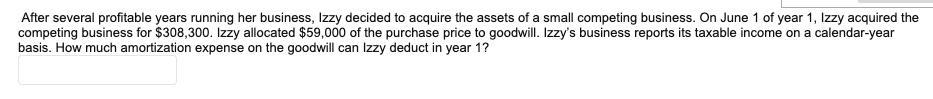

Question: After several profitable years running her business, Izzy decided to acquire the assets of a small competing business. On June 1 of year 1,

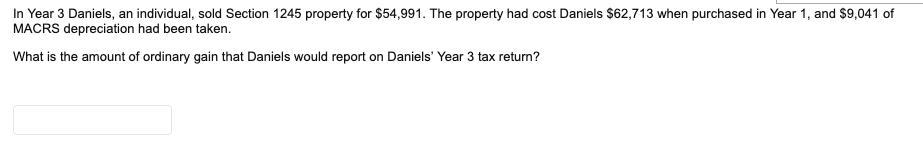

After several profitable years running her business, Izzy decided to acquire the assets of a small competing business. On June 1 of year 1, Izzy acquired the competing business for $308,300. Izy allocated $59,000 of the purchase price to goodwill. Izzy's business reports its taxable income on a calendar-year basis. How much amortization expense on the goodwill can Izzy deduct in year 1? In Year 3 Daniels, an individual, sold Section 1245 property for $54,991. The property had cost Daniels $62,713 when purchased in Year 1, and $9,041 of MACRS depreciation had been taken. What is the amount of ordinary gain that Daniels would report on Daniels' Year 3 tax return?

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Answer Part 1 Event Description Amount 1 Basis 59000 2 Reco... View full answer

Get step-by-step solutions from verified subject matter experts