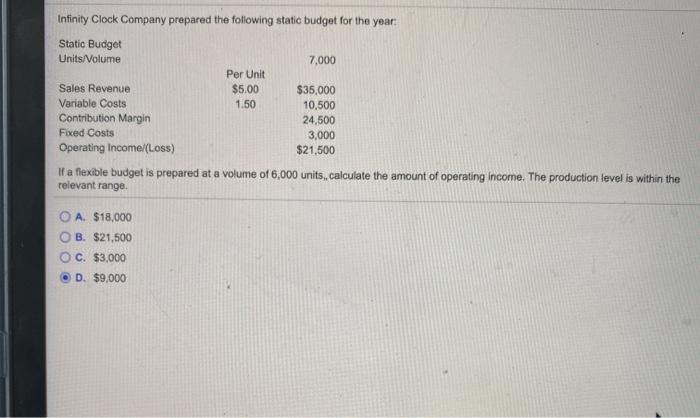

Question: 1 and 2 please help Infinity Clock Company prepared the following static budget for the year Static Budget Units/Volume 7,000 Per Unit Sales Revenue $5.00

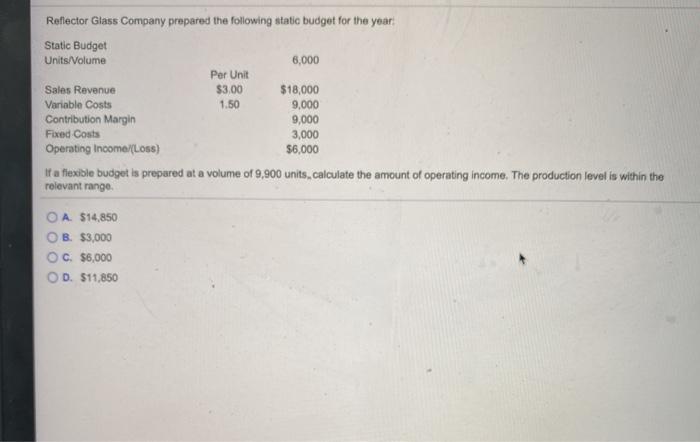

Infinity Clock Company prepared the following static budget for the year Static Budget Units/Volume 7,000 Per Unit Sales Revenue $5.00 $35,000 Variable Costs 1.50 10,500 Contribution Margin 24,500 Fixed Costs 3,000 Operating Income/(Loss) $21.500 If a flexible budget is prepared at a volume of 6,000 units, calculate the amount of operating income. The production level is within the relevant range O A $18,000 B. $21,500 C. $3,000 D. $9,000 Reflector Glass Company prepared the following static budget for the year Static Budget Units/Volume 6,000 Per Unit Sales Revenue $3.00 $18,000 Variable Costs 1.50 Contribution Margin 9,000 Fixed Costs 3,000 Operating Income (Loss) $6,000 If a flexible budget is prepared at a volume of 9,900 units, calculate the amount of operating income. The production level is within the relevant range 9,000 OA. $14,850 OB. $3,000 OC. $6,000 OD. 511,850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts