Question: 1. Based on the projection, NewStar Corp expects to generate revenues of $500,000 per year, with fixed costs of $200,000 per year, and variable costs

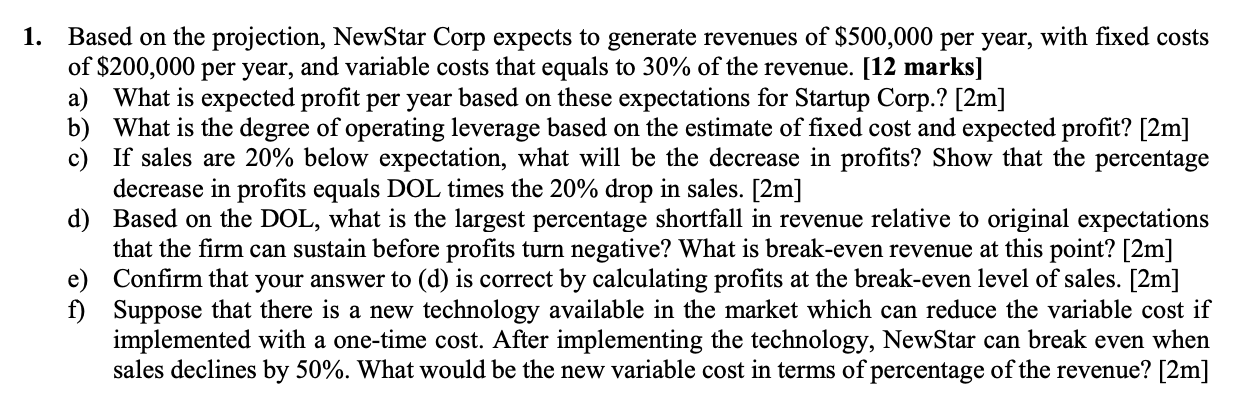

1. Based on the projection, NewStar Corp expects to generate revenues of $500,000 per year, with fixed costs of $200,000 per year, and variable costs that equals to 30% of the revenue. (12 marks] a) What is expected profit per year based on these expectations for Startup Corp.? [2m] b) What is the degree of operating leverage based on the estimate of fixed cost and expected profit? [2m] c) If sales are 20% below expectation, what will be the decrease in profits? Show that the percentage decrease in profits equals DOL times the 20% drop in sales. [2m] d) Based on the DOL, what is the largest percentage shortfall in revenue relative to original expectations that the firm can sustain before profits turn negative? What is break-even revenue at this point? [2m] e) Confirm that your answer to (d) is correct by calculating profits at the break-even level of sales. [2m] f) Suppose that there is a new technology available in the market which can reduce the variable cost if implemented with a one-time cost. After implementing the technology, NewStar can break even when sales declines by 50%. What would be the new variable cost in terms of percentage of the revenue? [2m] 1. Based on the projection, NewStar Corp expects to generate revenues of $500,000 per year, with fixed costs of $200,000 per year, and variable costs that equals to 30% of the revenue. (12 marks] a) What is expected profit per year based on these expectations for Startup Corp.? [2m] b) What is the degree of operating leverage based on the estimate of fixed cost and expected profit? [2m] c) If sales are 20% below expectation, what will be the decrease in profits? Show that the percentage decrease in profits equals DOL times the 20% drop in sales. [2m] d) Based on the DOL, what is the largest percentage shortfall in revenue relative to original expectations that the firm can sustain before profits turn negative? What is break-even revenue at this point? [2m] e) Confirm that your answer to (d) is correct by calculating profits at the break-even level of sales. [2m] f) Suppose that there is a new technology available in the market which can reduce the variable cost if implemented with a one-time cost. After implementing the technology, NewStar can break even when sales declines by 50%. What would be the new variable cost in terms of percentage of the revenue? [2m]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts