Question: 1) Binomial Pricing Model Write a Python function that returns the price of a European call or put option by using the binomial (risk- neutral)

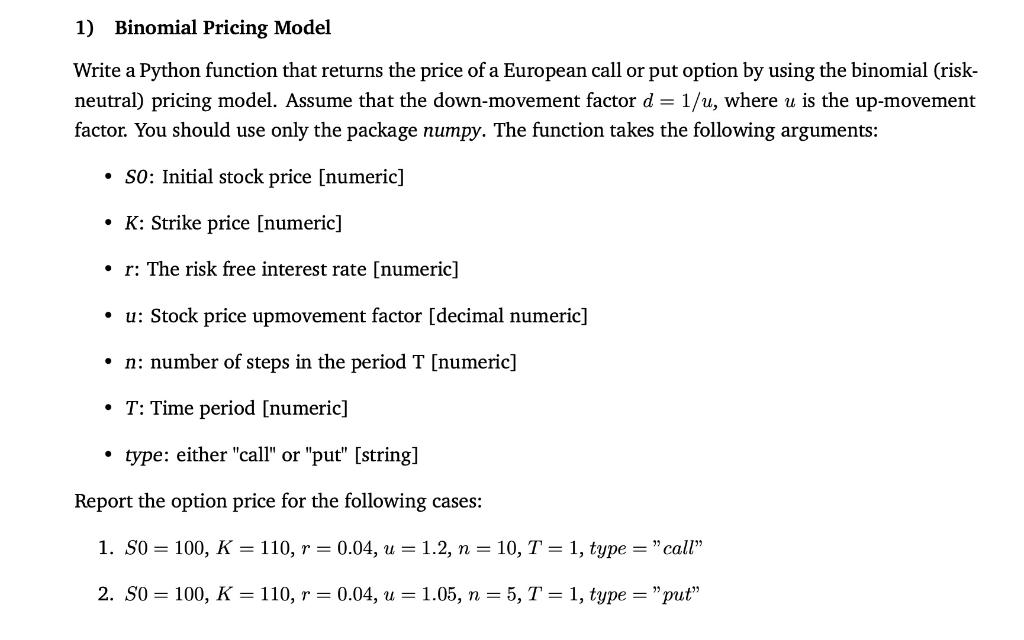

1) Binomial Pricing Model Write a Python function that returns the price of a European call or put option by using the binomial (risk- neutral) pricing model. Assume that the down- movement factor d = 1/u, where u is the up-movement factor. You should use only the package numpy. The function takes the following arguments: SO: Initial stock price [numeric] K: Strike price (numeric] r: The risk free interest rate [numeric] . u: Stock price upmovement factor [decimal numeric] n: number of steps in the period T [numeric] T: Time period (numeric] type: either "call" or "put" (string] Report the option price for the following cases: 1. S0= 100, K = 110, r=0.04, u=1.2, n = 10, T = 1, type = "call" 2. S0 = 100, K = 110, r = 0.04, u = 1.05, n=5, T = 1, type = "put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts