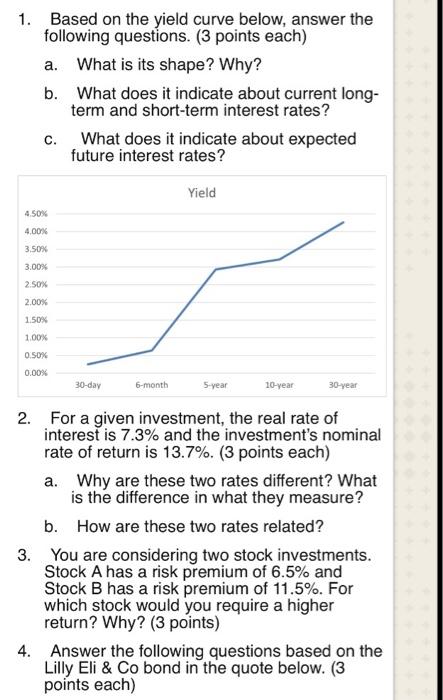

Question: 1. Based on the yield curve below, answer the following questions. (3 points each) a. What is its shape? Why? b. What does it indicate

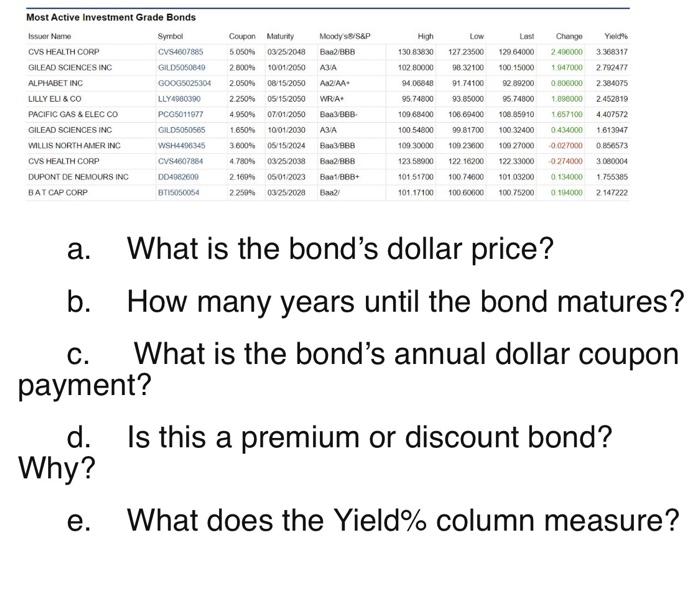

1. Based on the yield curve below, answer the following questions. (3 points each) a. What is its shape? Why? b. What does it indicate about current long- term and short-term interest rates? c. What does it indicate about expected future interest rates? Yield 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 30-day 6-month 5-year 10-year 30-year 2. For a given investment, the real rate of interest is 7.3% and the investment's nominal rate of return is 13.7%. (3 points each) a. Why are these two rates different? What is the difference in what they measure? b. How are these two rates related? 3. You are considering two stock investments. Stock A has a risk premium of 6.5% and Stock B has a risk premium of 11.5%. For which stock would you require a higher return? Why? (3 points) 4. Answer the following questions based on the Lilly Eli & Co bond in the quote below. (3 points each) Low 127 23500 90.32100 91.74100 93.85000 Most Active Investment Grade Bonds Issuer Name Symbol CVS HEALTH CORP CVS4607885 GILEAD SCIENCES INC GILD5050840 ALPHABET INC GOOG5025304 LILLY ELI & CO LLY4960300 PACIFIC GAS & ELECCO PCG5011977 GILEAD SCIENCES INC GILD5050565 WILLIS NORTH AMER INC WSH4406345 CVS HEALTH CORP CVS4607884 DUPONT DE NEMOURS INC DO482000 BAT CAP CORP BT15050054 Coupon Maturity 5050% 03/25 2048 2000% 10:01 2050 2.050% 08/152050 2.250% 05/152050 4950% 07/01 2050 1.6509 10012030 3600% 06/15/2004 47804 03/25 2038 2 100% 05012023 22504 03252028 Moody S8/S&P Baa2888 A2AA WRA Baa3B0B Baa3888 Baa2888 Baa/B88+ Baa2 High 13083830 102 80000 9406848 95,74800 109 88400 100.54800 109 30000 123 58000 10151700 101 17100 108.69400 99.81700 109 23600 122 16200 100 74000 100 60000 Last 12964000 100 15000 9289200 96.74800 100.85910 100 32400 100 27000 12233000 10103200 100 75200 Change 2400000 1047000 0 106000 1.898000 1857100 0434000 0.027000 0274000 0134000 011000 Yield 3.368317 2792477 2.384075 2452819 4.407572 1.613947 0.866573 3080004 1.755385 2 147222 a. What is the bond's dollar price? b. How many years until the bond matures? C. What is the bond's annual dollar coupon payment? d. Is this a premium or discount bond? Why? e. What does the Yield% column measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts