Question: #1 and #2b Suppose that every time a fund manager trades stock, transaction costs such as commissions and bid-ask spreads amount to 1.1% of the

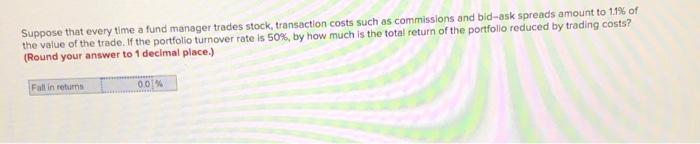

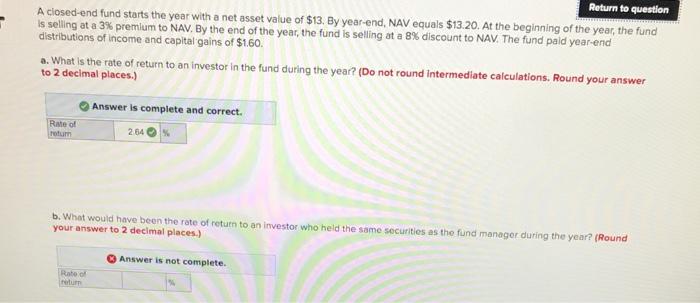

Suppose that every time a fund manager trades stock, transaction costs such as commissions and bid-ask spreads amount to 1.1% of the value of the trade. If the portfolio turnover rate is 50%, by how much is the total return of the portfolio reduced by trading costs? (Round your answer to 1 decimal place.) Fall in returns 0014 - Return to question A closed-end fund starts the year with a net asset value of $13. By year-end, NAV equals $13.20. At the beginning of the year, the fund is selling at a 3% premium to NAV. By the end of the year, the fund is selling at a 8% discount to NAV. The fund paid year-end distributions of income and capital gains of $1.60. a. What is the rate of return to an investor in the fund during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Rate of rotum 264 b. What would have been the rate of return to an investor who held the same securities as the fund manager during the year? (Round your answer to 2 decimal places.) Answer is not complete. Rate of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts