Question: 1. Anu owns Anu's Personal Services Corp. (Anu's). Anu's purchased $200,000 of new Class 8 assets during 2019. Anu has asked you to prepare a

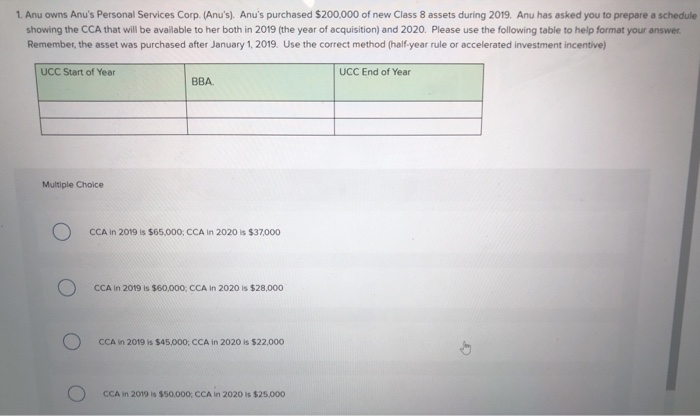

1. Anu owns Anu's Personal Services Corp. (Anu's). Anu's purchased $200,000 of new Class 8 assets during 2019. Anu has asked you to prepare a schedule showing the CCA that will be available to her both in 2019 (the year of acquisition) and 2020. Please use the following table to help format your answer. Remember, the asset was purchased after January 1, 2019. Use the correct method (half-year rule or accelerated investment incentive) UCC Start of Year UCC End of Year BBA Multiple Choice CCA in 2019 is $65,000: CCA in 2020 is $37,000 CCA in 2019 is $60,000, CCA in 2020 is $28,000 CCA in 2019 is $45,000, CCA in 2020 is $22,000 CCA in 2019 is $50,000, CCA in 2020 is $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts