Question: 1 Appendix B , CP B - 4 Shelly Beaman ( Social Security number 4 1 2 - 3 4 - 5 6 7 0

Appendix B CP B

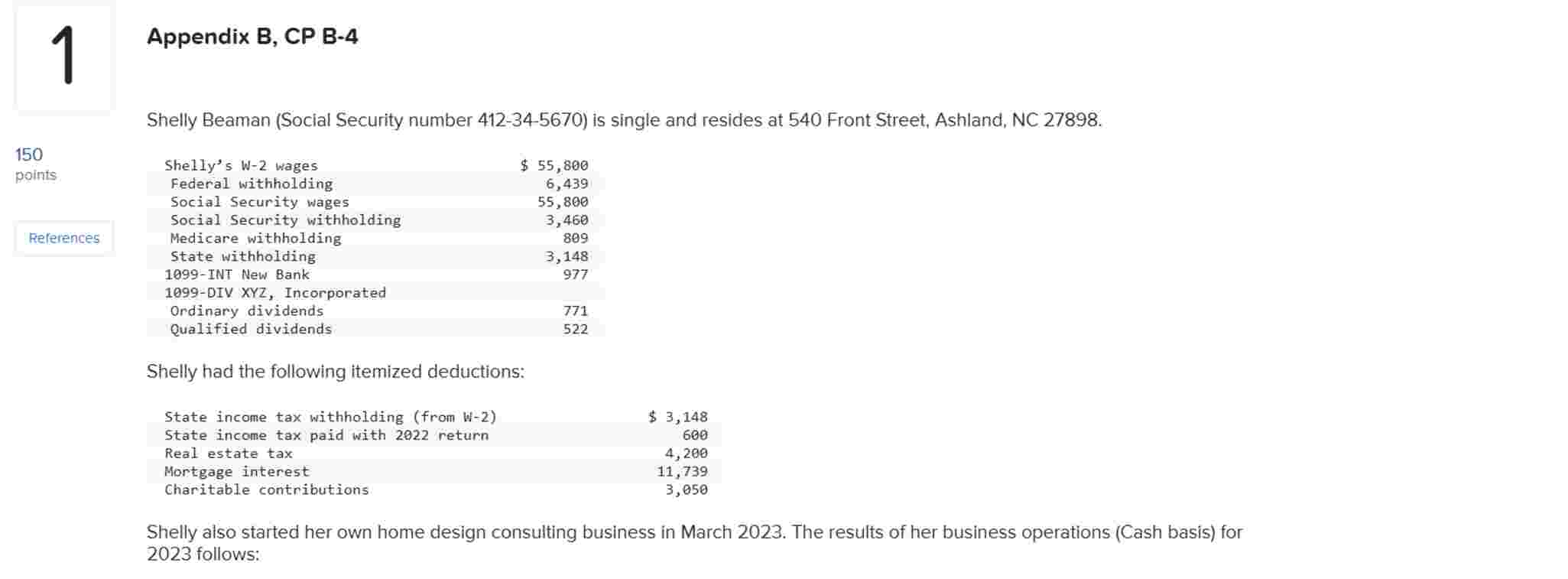

Shelly Beaman Social Security number is single and resides at Front Street, Ashland, NC

Shelly had the following itemized deductions:

Shelly also started her own home design consulting business in March The results of her business operations Cash basis for follows: Appendix B CP B

Shelly Beaman Social Security number is single and resides at Front Street, Ashland, NC

Shelly had the following itemized deductions:

Shelly also started her own home design consulting business in March The results of her business operations Cash basis for follows: Shelly also started her own home design consulting business in March The results of her business operations Cash basis for follows:

Shelly made a $ estimated tax payment on April Shelly made a $ estimated tax payment on April

Required:

Prepare Shelly's Form for including all appropriate schedules. Schedule A Schedule C Form and Schedule SE are required. Section is elected on all eligible assets in She wants to contribute to the presidential election campaign and does not want anyone to be a thirdparty designee. Shelly has not acquired any financial interest in virtual currency last year. For any missing information, make reasonable assumptions. Use the appropriate depreciation table underline Aunderline A or A Use the appropriate Tax Tables and Tax Rate Schedules.

Note: List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Input all the values as positive numbers unless otherwise stated in the forms. Instructions can be found on certain cells within the forms. Round your intermediate computations and your final answers to the nearest whole dollar amount. Do not skip rows while entering in Other Expenses section of Schedule C and in Section B of Part III Form Round the depreciation percent from the appropriate table to mathbf decimal places.

along with Form and Form for a Single taxpayer with no dependents.

Schedule SE

Form

P

Form

P

Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock