Question: 1. Answer: Purchasing power parity (PPP) suggests that A) A home currency will depreciate if home country interest rates exceed foreign interest rates B) A

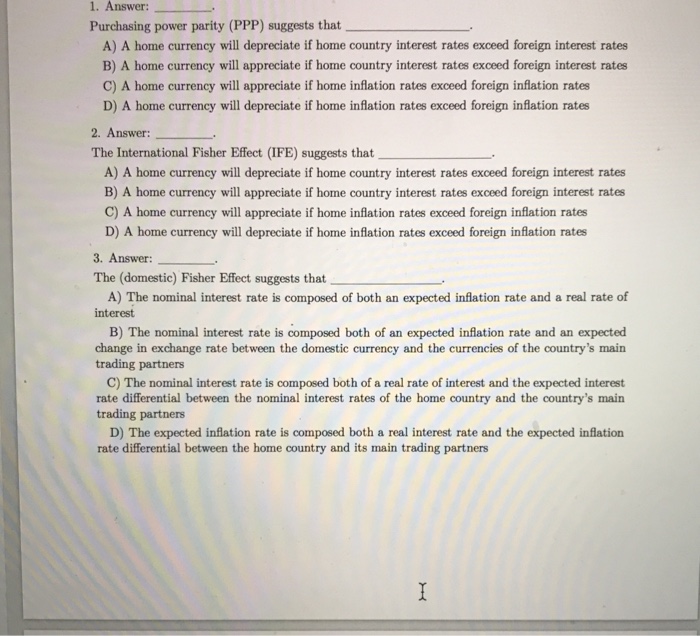

1. Answer: Purchasing power parity (PPP) suggests that A) A home currency will depreciate if home country interest rates exceed foreign interest rates B) A home currency will appreciate if home country interest rates exceed foreign interest rates C) A home currency will appreciate if home inflation rates exceed foreign inflation rates D) A home currency will depreciate if home inflation rates exceed foreign inflation rates 2. Answer:_* The International Fisher Effect (IFE) suggests that A) A home currency will depreciate if home country interest rates exceed foreign interest rates B) A home currency will appreciate if home country interest rates exceed foreign interest rates C) A home currency will appreciate if home inflation rates exceed foreign inflation rates D) A home currency will depreciate if home inflation rates exceed foreign inflation rates 3. Answer: The (domestic) Fisher Effect suggests that interest A) The nominal interest rate is composed of both an expected inflation rate and a real rate of B) The nominal interest rate is composed both of an expected inflation rate and an expected change in exchange rate between the domestic currency and the currencies of the country's main trading partners C) The nominal interest rate is composed both of a real rate of interest and the expected interest rate differential between the nominal interest rates of the home country and the country's main trading partners D) The expected inflation rate is composed both a real interest rate and the expected inflation rate differential between the home country and its main trading partners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts