Question: 1. Bank managers should always seek the highest return possible on their assets. Is this statement true, false or uncertain? Explain your answer. 2. If

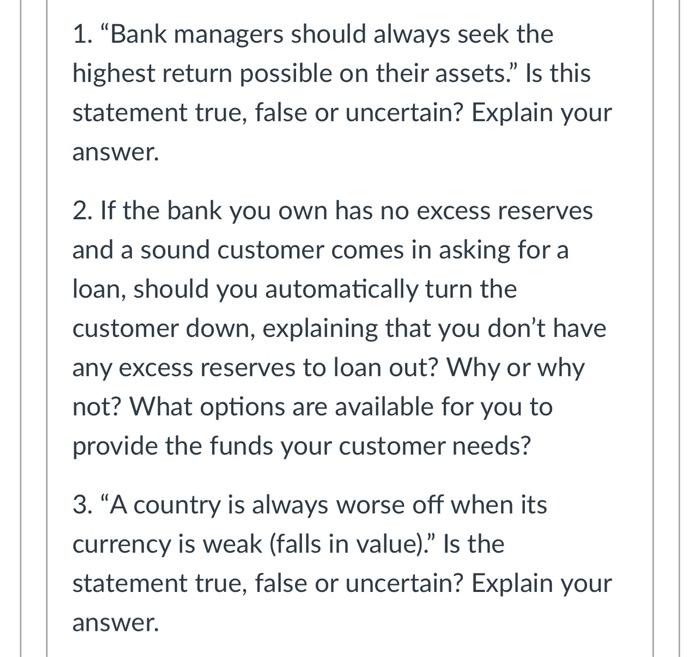

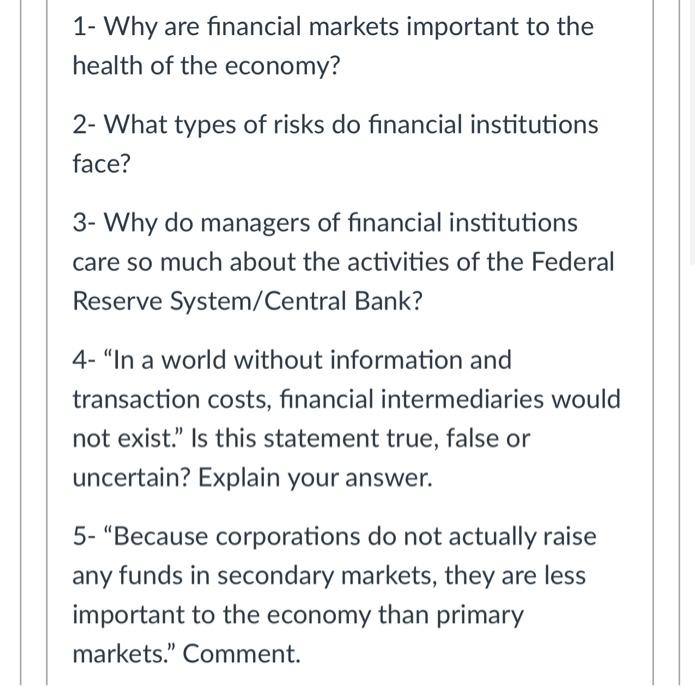

1. "Bank managers should always seek the highest return possible on their assets." Is this statement true, false or uncertain? Explain your answer. 2. If the bank you own has no excess reserves and a sound customer comes in asking for a loan, should you automatically turn the customer down, explaining that you don't have any excess reserves to loan out? Why or why not? What options are available for you to provide the funds your customer needs? 3. "A country is always worse off when its currency is weak (falls in value)." Is the statement true, false or uncertain? Explain your answer. 1- Why are financial markets important to the health of the economy? 2- What types of risks do financial institutions face? 3- Why do managers of financial institutions care so much about the activities of the Federal Reserve System/Central Bank? 4- "In a world without information and transaction costs, financial intermediaries would not exist." Is this statement true, false or uncertain? Explain your answer. 5- "Because corporations do not actually raise any funds in secondary markets, they are less important to the economy than primary markets." Comment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts