Question: 1. Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million of debt at a pre-tax rate

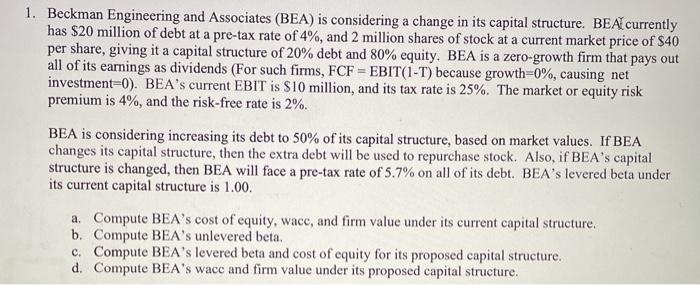

1. Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million of debt at a pre-tax rate of 4%, and 2 million shares of stock at a current market price of $40 per share, giving it a capital structure of 20% debt and 80% equity. BEA is a zero-growth firm that pays out all of its earnings as dividends (For such firms, FCF = EBIT(1-T) because growth=0%, causing net investment=0). BEA's current EBIT is $10 million, and its tax rate is 25%. The market or equity risk premium is 4%, and the risk-free rate is 2%. BEA is considering increasing its debt to 50% of its capital structure, based on market values. If BEA changes its capital structure, then the extra debt will be used to repurchase stock. Also, if BEA's capital structure is changed, then BEA will face a pre-tax rate of 5.7% on all of its debt. BEA's levered beta under its current capital structure is 1.00. a. Compute BEA's cost of equity, wace, and firm value under its current capital structure. b. Compute BEA's unlevered beta. c. Compute BEA's levered beta and cost of equity for its proposed capital structure. d. Compute BEA's wacc and firm value under its proposed capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts