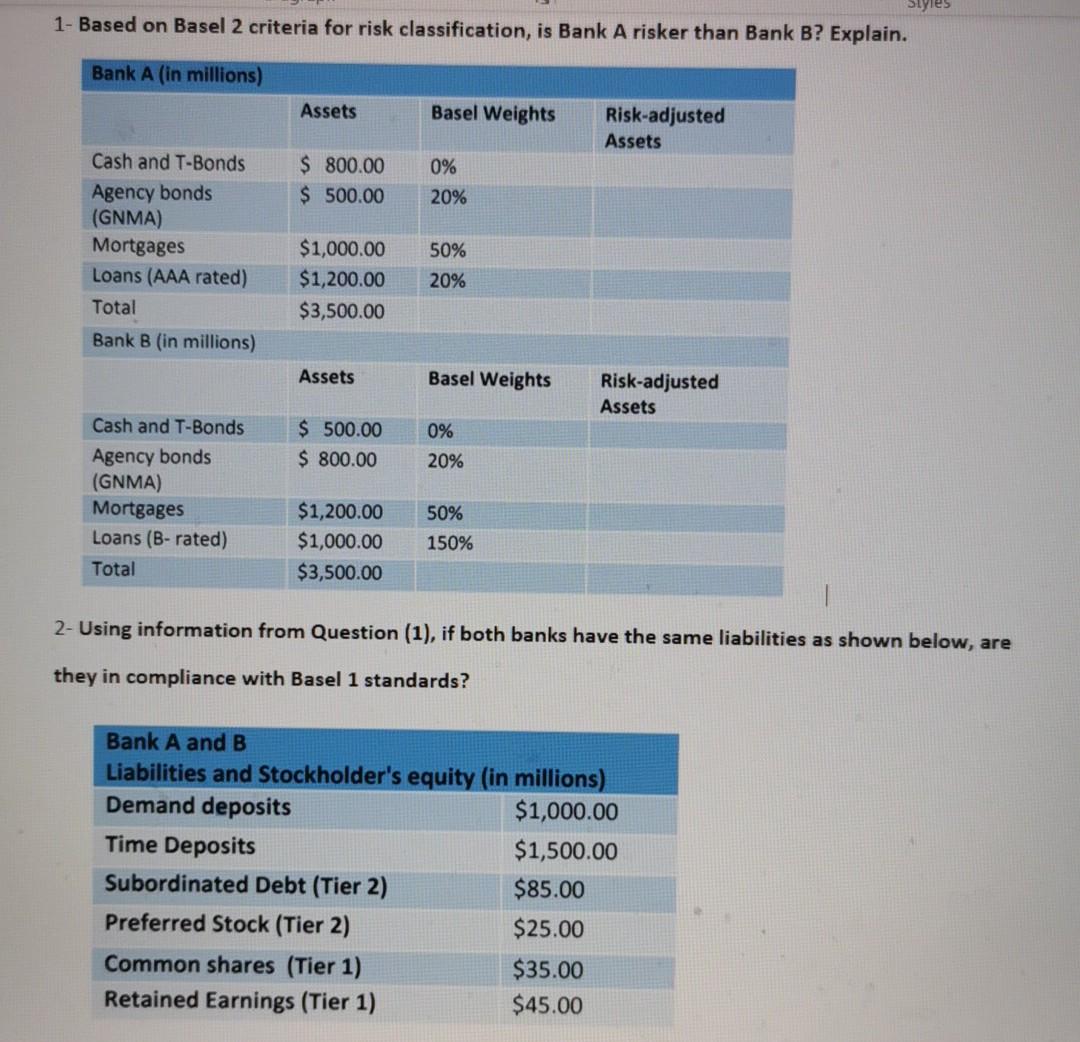

Question: 1- Based on Basel 2 criteria for risk classification, is Bank A risker than Bank B? Explain. Bank A (in millions) Assets Basel Weights Risk-adjusted

1- Based on Basel 2 criteria for risk classification, is Bank A risker than Bank B? Explain. Bank A (in millions) Assets Basel Weights Risk-adjusted Assets $ 800.00 $ 500.00 0% 20% Cash and T-Bonds Agency bonds (GNMA) Mortgages Loans (AAA rated) Total Bank B (in millions) $1,000.00 $1,200.00 $3,500.00 50% 20% Assets Basel Weights Risk-adjusted Assets 0% $ 500.00 $ 800.00 20% Cash and T-Bonds Agency bonds (GNMA) Mortgages Loans (B-rated) Total 50% $1,200.00 $1,000.00 $3,500.00 150% 2- Using information from Question (1), if both banks have the same liabilities as shown below, are they in compliance with Basel 1 standards? Bank A and B Liabilities and Stockholder's equity (in millions) Demand deposits $1,000.00 Time Deposits $1,500.00 Subordinated Debt (Tier 2) $85.00 Preferred Stock (Tier 2) $25.00 Common shares (Tier 1) $35.00 Retained Earnings (Tier 1) $45.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts