Question: 1. Answer both questions: a. A project currently generates sales of $10 million, variable costs equal to 50% of sales, and fixed costs of $2

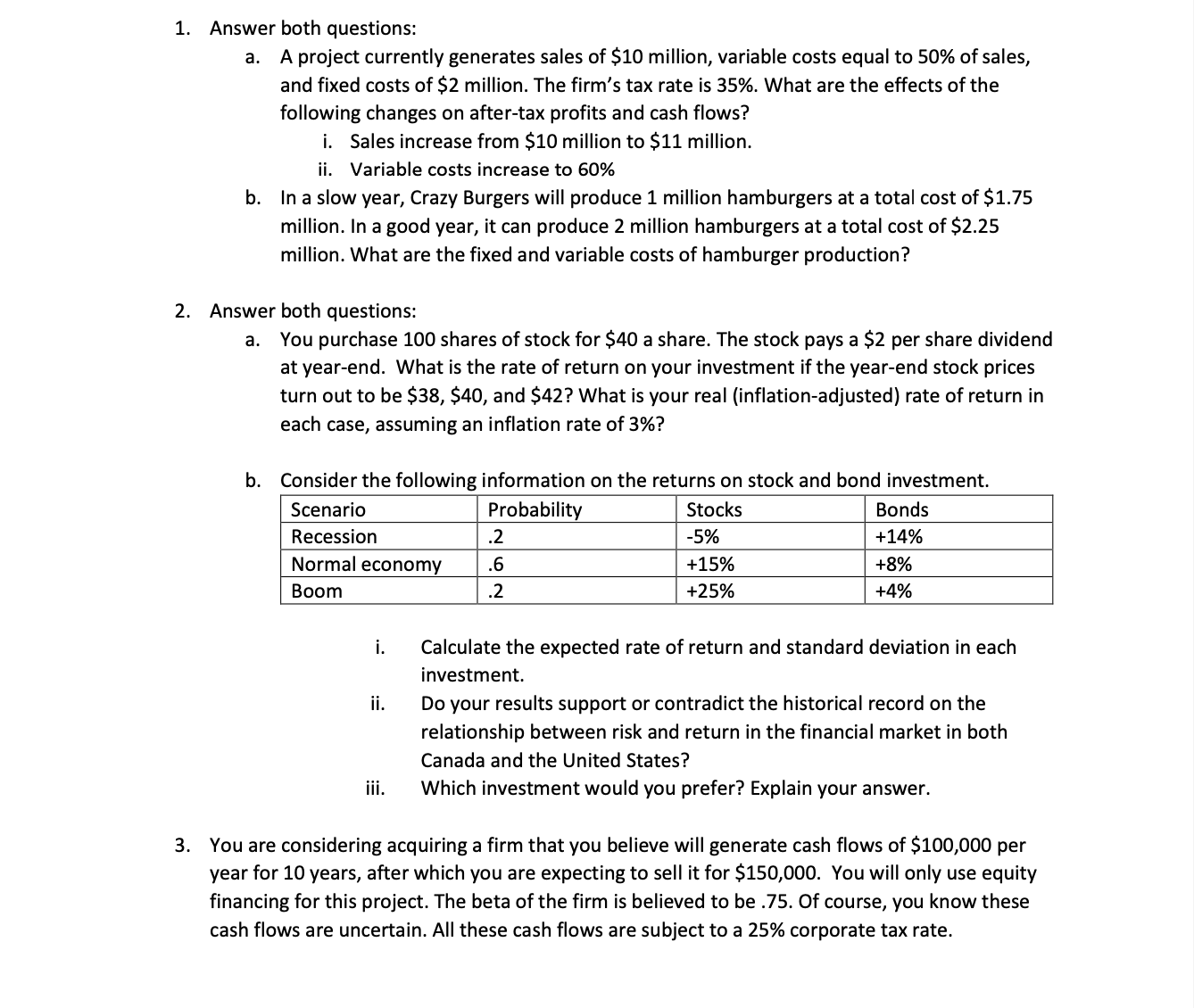

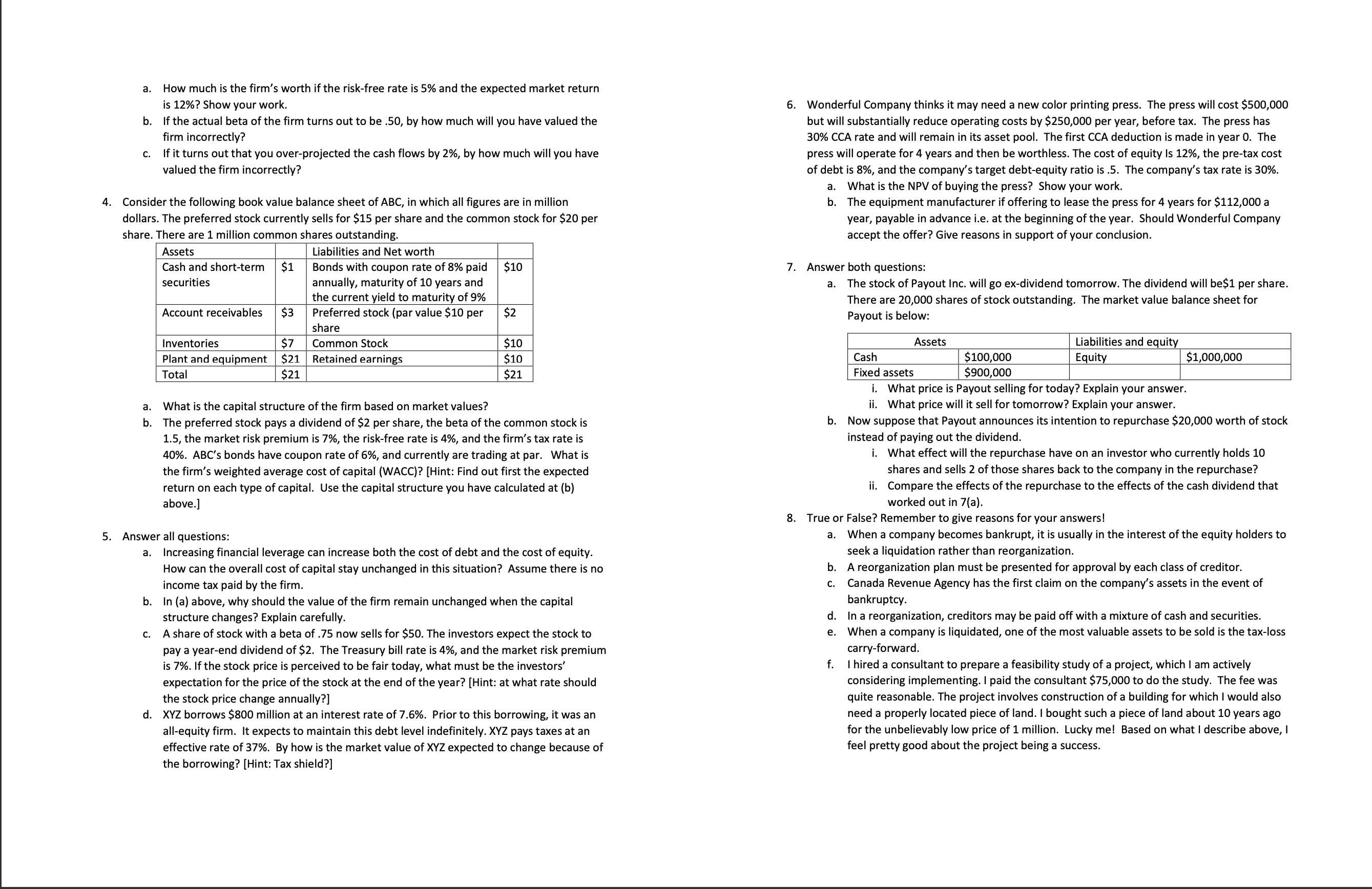

1. Answer both questions: a. A project currently generates sales of $10 million, variable costs equal to 50% of sales, and fixed costs of $2 million. The firm's tax rate is 35%. What are the effects of the following changes on after-tax profits and cash flows? i. Sales increase from $10 million to $11 million. ii. Variable costs increase to 60% b. In a slow year, Crazy Burgers will produce 1 million hamburgers at a total cost of $1.75 million. In a good year, it can produce 2 million hamburgers at a total cost of $2.25 million. What are the fixed and variable costs of hamburger production? 2. Answer both questions: a. You purchase 100 shares of stock for 540 a share. The stock pays a $2 per share dividend at yearend. What is the rate of return on your investment if the year-end stock prices turn out to be $38, $40, and 542? What is your real [inflation-adjusted) rate of return in each case, assuming an inflation rate of 3%? b. Consider the following information on the returns on stock and bond investment. Scenario Probability Stocks Bonds Recession .2 -5% +14% Normal economy .6 +15% +8% Boom .2 +25% +456 i. Calculate the expected rate of return and standard deviation in each investment. ii. Do your results support or contradict the historical record on the relationship between risk and return in the financial market in both Canada and the United States? iii. Which investment would you prefer? Explain your answer. 3. You are considering acquiring a firm that you believe will generate cash flows of $100,000 per year for 10 years, after which you are expecting to sell it for $150,000. You will only use equity financing for this project. The beta of the firm is believed to be .75. Of course, you know these cash flows are uncertain. All these cash ows are subject to a 25% corporate tax rate. 4. 5. a. How much is the firrn's worth ifthe riskfree rate is 5% and the expected market return is 12%? Show your work. b. If the actual beta ofthe rm turns out to be .50, by how much will you have valued the rm incorrectly? c. If it turns out that you over-projected the cash flows by 2%, by how much will you have valued the firm incorrectly? Consider the following book value balance sheet of ABC, in which all gures are in million dollars. The preferred stock currently sells for $15 per share and the common stock for $20 per share. There are 1 million common shares outstanding. Assets Liabilities and Net worth Cash and short-term $1 Bonds with coupon rate of 8% paid $10 securities annually, maturity of 10 years and the current yield to maturity of 9% Account receivables $3 Preferred stock (par value $10 per $2 share Inventories $7 Common Stock $10 Plant and equipment $21 Retained earnings 510 Total $21 $21 What is the capital structure of the rm based on market values? b. The preferred stock pays a dividend of $2 per share, the beta of the common stock is 1.5, the market risk premium is 7%, the risk-free rate is 4%, and the rm's tax rate is 40%. ABC's bonds have coupon rate of 6%, and currently are trading at par. What is the firm's weighted average cost of capital (WACC)? [Hintz Find out rst the expected return on each type of capital. Use the capital structure you have calculated at (b) above] Answer all questions: a. Increasing financial leverage can increase both the cost of debt and the cost of equity. How can the overall cost of capital stay unchanged in this situation? Assume there is no income tax paid by the rm. b. In (a) above, why should the value of the firm remain unchanged when the capital structure changes? Explain carefully. c. A share of stock with a beta of .75 now sells for $50. The investors expect the stock to pay a year-end dividend of $2. The Treasury bill rate is 4%, and the market risk premium is 7%. If the stock price is perceived to be fair today, what must be the investors' expectation for the price of the stock at the end of the yea r? [Hint: at what rate should the stock price change annually?] d. XVZ borrows $800 million at an interest rate of 7.6%. Prior to this borrowing, It was an all-equ' firm. It expects to maintain this debt level indefinitely. XVZ pays taxes at an effective rate of 37%. By how is the market value of XYZ expected to change because of the borrowing? [Hinti Tax shield?] 6. Wonderful Company thinks it may need a new color printing press. The press will cost $500,000 but will substantially reduce operating costs by $250,000 per year, before tax. The press has 30% CCA rate and will remain in its asset pool. The first CCA deduction is made in year 0. The press will operate for 4 years and then be worthless. The cost of equity Is 12%, the pre-tax cost of debt is 8%, and the compaan target debtequity ratio is .5. The company's tax rate is 30%. a. What is the NPV of buying the press? Show your work. b. The equipment manufacturer if offering to lease the press for 4 years for $112,000 a year, payable in advance i.e. at the beginning of the year. Should Wonderful Company accept the offer? Give reasons in support of your conclusion. 7. Answer both questions: a. The stock of Payout Inc. will go ex-dividend tomorrow. The dividend will be$1 per share. There are 20,000 shares of stock outstanding. The market value balance sheet for Payout is below: Assets Liabilities and equity Cash $100,000 Equity $1,000,000 Fixed assets $900,000 i. What price is Payout selling for today? Explain your answer. ii. What price will it sell for tomorrow? Explain your answer. b. Now suppose that Payout announces its intention to repurchase $20,000 worth of stock instead of paying out the dividend. i. What effect will the repurchase have on an investor who currently holds 10 shares and sells 2 of those shares back to the company in the repurchase? ii. Compare the effects of the repurchase to the effects of the cash dividend that worked out in 7(a). 8. True or False? Remember to give reasons for your answersl a. When a company becomes bankrupt, i 5 usually in the interest of the equity holders to seek a liquidation rather than reorganization. b. A reorganization plan must be presented for approval by each class of creditor. c. Canada Revenue Agency has the rst claim on the company's assets in the event of bankruptcy. d. In a reorganization, creditors may be paid off with a mixture of cash and securities. e. When a company is liquidated, one of the most valuable assets to be sold is the tax-loss carry-forward. f. I hired a consultant to prepare a feasibility study of a project, which I am actively considering implementing. I paid the consultant $75,000 to do the study. The fee was quite reasonable. The project involves construction ofa building for which I would also need a properly located piece of land. I bought such a piece of land about 10 years ago for the unbelievably low price of 1 million. Lucky me! Based on what I describe above, I feel pretty good about the project being a success