Question: 1) Assume the company does not expect to replace the units of beginning inventory sold, it plans to reduce inventory by year-end to 500 units.

1) Assume the company does not expect to replace the units of beginning inventory sold, it plans to reduce inventory by year-end to 500 units. what amount of cost of goods sold should be recorded for the quarter ended March 31?

a)$657,000 b)$659,600 c)$671,600 d)618,000

2) Assume the company expects to replace the units of beginning inventory sold in April at a cost of $92 per unit and expects inventory at year-end to be between 1,500 and 2,000 units. What amount of cost of goods sold should be recorded for the quarter ended March 31?

a)$659,600 b)$618,000 c)$657,000 d)$671,000

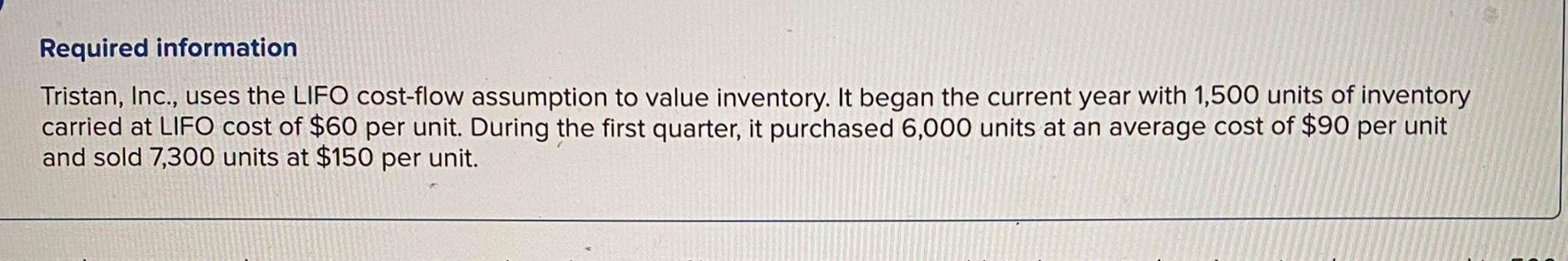

Required information Tristan, Inc., uses the LIFO cost-flow assumption to value inventory. It began the current year with 1,500 units of inventory carried at LIFO cost of $60 per unit. During the first quarter, it purchased 6,000 units at an average cost of $90 per unit and sold 7,300 units at $150 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts