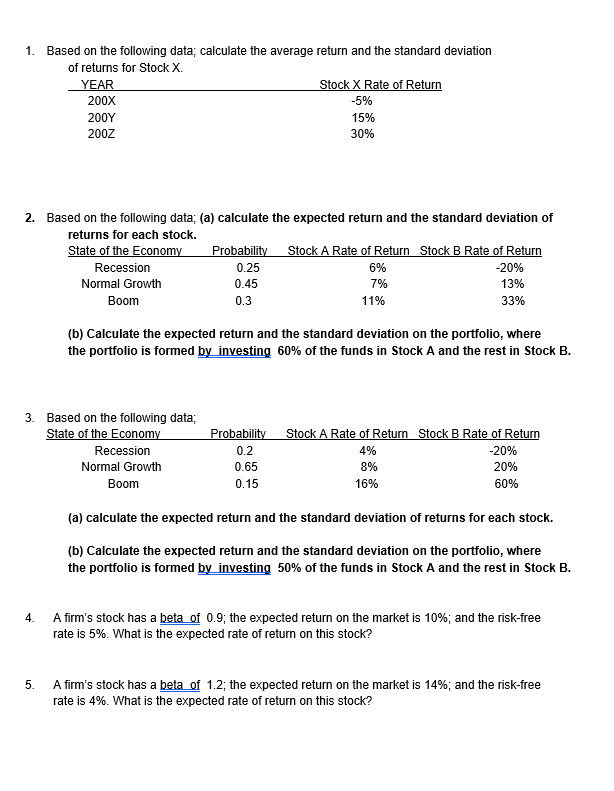

Question: 1. Based on the following data, calculate the average return and the standard deviation of returns for Stock X. YEAR Stock X Rate of Return

1. Based on the following data, calculate the average return and the standard deviation of returns for Stock X. YEAR Stock X Rate of Return 200X -5% 2007 15% 2002 30% 2. Based on the following data; (a) calculate the expected return and the standard deviation of returns for each stock. State of the Economy Probability Stock A Rate of Return Stock B Rate of Return Recession 0.25 6% -20% Normal Growth 0.45 13% Boom 0.3 11% 33% 7% (b) Calculate the expected return and the standard deviation on the portfolio, where the portfolio is formed by investing 60% of the funds in Stock A and the rest in Stock B. 3. Based on the following data; State of the Economy Recession Normal Growth Boom Probability 0.2 0.65 0.15 Stock A Rate of Return Stock B Rate of Return 4% -20% 20% 16% 60% 8% (a) calculate the expected return and the standard deviation of returns for each stock. (b) Calculate the expected return and the standard deviation on the portfolio, where the portfolio is formed by investing 50% of the funds in Stock A and the rest in Stock B. 4. A firm's stock has a beta of 0.9; the expected return on the market is 10%, and the risk-free rate is 5%. What is the expected rate of return on this stock? 5. A firm's stock has a beta of 1.2; the expected return on the market is 14%, and the risk-free rate is 4%. What is the expected rate of return on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts