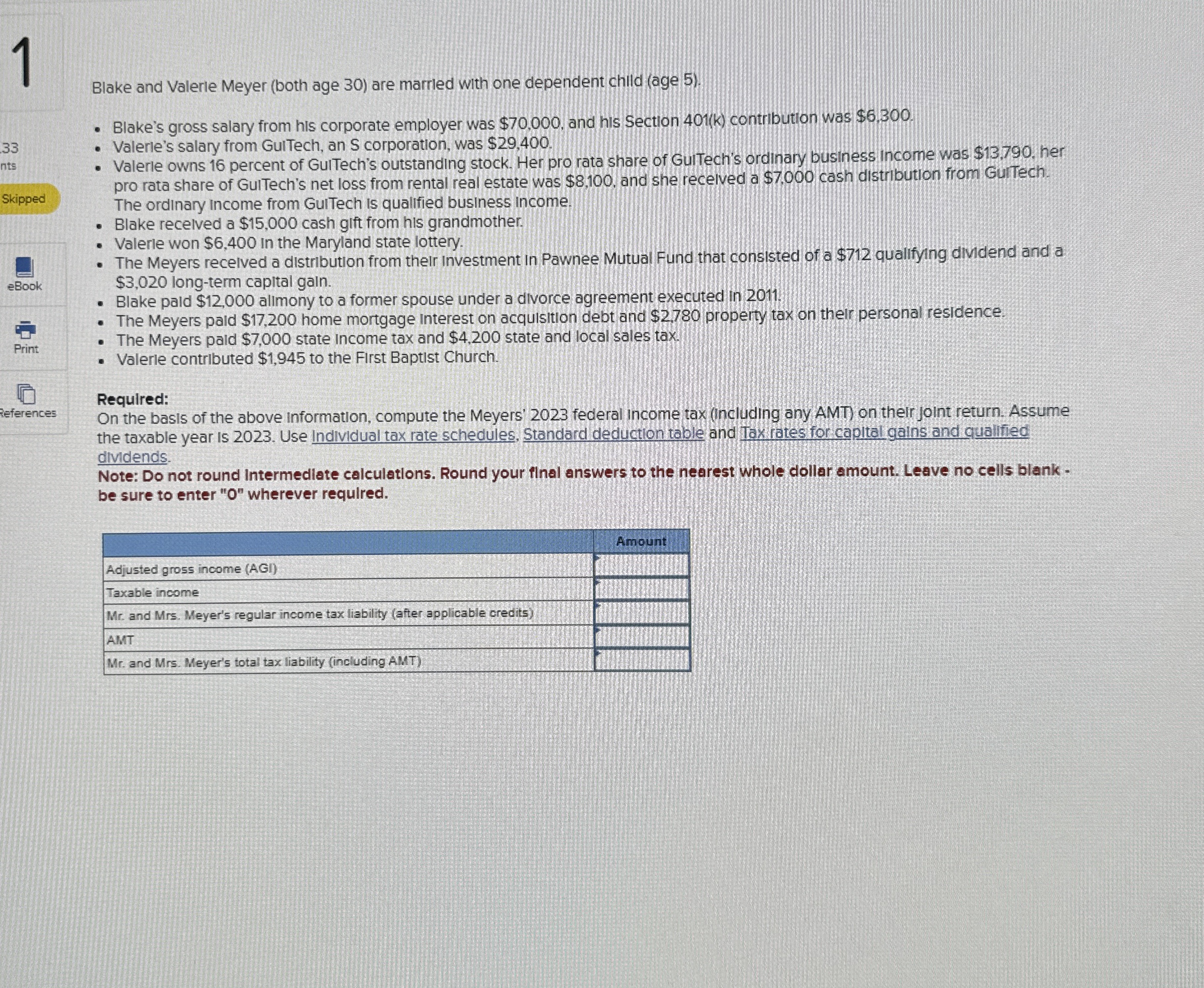

Question: 1 Blake and Valerle Meyer ( both age 3 0 ) are married with one dependent child ( age 5 ) . Blake's gross salary

Blake and Valerle Meyer both age are married with one dependent child age

Blake's gross salary from his corporate employer was $ and his Section contribution was $

nts

Skipped

Valerle's salary from GulTech, an S corporation, was $

Valerle owns percent of GulTech's outstanding stock. Her pro rata share of GulTech's ordinary business income was $ her pro rata share of GulTech's net loss from rental real estate was $ and she recelved a $ cash distribution from GulTech. The ordinary income from GulTech is qualified business income.

Blake recelved a $ cash glft from his grandmother.

Valerle won $ in the Maryland state lottery.

The Meyers recelved a distribution from their Investment in Pawnee Mutual Fund that consisted of a $ qualifying dividend and a $ longterm capital galn.

Blake pald $ alimony to a former spouse under a divorce agreement executed in

The Meyers pald $ home mortgage interest on acquisition debt and $ property tax on their personal residence.

The Meyers paid $ state income tax and $ state and local sales tax.

Valerle contrlbuted $ to the First Baptist Church.

Required:

On the basis of the above information, compute the Meyers' federal income tax including any AMT on their joint return. Assume the taxable year is Use Individual tax rate schedules, Standard deduction table and Tax rates for capltal gains and quallified dividends.

Note: Do not round Intermediate calculatlons. Round your final answers to the nearest whole dollar amount. Leave no cells blankbe sure to enter wherever required.

tableAmquntAdjusted gross income AGITaxable income,Mr and Mrs Meyer's regular income tax liability after applicable creditsAMTMr and Mrs Meyer's total tax liability including AMT

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock