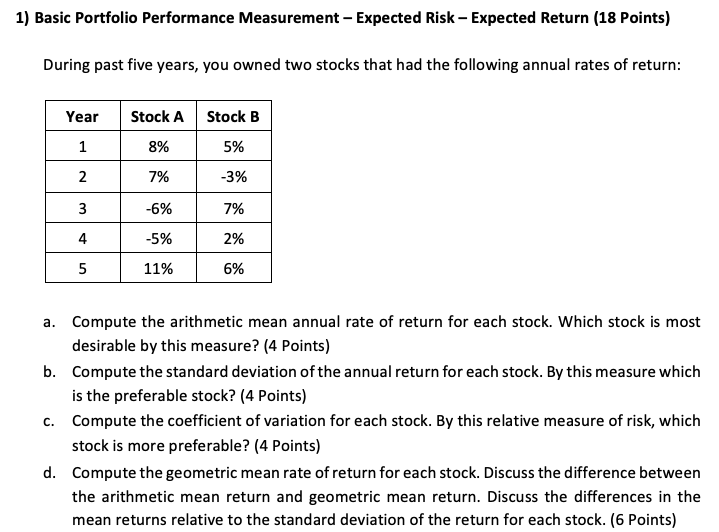

Question: 1) Basic Portfolio Performance Measurement - Expected Risk - Expected Return (18 points) During past five years, you owned two stocks that had the following

1) Basic Portfolio Performance Measurement - Expected Risk - Expected Return (18 points) During past five years, you owned two stocks that had the following annual rates of return: Year Stock A Stock B 1 8% 5% 2 7% -3% 3 -6% 7% 4 -5% 2% 5 11% 6% a. Compute the arithmetic mean annual rate of return for each stock. Which stock is most desirable by this measure? (4 Points) b. Compute the standard deviation of the annual return for each stock. By this measure which is the preferable stock? (4 points) C. Compute the coefficient of variation for each stock. By this relative measure of risk, which stock is more preferable? (4 Points) d. Compute the geometric mean rate of return for each stock. Discuss the difference between the arithmetic mean return and geometric mean return. Discuss the differences in the mean returns relative to the standard deviation of the return for each stock. (6 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts