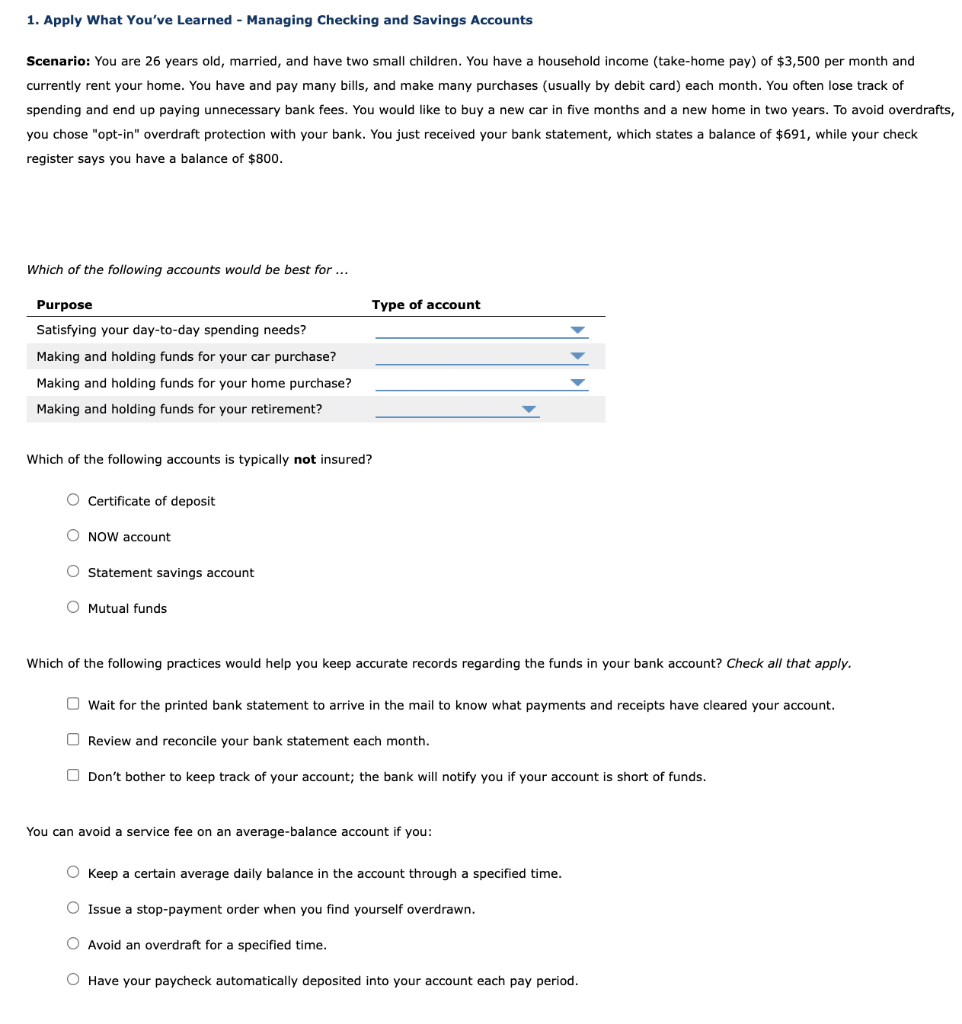

Question: 1. Apply What You've Learned - Managing Checking and Savings Accounts Scenario: You are 26 years old, married, and have two small children. You have

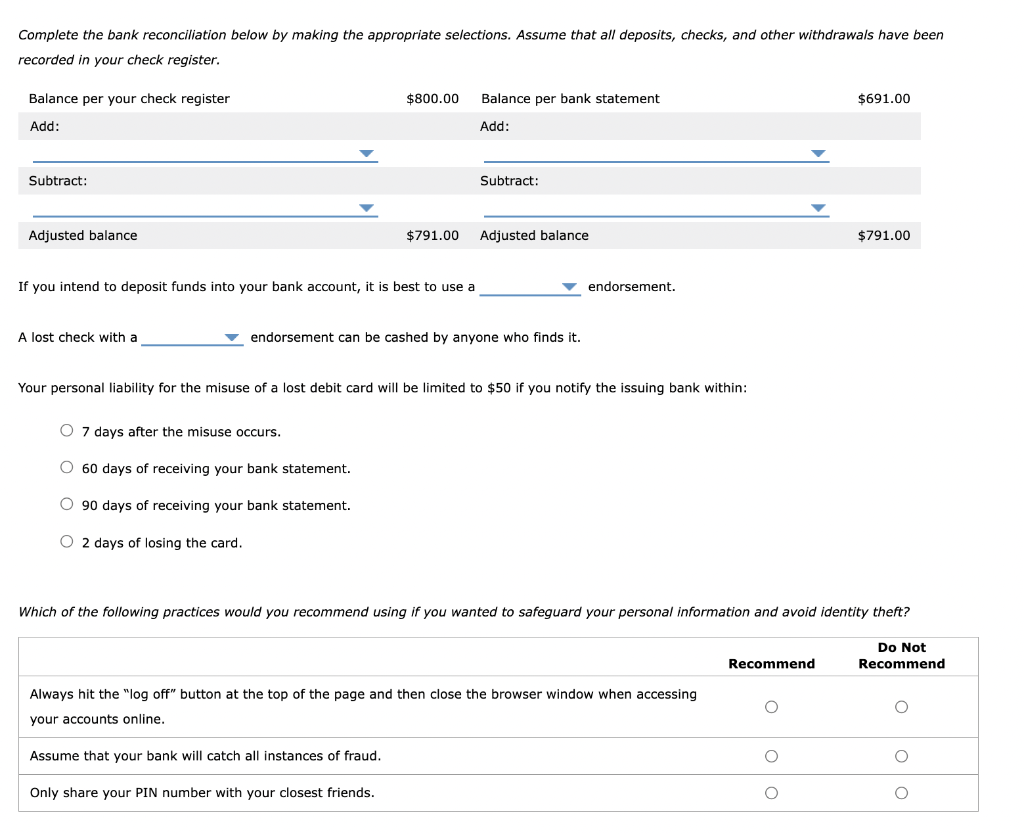

1. Apply What You've Learned - Managing Checking and Savings Accounts Scenario: You are 26 years old, married, and have two small children. You have a household income (take-home pay) of $3,500 per month and currently rent your home. You have and pay many bills, and make many purchases (usually by debit card) each month. You often lose track of spending and end up paying unnecessary bank fees. You would like to buy a new car in five months and a new home in two years. To avoid overdrafts, you chose "opt-in" overdraft protection with your bank. You just received your bank statement, which states a balance of $691, while your check register says you have a balance of $800. Which of the following accounts would be best for ... Type of account Purpose Satisfying your day-to-day spending needs? Making and holding funds for your car purchase? Making and holding funds for your home purchase? Making and holding funds for your retirement? Which of the following accounts is typically not insured? Certificate of deposit NOW account Statement savings account O Mutual funds Which of the following practices would help you keep accurate records regarding the funds in your bank account? Check all that apply. Wait for the printed bank statement to arrive in the mail to know what payments and receipts have cleared your account. Review and reconcile your bank statement each month. Don't bother to keep track of your account; the bank will notify you if your account is short of funds. You can avoid a service fee on an average-balance account if you: O OKee a certain average daily balance in the account through a specified time. Issue a stop-payment order when you find yourself overdrawn. O Avoid an overdraft for a specified time. Have your paycheck automatically deposited into your account each pay period. Complete the bank reconciliation below by making the appropriate selections. Assume that all deposits, checks, and other withdrawals have been recorded in your check register. Balance per your check register $800.00 Balance per bank statement $691.00 Add: Add: Subtract: Subtract: Adjusted balance $791.00 Adjusted balance $791.00 If you intend to deposit funds into your bank account, it is best to use a endorsement. A lost check with a endorsement can be cashed by anyone who finds it. Your personal liability for the misuse of a lost debit card will be limited to $50 if you notify the issuing bank within: O 7 days after the misuse occurs. O 60 days of receiving your bank statement. O 90 days of receiving your bank statement. O 2 days of losing the card. Which of the following practices would you recommend using if you wanted to safeguard your personal information and avoid identity theft? Do Not Recommend Recommend Always hit the "log off" button at the top of the page and then close the browser window when accessing your accounts online. O Assume that your bank will catch all instances of fraud. O o Only share your PIN number with your closest friends. 1. Apply What You've Learned - Managing Checking and Savings Accounts Scenario: You are 26 years old, married, and have two small children. You have a household income (take-home pay) of $3,500 per month and currently rent your home. You have and pay many bills, and make many purchases (usually by debit card) each month. You often lose track of spending and end up paying unnecessary bank fees. You would like to buy a new car in five months and a new home in two years. To avoid overdrafts, you chose "opt-in" overdraft protection with your bank. You just received your bank statement, which states a balance of $691, while your check register says you have a balance of $800. Which of the following accounts would be best for ... Type of account Purpose Satisfying your day-to-day spending needs? Making and holding funds for your car purchase? Making and holding funds for your home purchase? Making and holding funds for your retirement? Which of the following accounts is typically not insured? Certificate of deposit NOW account Statement savings account O Mutual funds Which of the following practices would help you keep accurate records regarding the funds in your bank account? Check all that apply. Wait for the printed bank statement to arrive in the mail to know what payments and receipts have cleared your account. Review and reconcile your bank statement each month. Don't bother to keep track of your account; the bank will notify you if your account is short of funds. You can avoid a service fee on an average-balance account if you: O OKee a certain average daily balance in the account through a specified time. Issue a stop-payment order when you find yourself overdrawn. O Avoid an overdraft for a specified time. Have your paycheck automatically deposited into your account each pay period. Complete the bank reconciliation below by making the appropriate selections. Assume that all deposits, checks, and other withdrawals have been recorded in your check register. Balance per your check register $800.00 Balance per bank statement $691.00 Add: Add: Subtract: Subtract: Adjusted balance $791.00 Adjusted balance $791.00 If you intend to deposit funds into your bank account, it is best to use a endorsement. A lost check with a endorsement can be cashed by anyone who finds it. Your personal liability for the misuse of a lost debit card will be limited to $50 if you notify the issuing bank within: O 7 days after the misuse occurs. O 60 days of receiving your bank statement. O 90 days of receiving your bank statement. O 2 days of losing the card. Which of the following practices would you recommend using if you wanted to safeguard your personal information and avoid identity theft? Do Not Recommend Recommend Always hit the "log off" button at the top of the page and then close the browser window when accessing your accounts online. O Assume that your bank will catch all instances of fraud. O o Only share your PIN number with your closest friends.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts