity invests in a security that is not, in form, common stock. Identify a characteristic of that security that would support a determination (even if not conclusively) that the security is in-substance common stock 2. Identify one condition that must be met for an asset group to be classified as held for sale. 3. What is the main condition for reporting a disposed component as a discontinued operation? 4. Company X leases property for 10 years under which it agrees to remove improvements at the end of the lease. I. At what amount does X recognize obligation to remove the improvements when it enters into the lease? il. Suppose it is highly unlikely that the landlord will require removal of the improvements. What is the effect on X's obligation? 5. Y, a segment of company X, carries goodwill on its balance sheet. Give an example of an event would cause X to assess whether the goodwill is impaired. 6. Y has Sim of goodwill on its balance sheet. Y's carrying value is $100m. Its fair value is $97m. How much of a write down of goodwill, if any, should it record? 7. A law has been passed that will require Stinko to remove hazardous waste after Stinko's year-end. Explain briefly Stinko's financial reporting obligation at year-end under U.S. GAAP. 8. What is the condition for deciding that an asset group is impaired under US GAAP? 2 POINTS FOR EACH RESPONSE - 30 POINTS TU 9. Deadbeat has an obligation that is unlikely to be enforced by the creditor. Identify a condition under which Deadbeat can derecognize that obligation, other than by paying it. 10. Jumbo buys Dumbo in an arms-length transaction. Dumbo is an inactive corporation whose only remaining asset is the Dumbo trademark (Dumbo has no liabilities]. Jumbo plans to create a new product line and market it with the Dumbo name. Briefly explain whether or not Jumbo is buying a business. 11. Rufus paid Dufus $4 million cash for an empty building that is appraised at $5 million. If the appraisal is accurate, what amount does Rufus recognize the acquisition? Briefly explain. 12. Tsarbucks has decided to close all 50 tea rooms that are located in Florida. It will have 400 tea rooms in other states. Can Tsarbucks report the closings as a discontinued operation? Why? 13. Badbuy owns a bond issued by Boyscout. The fair value of the bond is materially less than its carrying value. Give a reason supporting a decision for Badbuy not to write down the bond. 14. If an asset group is impaired, how is the impairment amount calculated? 1. An entity invests in a security that is not, in form, common stock. Identify a characteristic of that security that would support a determination (even if not conclusively) that the security is in-substance common stock 2. Identify one condition that must be met for an asset group to be classified as held for sale. 3. What is the main condition for reporting a disposed component as a discontinued operation? 4. Company X leases property for 10 years under which it agrees to remove improvements at the end of the lease. I. At what amount does X recognize obligation to remove the improvements when it enters into the lease? il. Suppose it is highly unlikely that the landlord will require removal of the improvements. What is the effect on X's obligation? 5. Y, a segment of company X, carries goodwill on its balance sheet. Give an example of an event would cause X to assess whether the goodwill is impaired. 6. Y has Sim of goodwill on its balance sheet. Y's carrying value is $100m. Its fair value is $97m. How much of a write down of goodwill, if any, should it record? 7. A law has been passed that will require Stinko to remove hazardous waste after Stinko's year-end. Explain briefly Stinko's financial reporting obligation at year-end under U.S. GAAP. 8. What is the condition for deciding that an asset group is impaired under US GAAP? 2 POINTS FOR EACH RESPONSE - 30 POINTS TU 9. Deadbeat has an obligation that is unlikely to be enforced by the creditor. Identify a condition under which Deadbeat can derecognize that obligation, other than by paying it. 10. Jumbo buys Dumbo in an arms-length transaction. Dumbo is an inactive corporation whose only remaining asset is the Dumbo trademark (Dumbo has no liabilities]. Jumbo plans to create a new product line and market it with the Dumbo name. Briefly explain whether or not Jumbo is buying a business. 11. Rufus paid Dufus $4 million cash for an empty building that is appraised at $5 million. If the appraisal is accurate, what amount does Rufus recognize the acquisition? Briefly explain. 12. Tsarbucks has decided to close all 50 tea rooms that are located in Florida. It will have 400 tea rooms in other states. Can Tsarbucks report the closings as a discontinued operation? Why? 13. Badbuy owns a bond issued by Boyscout. The fair value of the bond is materially less than its carrying value. Give a reason supporting a decision for Badbuy not to write down the bond. 14. If an asset group is impaired, how is the impairment amount calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts