Question: 1. Background: please start by building an n=10-period binomial model for the short-rate, ri,j. The lattice parameters are: r0,0=5%,u=1.1,d=0.9 and q=1q=1/2. Compute the price of

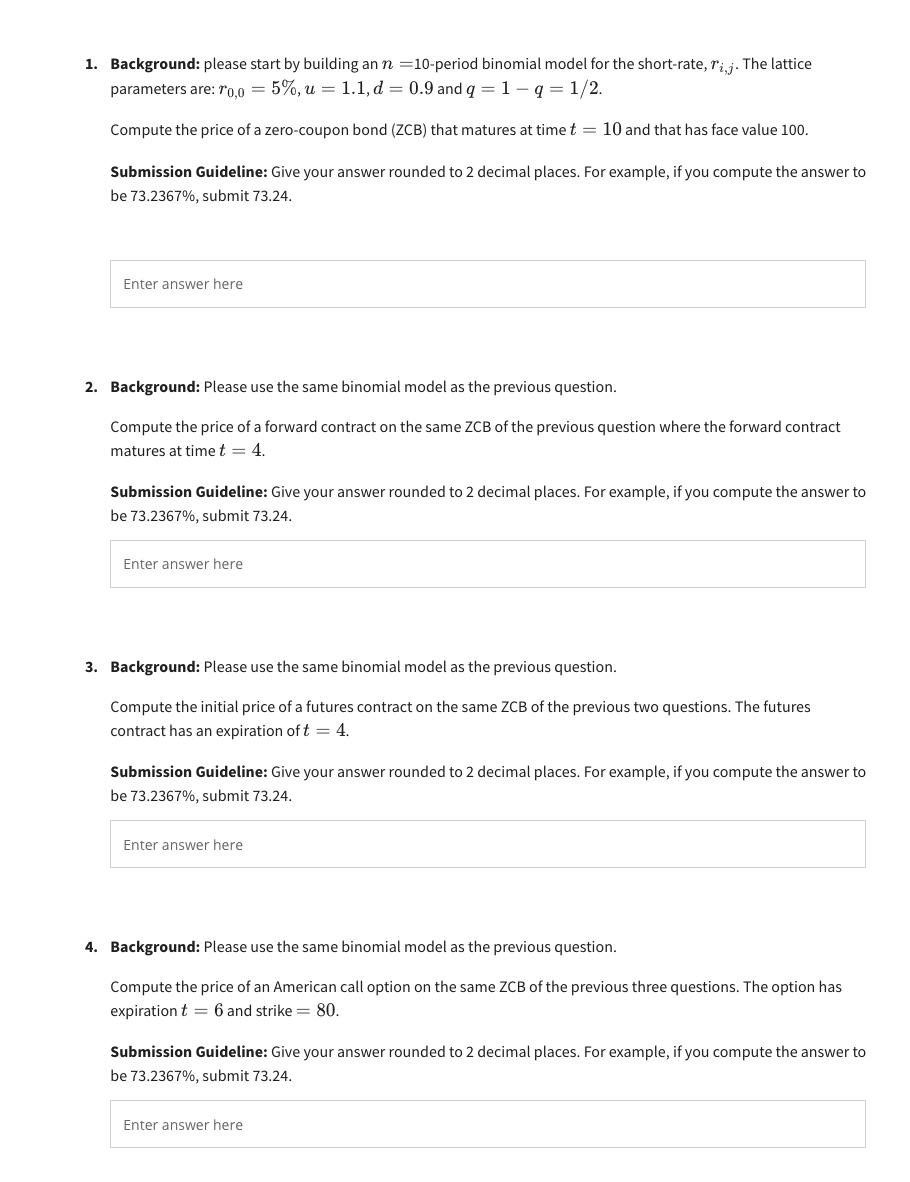

1. Background: please start by building an n=10-period binomial model for the short-rate, ri,j. The lattice parameters are: r0,0=5%,u=1.1,d=0.9 and q=1q=1/2. Compute the price of a zero-coupon bond (ZCB) that matures at time t=10 and that has face value 100. Submission Guideline: Give your answer rounded to 2 decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24 2. Background: Please use the same binomial model as the previous question. Compute the price of a forward contract on the same ZCB of the previous question where the forward contract matures at time t=4 Submission Guideline: Give your answer rounded to 2 decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24 3. Background: Please use the same binomial model as the previous question. Compute the initial price of a futures contract on the same ZCB of the previous two questions. The futures contract has an expiration of t=4. Submission Guideline: Give your answer rounded to 2 decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24 4. Background: Please use the same binomial model as the previous question. Compute the price of an American call option on the same ZCB of the previous three questions. The option has expiration t=6 and strike =80. Submission Guideline: Give your answer rounded to 2 decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts