Question: 1. assume all facts are the same except in Required a. Millers stock has a fair value of $30 per share. Prepare the necessary journal

1. assume all facts are the same except in Required a. Millers stock has a fair value of $30 per share. Prepare the necessary journal entries if Miller Dissolves Richmond so it is no longer a separate legal entity. (On the date of acquisition).

2. Assume instead that Richmond will retain separate legal incorporation and maintain its own accounting system. Prepare the necessary journal entries and a worksheet to consolidate the accounts of the two companies. (On the date of acquisition)

3. Assume Building and Equipment has 20 years useful life and all others have indefinite useful life, Calculate Amortization Expense.

4.In the year subsequent to the acquisition (2021), Richmond generates an income of $80,000 and pays a dividend of $10,000.

Prepare the necessary journal entries for 2021.

What is the ending balance of Investment in Richmond Company as of 12/31/2021?

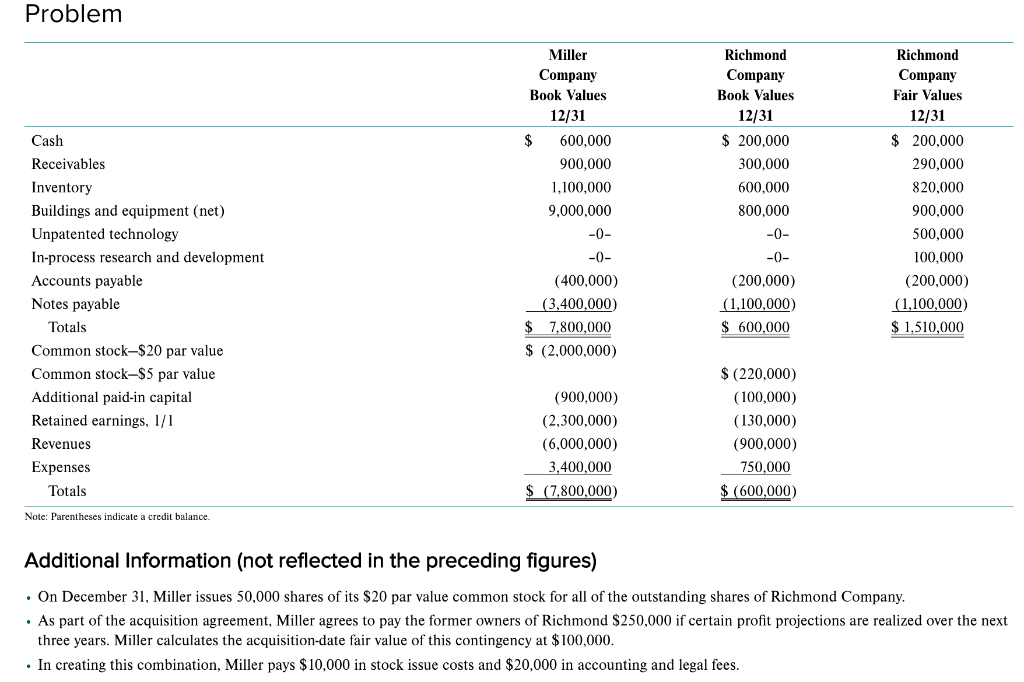

Problem Additional Information (not reflected in the preceding figures) - On December 31, Miller issues 50,000 shares of its $20 par value common stock for all of the outstanding shares of Richmond Company. - As part of the acquisition agreement, Miller agrees to pay the former owners of Richmond $250,000 if certain profit projections are realized over the next three years. Miller calculates the acquisition-date fair value of this contingency at $100,000. - In creating this combination, Miller pays $10,000 in stock issue costs and $20,000 in accounting and legal fees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts