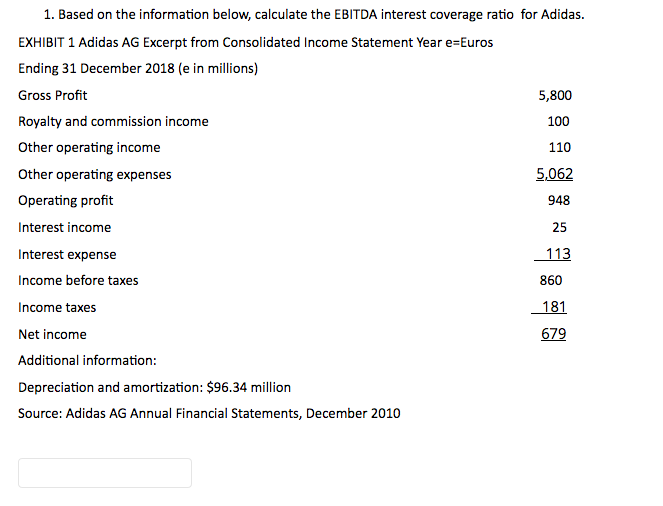

Question: 1. Based on the information below, calculate the EBITDA interest coverage ratio for Adidas. EXHIBIT 1 Adidas AG Excerpt from Consolidated Income Statement Year e=Euros

1. Based on the information below, calculate the EBITDA interest coverage ratio for Adidas. EXHIBIT 1 Adidas AG Excerpt from Consolidated Income Statement Year e=Euros Ending 31 December 2018 (e in millions) Gross Profit 5,800 Royalty and commission income 100 Other operating income 110 Other operating expenses 5,062 Operating profit 948 Interest income 25 Interest expense 113 Income before taxes 860 Income taxes 181 Net income 679 Additional information: Depreciation and amortization: $96.34 million Source: Adidas AG Annual Financial Statements, December 2010 1. Based on the information below, calculate the EBITDA interest coverage ratio for Adidas. EXHIBIT 1 Adidas AG Excerpt from Consolidated Income Statement Year e=Euros Ending 31 December 2018 (e in millions) Gross Profit 5,800 Royalty and commission income 100 Other operating income 110 Other operating expenses 5,062 Operating profit 948 Interest income 25 Interest expense 113 Income before taxes 860 Income taxes 181 Net income 679 Additional information: Depreciation and amortization: $96.34 million Source: Adidas AG Annual Financial Statements, December 2010

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts