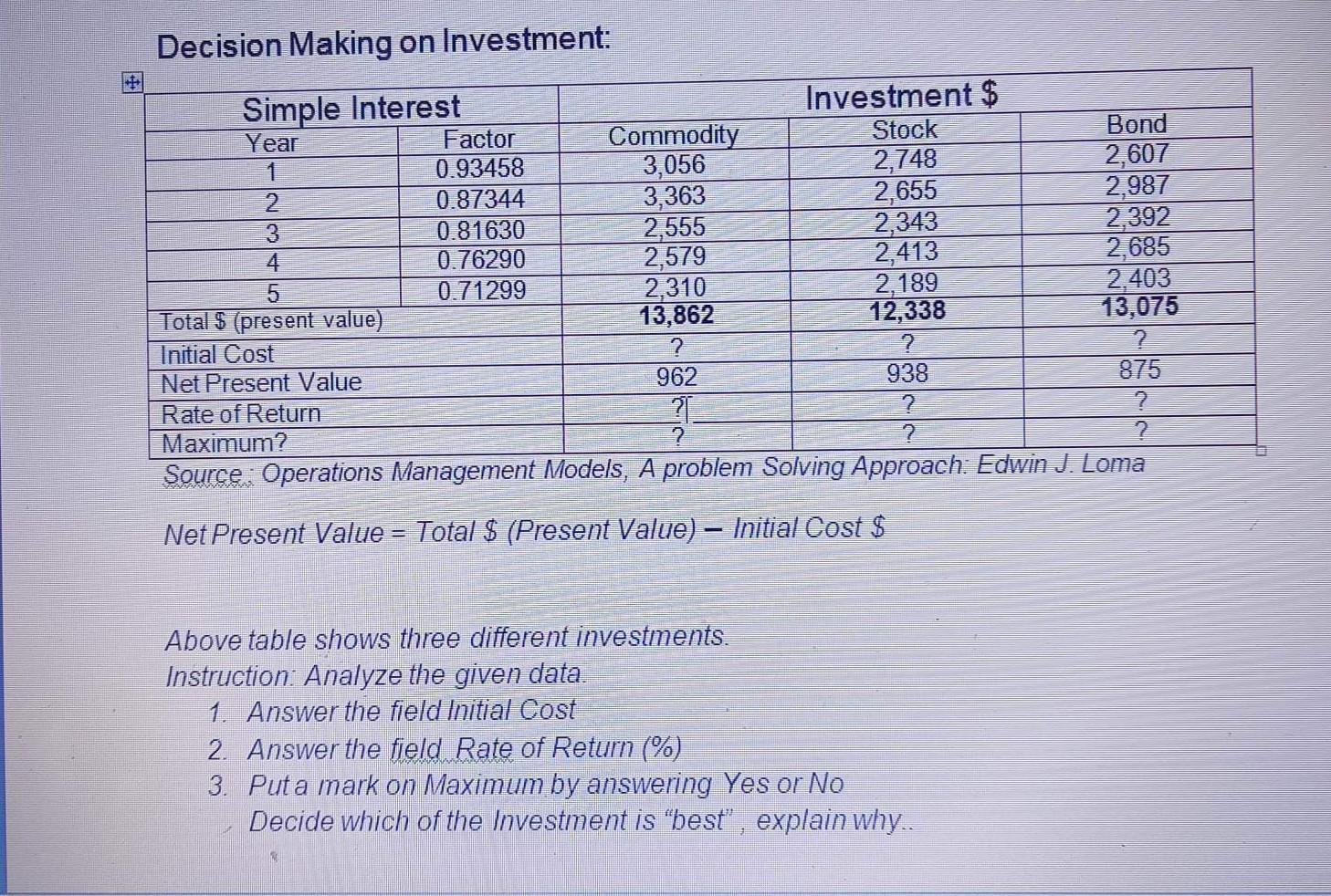

Question: 1. Answer the field Initial Cost 2. Answer the field Rate of Return(%) 3. Put a Mark on Maximum by Answering Yes or No And

1. Answer the field Initial Cost 2. Answer the field Rate of Return(%) 3. Put a Mark on Maximum by Answering Yes or No And please don't forget to Decide which of the Investment is "best" and explain why. Will UPVOTE!

Decision Making on Investment: 2,655 Simple Interest Investment $ Year Factor Commodity Stock Bond 1 0.93458 3,056 2,748 2,607 2 0.87344 3,363 2,987 3 0.81630 2,555 2,343 2,392 4 0.76290 2,579 2,413 2,685 5 0.71299 2,310 2,189 2,403 Total $ (present value) 13,862 12,338 13,075 Initial Cost ? ? ? Net Present Value 962 938 875 Rate of Return ? ? Maximum? ? ? ? Source: Operations Management Models, A problem Solving Approach: Edwin J. Loma Net Present Value = Total $ (Present Value) Initial Cost $ Above table shows three different investments. Instruction: Analyze the given data. 1. Answer the field Initial Cost 2. Answer the field Rate of Return (%) 3. Puta mark on Maximum by answering Yes or No Decide which of the Investment is "best", explain whyStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts