Question: 1. BBB Ltd., issued a 20 year zero coupon bond on 1 July 2016. It is now 1 July 2020. The current yield to

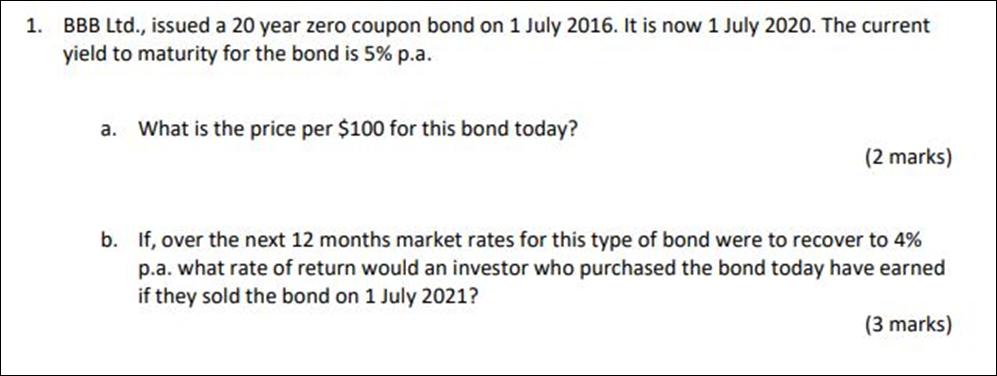

1. BBB Ltd., issued a 20 year zero coupon bond on 1 July 2016. It is now 1 July 2020. The current yield to maturity for the bond is 5% p.a. a. What is the price per $100 for this bond today? (2 marks) b. If, over the next 12 months market rates for this type of bond were to recover to 4% p.a. what rate of return would an investor who purchased the bond today have earned if they sold the bond on 1 July 2021? (3 marks)

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

a Given Zero coupon bond issued on 1 July 2016 Date is now 1 July 2020 Time remaining to ... View full answer

Get step-by-step solutions from verified subject matter experts