Question: 1. Assume the Vasicek model is true. Consider the evolution of the term structure as follows with T=3 years and h= 1 year. G 3d4

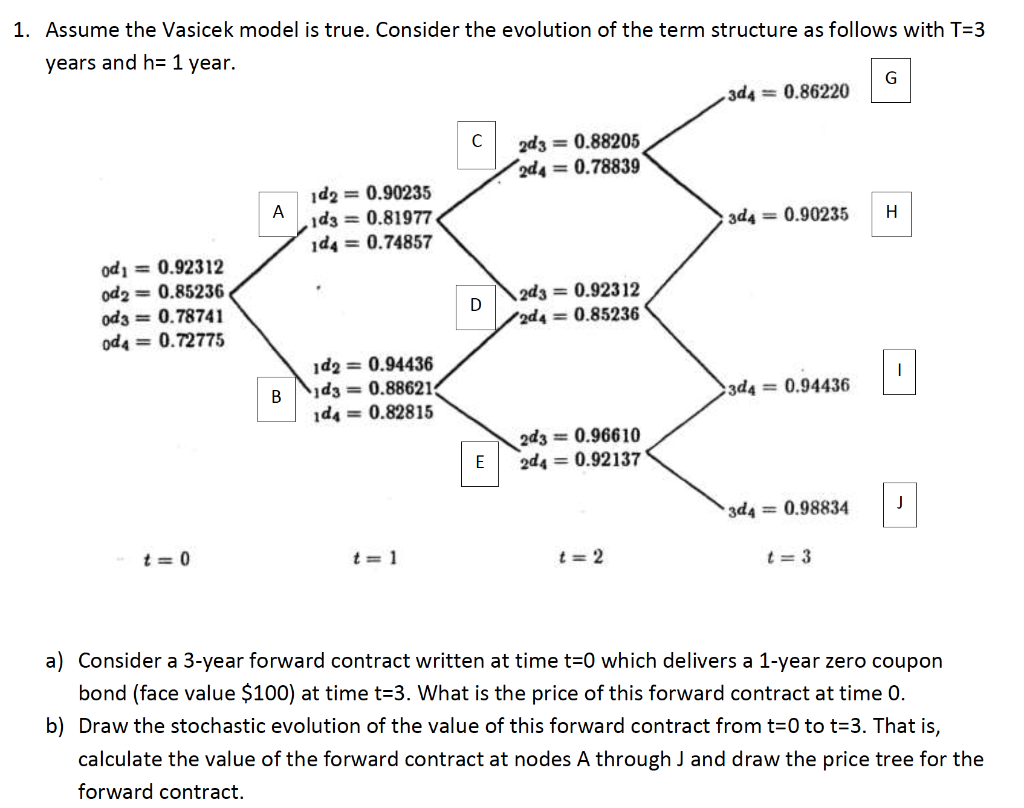

1. Assume the Vasicek model is true. Consider the evolution of the term structure as follows with T=3 years and h= 1 year. G 3d4 = 0.86220 2d3 = 0.88205 2d4 = 0.78839 . 1d2 = 0.90235 1d3 = 0.81977 id4 = 0.74857 3d4 = 0.90235 H od, = 0.92312 od2 = 0.85236 odz = 0.78741 odA = 0.72775 D \2d3 = 0.92312 2d4 = 0.85236 1 B id2 = 0.94436 idz = 0.886214 idt = 0.82815 3d4 = 0.94436 2d3 = 0.96610 2d4 = 0.92137 E 3d4 = 0.98834 J t=0 t=1 t = 2 t=3 a) Consider a 3-year forward contract written at time t=0 which delivers a 1-year zero coupon bond (face value $100) at time t=3. What is the price of this forward contract at time 0. b) Draw the stochastic evolution of the value of this forward contract from t=0 to t=3. That is, calculate the value of the forward contract at nodes A through J and draw the price tree for the forward contract. 1. Assume the Vasicek model is true. Consider the evolution of the term structure as follows with T=3 years and h= 1 year. G 3d4 = 0.86220 2d3 = 0.88205 2d4 = 0.78839 . 1d2 = 0.90235 1d3 = 0.81977 id4 = 0.74857 3d4 = 0.90235 H od, = 0.92312 od2 = 0.85236 odz = 0.78741 odA = 0.72775 D \2d3 = 0.92312 2d4 = 0.85236 1 B id2 = 0.94436 idz = 0.886214 idt = 0.82815 3d4 = 0.94436 2d3 = 0.96610 2d4 = 0.92137 E 3d4 = 0.98834 J t=0 t=1 t = 2 t=3 a) Consider a 3-year forward contract written at time t=0 which delivers a 1-year zero coupon bond (face value $100) at time t=3. What is the price of this forward contract at time 0. b) Draw the stochastic evolution of the value of this forward contract from t=0 to t=3. That is, calculate the value of the forward contract at nodes A through J and draw the price tree for the forward contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts