Question: (1) Based on the information provided in Table 1, calculate the prices of the treasury securities assuming par value $1,000. (Note: All Treasury securities are

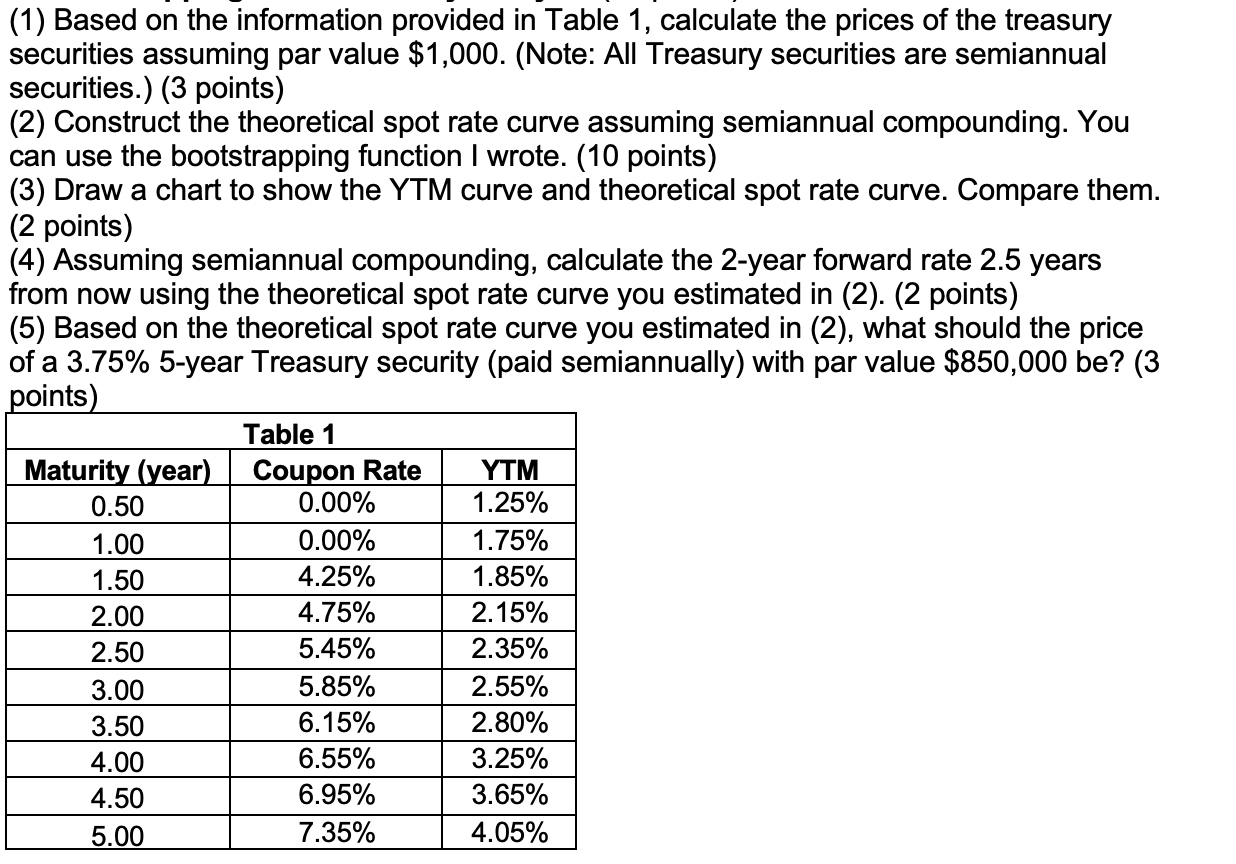

(1) Based on the information provided in Table 1, calculate the prices of the treasury securities assuming par value $1,000. (Note: All Treasury securities are semiannual securities.) (3 points) (2) Construct the theoretical spot rate curve assuming semiannual compounding. You can use the bootstrapping function I wrote. (10 points) (3) Draw a chart to show the YTM curve and theoretical spot rate curve. Compare them. (2 points) (4) Assuming semiannual compounding, calculate the 2-year forward rate 2.5 years from now using the theoretical spot rate curve you estimated in (2). (2 points) (5) Based on the theoretical spot rate curve you estimated in (2), what should the price of a 3.75% 5-year Treasury security (paid semiannually) with par value $850,000 be? (3 points) Table 1 Maturity (year) | Coupon Rate YTM 0.50 0.00% 1.25% 1.00 0.00% 1.75% 1.50 4.25% 1.85% 2.00 4.75% 2.15% 2.50 5.45% 2.35% 3.00 5.85% 2.55% 3.50 6.15% 2.80% 4.00 6.55% 3.25% 4.50 6.95% 3.65% 5.00 7.35% 4.05% (1) Based on the information provided in Table 1, calculate the prices of the treasury securities assuming par value $1,000. (Note: All Treasury securities are semiannual securities.) (3 points) (2) Construct the theoretical spot rate curve assuming semiannual compounding. You can use the bootstrapping function I wrote. (10 points) (3) Draw a chart to show the YTM curve and theoretical spot rate curve. Compare them. (2 points) (4) Assuming semiannual compounding, calculate the 2-year forward rate 2.5 years from now using the theoretical spot rate curve you estimated in (2). (2 points) (5) Based on the theoretical spot rate curve you estimated in (2), what should the price of a 3.75% 5-year Treasury security (paid semiannually) with par value $850,000 be? (3 points) Table 1 Maturity (year) | Coupon Rate YTM 0.50 0.00% 1.25% 1.00 0.00% 1.75% 1.50 4.25% 1.85% 2.00 4.75% 2.15% 2.50 5.45% 2.35% 3.00 5.85% 2.55% 3.50 6.15% 2.80% 4.00 6.55% 3.25% 4.50 6.95% 3.65% 5.00 7.35% 4.05%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts