Question: 1. ANALYSE THE PUBLISHED FINANCIAL STATEMENT FOR DECISION MAKING ATTACHED. 2. ANALYSE THE BUDGETING AND CASH FLOW DATA PROVIDED IN THE ANNUAL REPORT PROVIDED. 3.COMPLETE

1. ANALYSE THE PUBLISHED FINANCIAL STATEMENT FOR DECISION MAKING ATTACHED.

2. ANALYSE THE BUDGETING AND CASH FLOW DATA PROVIDED IN THE ANNUAL REPORT PROVIDED.

3.COMPLETE A RATIO ANALYSIS BASED ON THE FINANCIAL STATEMENT PUBLISHED.

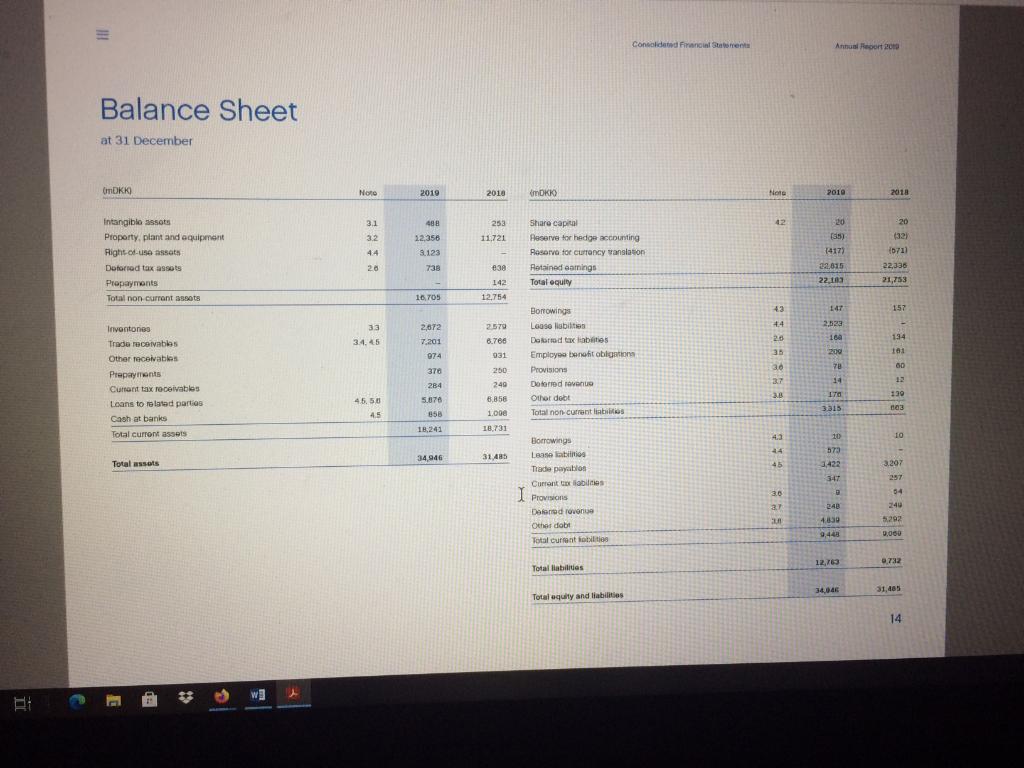

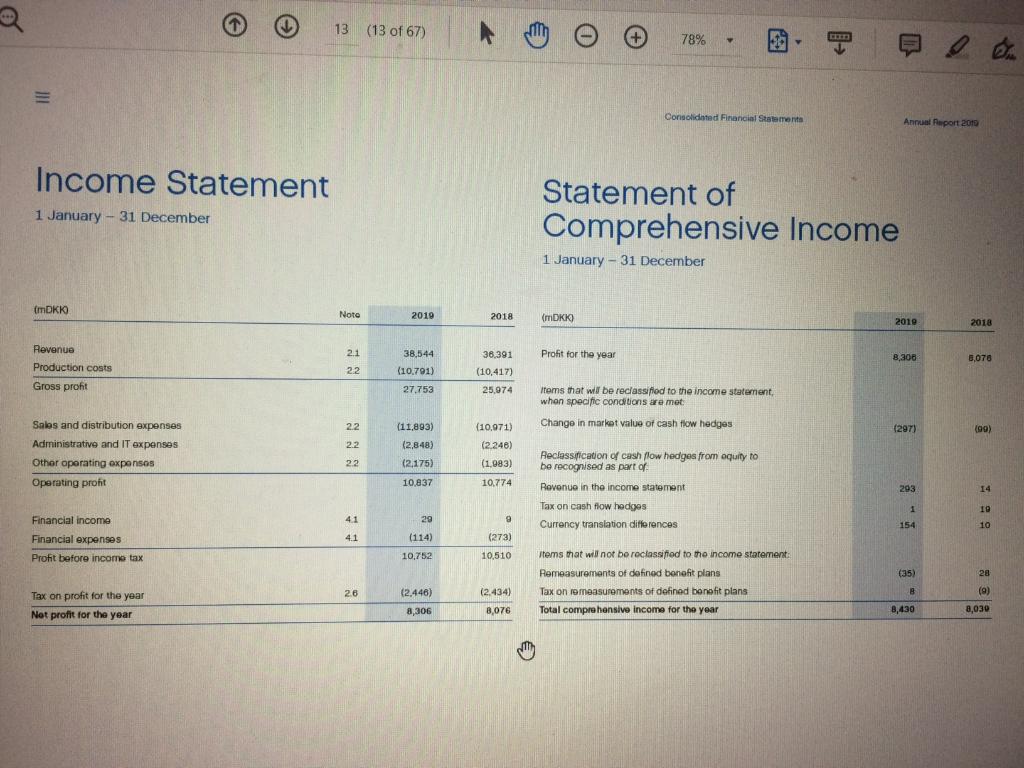

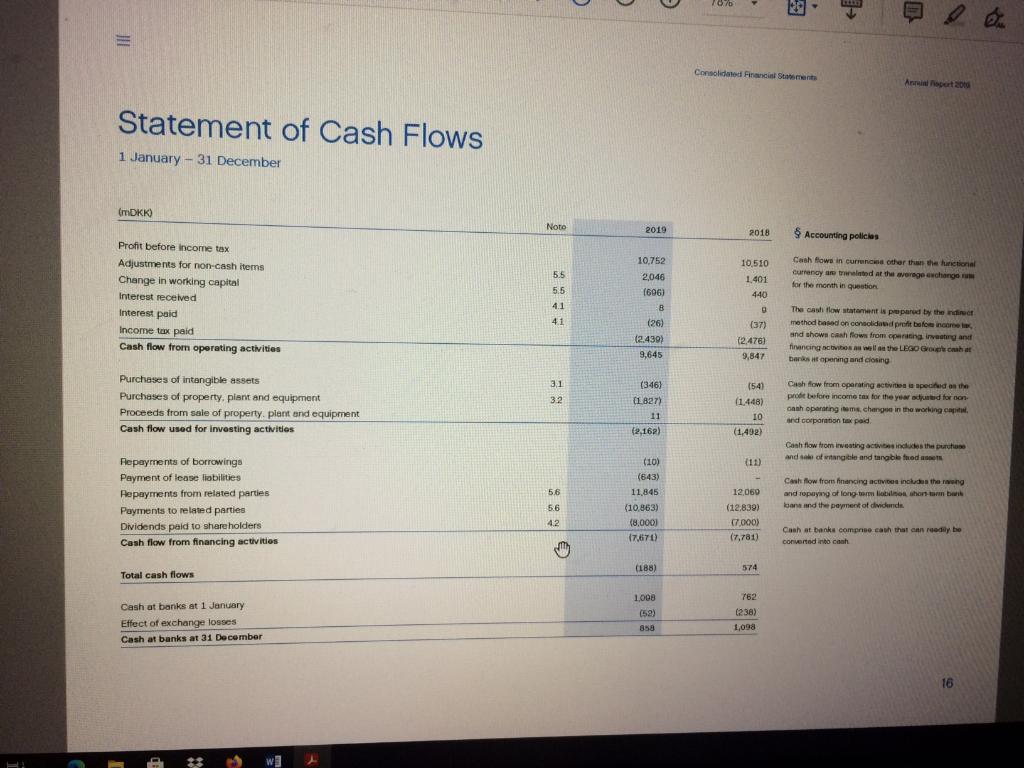

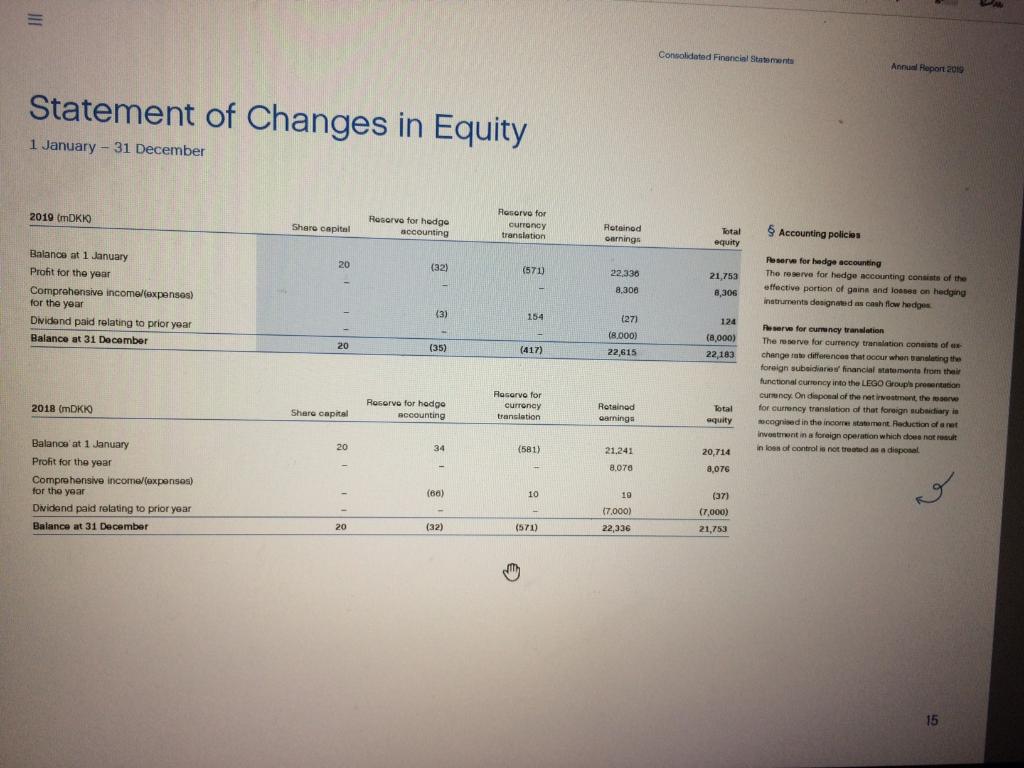

Consolidated Final Statement Annual Report 20 Balance Sheet at 31 December ODKK Noo 2010 2018 IMDKIO Foto 2010 2018 3.1 488 253 20 32 11,721 12.356 9.123 Intangible sota Property, plant and equipment Right use sots Dotored tax assets Prepayments Total non current assets Share capital Reserve for hedge accounting Reserve for currency vansson Retained amings Total equity 20 (55) (417) 32.615 (321 0711 44 28 738 e38 22,336 21,753 22 103 142 12,754 16705 43 157 2579 +4 2,533 33 34.45 2,672 7.201 2.0 160 134 6.760 931 35 074 Borrowings Lease liabilities Doord tax labios Employee benefit obligations Provisions Dolored to Other dobt Total non-current is 191 00 30 250 Inventones Trade receivables Other receivables Prepayments Currant tax receivables Loans to related parties Cash at banks Total current assets 200 78 14 170 37 12 370 284 5.87 240 3.B 130 45,50 8,856 3315 103 4.5 858 1.00 18,241 18,731 4.3 10 10 34,946 31 485 573 3,422 Total assets 45 3.207 347 1 Borrowings Las labios Tiade payabios Currant tot labies I Provisions Damodrovanie Other dobit Total current 3.0 04 3.7 24B 4.850 244 5292 2 9,448 9,000 12,763 2.732 Total liabilities 34,046 31,405 Total equity and liabilities 14 * w] 13 (13 of 67) 78% 1.5 O Consolidated Financial Statements Annual Report 2010 Income Statement 1 January - 31 December Statement of Comprehensive Income 1 January - 31 December ImDKI Noto 2019 2018 (mDKK 2019 2018 2.1 Profit for the year 8,300 Revenue Production costs Gross profit 38.544 (10.701) 8,070 22 36.391 (10,417) 25,974 27.753 items that will be reclassiflod to the income statement, when specific conditions are met 22 (11.893) Change in market value of cash flow hedges (297) (99) 2.2 Sales and distribution expenses Administrative and IT expenses Other operating expensos Operating profit (10.971) (2 248) (1.983) (2,848) (2,175) () 10,837 2.2 10.774 Reclassification of cash flow hedges from oquity to be recognised as part of Revenue in the income statement Tax on cash flow hedges Currency translation differences 203 14 1 10 41 29 9 154 10 Financial income Financial expenses Profit before income tax 4.1 (114) (273) 10,752 10,510 28 items mat will not be reclassified to the income statement: Remeasurements of defined benefit plans Tax on romeasurements of defined benefit plans Total comprehensive income for the year 26 (2.434) Tax on profit for the year Not profit for the year (0) (2.446) 8,306 (35) B 8,430 8,076 8,030 13 (13 of 67) 78% 1.5 O Consolidated Financial Statements Annual Report 2010 Income Statement 1 January - 31 December Statement of Comprehensive Income 1 January - 31 December ImDKI Noto 2019 2018 (mDKK 2019 2018 2.1 Profit for the year 8,300 Revenue Production costs Gross profit 38.544 (10.701) 8,070 22 36.391 (10,417) 25,974 27.753 items that will be reclassiflod to the income statement, when specific conditions are met 22 (11.893) Change in market value of cash flow hedges (297) (99) 2.2 Sales and distribution expenses Administrative and IT expenses Other operating expensos Operating profit (10.971) (2 248) (1.983) (2,848) (2,175) () 10,837 2.2 10.774 Reclassification of cash flow hedges from oquity to be recognised as part of Revenue in the income statement Tax on cash flow hedges Currency translation differences 203 14 1 10 41 29 9 154 10 Financial income Financial expenses Profit before income tax 4.1 (114) (273) 10,752 10,510 28 items mat will not be reclassified to the income statement: Remeasurements of defined benefit plans Tax on romeasurements of defined benefit plans Total comprehensive income for the year 26 (2.434) Tax on profit for the year Not profit for the year (0) (2.446) 8,306 (35) B 8,430 8,076 8,030 1070 Consolidated Frencialmente A cert 2010 Statement of Cash Flows 1 January - 31 December (mDKK) Noto 2019 2018 Accounting policies 10,510 5.5 10.752 2,046 (606) Cash flow in currencies other than the actional currency are trued at the average exchange for the month in question 1,401 Profit before income tax Adjustments for non-cash items Change in working capital Interest received Interest paid Income tax paid Cash flow from operating activities 440 5.5 41 4.1 8 (26) (2.430) 9,645 (37) (2.476) 9,847 The cash flow statement is prepared by the Indirect method hand on consolidand profit befinder and shows cash flow from opening investiga financing acts as well as the LEGO GO Chat ben opening and closing 31 Purchases of intangible assets Purchases of property, plant and equipment Proceeds from sale of property, plant and equipment Cash flow used for investing activities 32 (346) (1 827) 11 (2.162) ) (54) (1.448) 10 (1,492) Cash flow from operating active speed on the prodit before income tax for the yewed for non Ganh operating mechange in the working and corporation tax paid Cash flow from westing action induces the purchase and of tangible and tangible fred (11) 5.6 Repayments of borrowings Payment of love liabilities Repayments from related parties Payments to related parties Dividends paid to shareholders Cash flow from financing activities (10) (643) 11,845 (10.863) (8,0001 17,670) Cash flow from financing action includes the eng and repong of long-term is short term bu bone and the payment of dividende 5.6 12,050 (12.839) C7000 (7.781) 4.2 Cash at banks comprise cath that can reday be converted into cash (188) 574 Total cash flows 762 Cash at banks at 1 January Effect of exchange losses Cash at banks at 31 December 1008 (52) ( 858 (238) 1,098 16 W Consolidated Financial Statements Annual Report 2019 Statement of Changes in Equity 1 January - 31 December 2019 DKK Share capital Rosorve for hedge accounting Reserve for currency translation Retained cernings Total equity Accounting policies 20 (32) (571) 22.330 8,300 - 21,753 8,306 Balance at 1 January Profit for the year Comprehensive income/lexpenses) for the year Dividend paid relating to prior year Balance at 31 December Reserve for hedge accounting The reserve for hedge accounting consists of the effective portion of gains and less on hedging instruments designated as cash flow hedges 3) 254 (271 124 20 (35) (417) (8.000) 22,615 (8,000) 22 183 Reserve for ourney translation The reserve for currency translation contrate of change the differences that occur when anlating the foreign subsidiaries financial statement from their functional currency into the LEGO Groupla presentation currency. On disposal of the nativement, the for for currency translation of the foreign subsidiary in socognised in the income statement Reduction of anet Investment in a foreign operation which does not in loon of control is not treated as a disposal 2018 (mDKIO Reserve for currency translation Reserve for hedge accounting Share capital Retained Garnings Total equity 20 34 (581) 21.241 20,714 8.070 8,076 Balance at 1 January Profit for the year Comprehensive income (expenses) for the year Dividend paid relating to prior year Balance at 31 December (60) 10 19 (37) (7,000) (7,000) 22,336 20 (32) (571) 21,753 15 Consolidated Final Statement Annual Report 20 Balance Sheet at 31 December ODKK Noo 2010 2018 IMDKIO Foto 2010 2018 3.1 488 253 20 32 11,721 12.356 9.123 Intangible sota Property, plant and equipment Right use sots Dotored tax assets Prepayments Total non current assets Share capital Reserve for hedge accounting Reserve for currency vansson Retained amings Total equity 20 (55) (417) 32.615 (321 0711 44 28 738 e38 22,336 21,753 22 103 142 12,754 16705 43 157 2579 +4 2,533 33 34.45 2,672 7.201 2.0 160 134 6.760 931 35 074 Borrowings Lease liabilities Doord tax labios Employee benefit obligations Provisions Dolored to Other dobt Total non-current is 191 00 30 250 Inventones Trade receivables Other receivables Prepayments Currant tax receivables Loans to related parties Cash at banks Total current assets 200 78 14 170 37 12 370 284 5.87 240 3.B 130 45,50 8,856 3315 103 4.5 858 1.00 18,241 18,731 4.3 10 10 34,946 31 485 573 3,422 Total assets 45 3.207 347 1 Borrowings Las labios Tiade payabios Currant tot labies I Provisions Damodrovanie Other dobit Total current 3.0 04 3.7 24B 4.850 244 5292 2 9,448 9,000 12,763 2.732 Total liabilities 34,046 31,405 Total equity and liabilities 14 * w] 13 (13 of 67) 78% 1.5 O Consolidated Financial Statements Annual Report 2010 Income Statement 1 January - 31 December Statement of Comprehensive Income 1 January - 31 December ImDKI Noto 2019 2018 (mDKK 2019 2018 2.1 Profit for the year 8,300 Revenue Production costs Gross profit 38.544 (10.701) 8,070 22 36.391 (10,417) 25,974 27.753 items that will be reclassiflod to the income statement, when specific conditions are met 22 (11.893) Change in market value of cash flow hedges (297) (99) 2.2 Sales and distribution expenses Administrative and IT expenses Other operating expensos Operating profit (10.971) (2 248) (1.983) (2,848) (2,175) () 10,837 2.2 10.774 Reclassification of cash flow hedges from oquity to be recognised as part of Revenue in the income statement Tax on cash flow hedges Currency translation differences 203 14 1 10 41 29 9 154 10 Financial income Financial expenses Profit before income tax 4.1 (114) (273) 10,752 10,510 28 items mat will not be reclassified to the income statement: Remeasurements of defined benefit plans Tax on romeasurements of defined benefit plans Total comprehensive income for the year 26 (2.434) Tax on profit for the year Not profit for the year (0) (2.446) 8,306 (35) B 8,430 8,076 8,030 13 (13 of 67) 78% 1.5 O Consolidated Financial Statements Annual Report 2010 Income Statement 1 January - 31 December Statement of Comprehensive Income 1 January - 31 December ImDKI Noto 2019 2018 (mDKK 2019 2018 2.1 Profit for the year 8,300 Revenue Production costs Gross profit 38.544 (10.701) 8,070 22 36.391 (10,417) 25,974 27.753 items that will be reclassiflod to the income statement, when specific conditions are met 22 (11.893) Change in market value of cash flow hedges (297) (99) 2.2 Sales and distribution expenses Administrative and IT expenses Other operating expensos Operating profit (10.971) (2 248) (1.983) (2,848) (2,175) () 10,837 2.2 10.774 Reclassification of cash flow hedges from oquity to be recognised as part of Revenue in the income statement Tax on cash flow hedges Currency translation differences 203 14 1 10 41 29 9 154 10 Financial income Financial expenses Profit before income tax 4.1 (114) (273) 10,752 10,510 28 items mat will not be reclassified to the income statement: Remeasurements of defined benefit plans Tax on romeasurements of defined benefit plans Total comprehensive income for the year 26 (2.434) Tax on profit for the year Not profit for the year (0) (2.446) 8,306 (35) B 8,430 8,076 8,030 1070 Consolidated Frencialmente A cert 2010 Statement of Cash Flows 1 January - 31 December (mDKK) Noto 2019 2018 Accounting policies 10,510 5.5 10.752 2,046 (606) Cash flow in currencies other than the actional currency are trued at the average exchange for the month in question 1,401 Profit before income tax Adjustments for non-cash items Change in working capital Interest received Interest paid Income tax paid Cash flow from operating activities 440 5.5 41 4.1 8 (26) (2.430) 9,645 (37) (2.476) 9,847 The cash flow statement is prepared by the Indirect method hand on consolidand profit befinder and shows cash flow from opening investiga financing acts as well as the LEGO GO Chat ben opening and closing 31 Purchases of intangible assets Purchases of property, plant and equipment Proceeds from sale of property, plant and equipment Cash flow used for investing activities 32 (346) (1 827) 11 (2.162) ) (54) (1.448) 10 (1,492) Cash flow from operating active speed on the prodit before income tax for the yewed for non Ganh operating mechange in the working and corporation tax paid Cash flow from westing action induces the purchase and of tangible and tangible fred (11) 5.6 Repayments of borrowings Payment of love liabilities Repayments from related parties Payments to related parties Dividends paid to shareholders Cash flow from financing activities (10) (643) 11,845 (10.863) (8,0001 17,670) Cash flow from financing action includes the eng and repong of long-term is short term bu bone and the payment of dividende 5.6 12,050 (12.839) C7000 (7.781) 4.2 Cash at banks comprise cath that can reday be converted into cash (188) 574 Total cash flows 762 Cash at banks at 1 January Effect of exchange losses Cash at banks at 31 December 1008 (52) ( 858 (238) 1,098 16 W Consolidated Financial Statements Annual Report 2019 Statement of Changes in Equity 1 January - 31 December 2019 DKK Share capital Rosorve for hedge accounting Reserve for currency translation Retained cernings Total equity Accounting policies 20 (32) (571) 22.330 8,300 - 21,753 8,306 Balance at 1 January Profit for the year Comprehensive income/lexpenses) for the year Dividend paid relating to prior year Balance at 31 December Reserve for hedge accounting The reserve for hedge accounting consists of the effective portion of gains and less on hedging instruments designated as cash flow hedges 3) 254 (271 124 20 (35) (417) (8.000) 22,615 (8,000) 22 183 Reserve for ourney translation The reserve for currency translation contrate of change the differences that occur when anlating the foreign subsidiaries financial statement from their functional currency into the LEGO Groupla presentation currency. On disposal of the nativement, the for for currency translation of the foreign subsidiary in socognised in the income statement Reduction of anet Investment in a foreign operation which does not in loon of control is not treated as a disposal 2018 (mDKIO Reserve for currency translation Reserve for hedge accounting Share capital Retained Garnings Total equity 20 34 (581) 21.241 20,714 8.070 8,076 Balance at 1 January Profit for the year Comprehensive income (expenses) for the year Dividend paid relating to prior year Balance at 31 December (60) 10 19 (37) (7,000) (7,000) 22,336 20 (32) (571) 21,753 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts