Question: 1 ) Analyze the balance sheet and income statement using HORIZONTAL analysis base on the percentage that already calculated HORIZONTAL ANALYSIS- Balance Sheet Income Statement

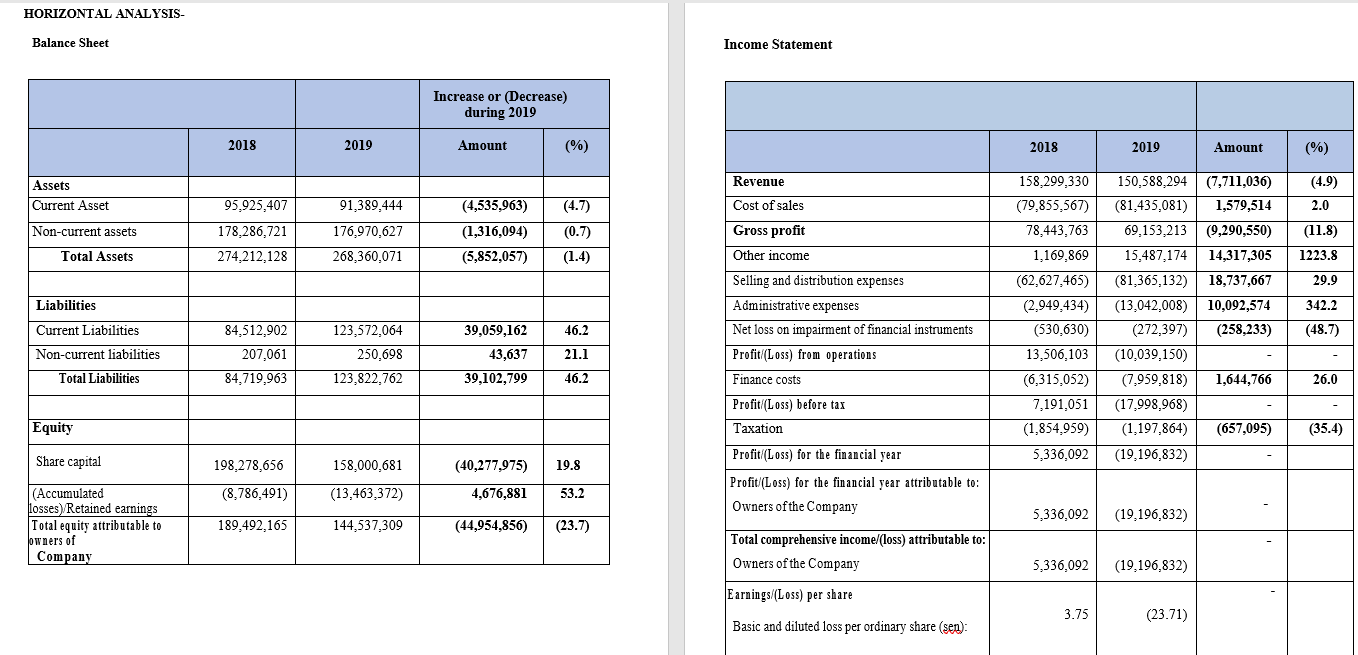

1 ) Analyze the balance sheet and income statement using HORIZONTAL analysis base on the percentage that already calculated

HORIZONTAL ANALYSIS- Balance Sheet Income Statement Increase or (Decrease) during 2019 2018 2019 Amount (%) 2018 2019 Amount (%) Revenue (4.9) Assets Current Asset 95,925,407 91,389,444 (4,535,963) (4.7) Cost of sales 2.0 Non-current assets Gross profit (11.8) 178,286,721 274,212,128 176,970,627 268,360,071 (1,316,094) (5,852,057) (0.7) (1.4) Total Assets Other income 1223.8 158,299,330 (79,855,567) 78,443,763 1,169,869 (62,627,465) (2,949,434) (530,630) 13,506,103 (6,315,052) 29.9 Liabilities 342.2 150,588,294 (7,711,036) (81,435,081) 1,579,514 69,153,213 (9,290,550) 15,487,174 14,317,305 (81,365,132) 18,737,667 (13,042,008) 10,092,574 (272,397) (258,233) (10,039,150) (7,959,818) 1,644,766 (17,998,968) (1,197,864) (657,095) (19,196,832) Current Liabilities 46.2 (48.7) Selling and distribution expenses Administrative expenses Net loss on impairment of financial instruments Profit/(Loss) from operations Finance costs Profit/(Loss) before tax 84,512,902 207,061 84.719,963 123,572,064 250.698 123,822,762 39,059,162 43,637 Non-current liabilities 21.1 Total Liabilities 39,102,799 46.2 26.0 Equity Taxation 7.191,051 (1,854,959) 5,336,092 (35.4) Share capital 198,278,656 158,000,681 (40,277,975) 19.8 Profit/(Loss) for the financial year Profit/(Loss) for the financial year attributable to: Owners of the Company (8.786,491) (13,463,372) 4,676,881 53.2 5,336,092 (19.196,832) (Accumulated losses) Retained earnings Total equity attributable to owners of Company 189,492,165 144,537,309 (44,954,856) (23.7) Total comprehensive income (loss) attributable to: Owners of the Company 5,336,092 (19,196,832) Earnings/(Loss) per share 3.75 (23.71) Basic and diluted loss per ordinary share (sen)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts