Question: 1). Based on the expectation theory with the term premium when ahor term interest rates are not expected to change or stav the same, the

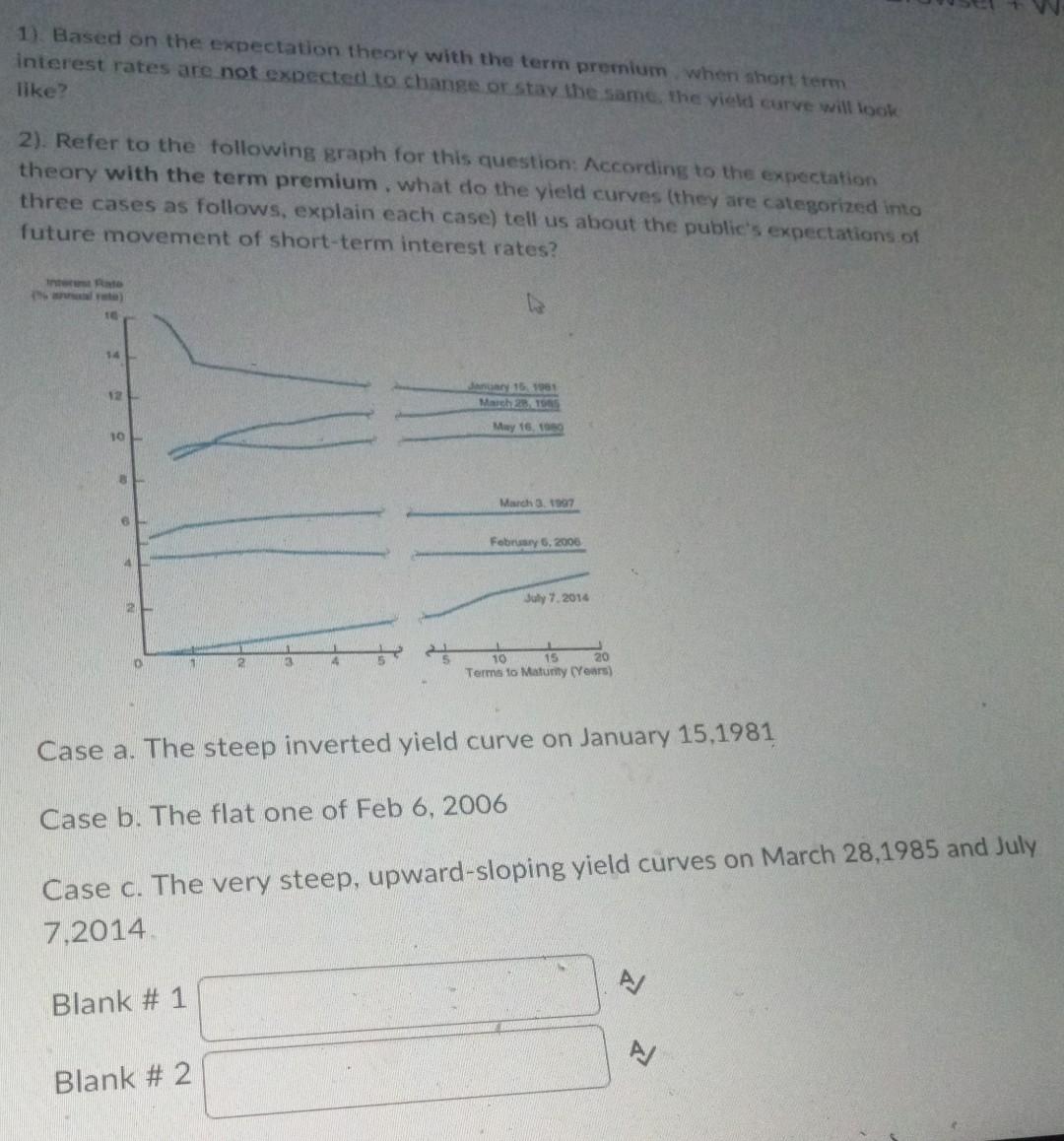

1). Based on the expectation theory with the term premium when ahor term interest rates are not expected to change or stav the same, the vield curve will looke like? 2). Refer to the following graph for this question: According to the expectation theory with the term premium, what do the yield curves (they are categorized into three cases as follows, explain each case) tell us about the public's expectations of future movement of short-term interest rates? Case a. The steep inverted yield curve on January 15,1981 Case b. The flat one of Feb 6, 2006 Case c. The very steep, upward-sloping yield curves on March 28,1985 and July 7,2014. Blank \#1 Blank \# 2 1). Based on the expectation theory with the term premium when ahor term interest rates are not expected to change or stav the same, the vield curve will looke like? 2). Refer to the following graph for this question: According to the expectation theory with the term premium, what do the yield curves (they are categorized into three cases as follows, explain each case) tell us about the public's expectations of future movement of short-term interest rates? Case a. The steep inverted yield curve on January 15,1981 Case b. The flat one of Feb 6, 2006 Case c. The very steep, upward-sloping yield curves on March 28,1985 and July 7,2014. Blank \#1 Blank \# 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts