Question: 1. At what price do you receive a margin call? 2. If the lender deposits your rebates into your margin account, at what price do

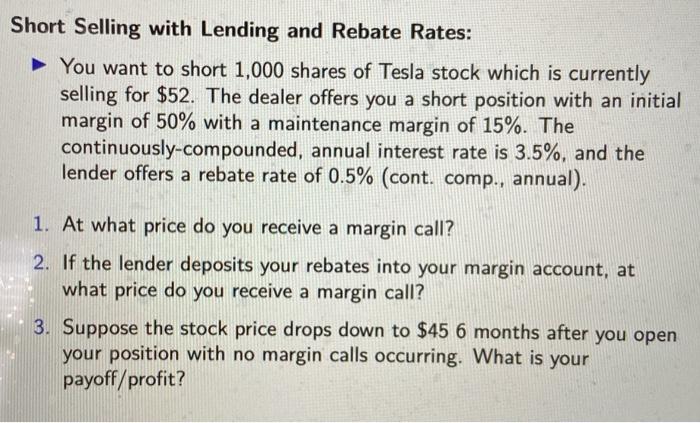

Short Selling with Lending and Rebate Rates: You want to short 1,000 shares of Tesla stock which is currently selling for $52. The dealer offers you a short position with an initial margin of 50% with a maintenance margin of 15%. The continuously-compounded, annual interest rate is 3.5%, and the lender offers a rebate rate of 0.5% (cont. comp., annual). 1. At what price do you receive a margin call? 2. If the lender deposits your rebates into your margin account, at what price do you receive a margin call? 3. Suppose the stock price drops down to $45 6 months after you open your position with no margin calls occurring. What is your payoff/profit? Short Selling with Lending and Rebate Rates: You want to short 1,000 shares of Tesla stock which is currently selling for $52. The dealer offers you a short position with an initial margin of 50% with a maintenance margin of 15%. The continuously-compounded, annual interest rate is 3.5%, and the lender offers a rebate rate of 0.5% (cont. comp., annual). 1. At what price do you receive a margin call? 2. If the lender deposits your rebates into your margin account, at what price do you receive a margin call? 3. Suppose the stock price drops down to $45 6 months after you open your position with no margin calls occurring. What is your payoff/profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts