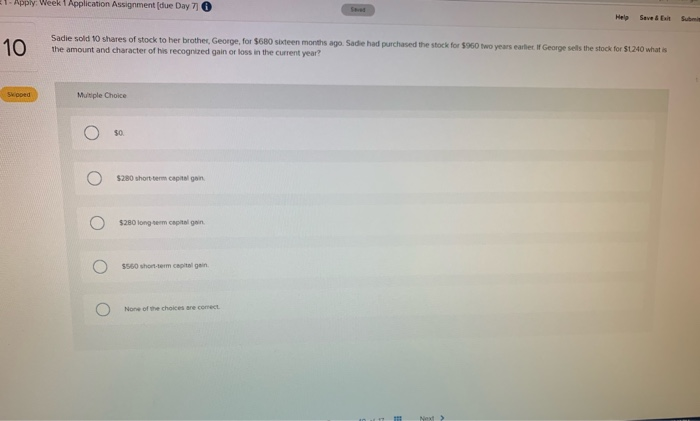

Question: 1 - Apply Week 1 Application Assignment (due Day 71 O Help Seve& 10 Sadie sold 10 shares of stock to her brother, George, for

1 - Apply Week 1 Application Assignment (due Day 71 O Help Seve& 10 Sadie sold 10 shares of stock to her brother, George, for $680 sixteen months ago Sadie had purchased the stock for $960 two years earlier if George sels the stock for $1.240 what is the amount and character of his recognized gain or loss in the current year? spoed Multiple Choice 50 $280 short term capital gain 5280 long term capital gain $560 short-term capital gain None of the choices are corect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts