Question: 1. Assume the equity method is applied. Compute the noncontrolling interest in Demers at December 31, 2020. a.107,000 b.126,000 c.109,200 d.149,600 e.148,200 2. Assume the

1. Assume the equity method is applied. Compute the noncontrolling interest in Demers at December 31, 2020.

1. Assume the equity method is applied. Compute the noncontrolling interest in Demers at December 31, 2020.

a.107,000 b.126,000 c.109,200 d.149,600 e.148,200

2. Assume the equity method is applied. Compute the noncontrolling interest in Demers at December 31, 2021.

a.107,800 b.140,000 c.165,200 d.160,800 e.146,800

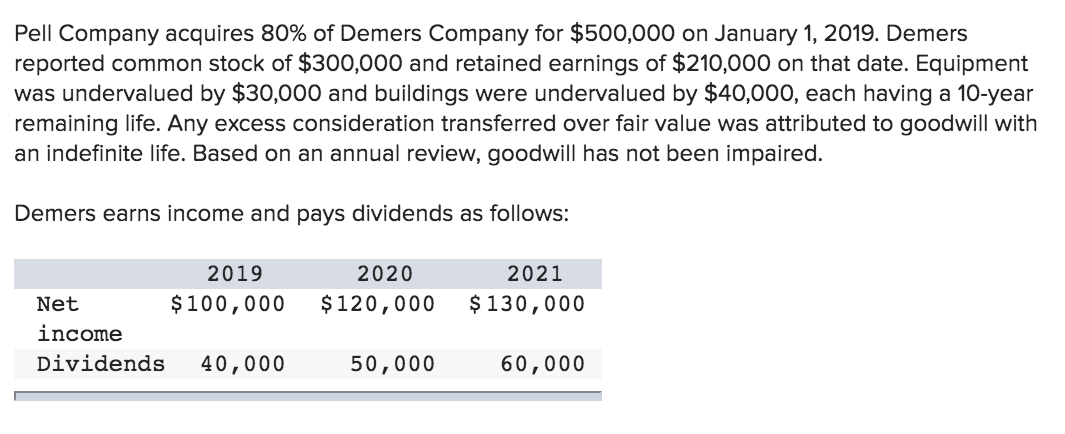

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. Demers earns income and pays dividends as follows: 2019 Net $100,000 income Dividends 40,000 2020 $120,000 2021 $ 130,000 50,000 60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts