Question: 1) Bond with a $1.000 par value has an 8 percent annual coupon rate. It will mature in 4 years, and annual coupon payments are

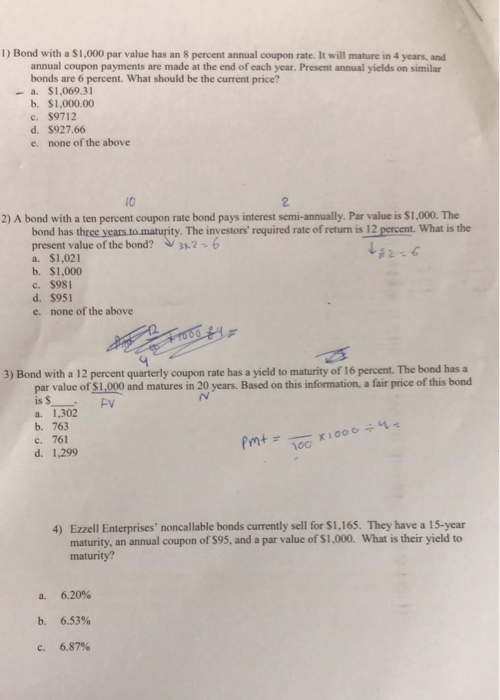

1) Bond with a $1.000 par value has an 8 percent annual coupon rate. It will mature in 4 years, and annual coupon payments are made at the end of each year. Present annual yields on similar bonds are 6 percent. What should be the current price? - a. S1.069.31 b. S1.000.00 c. $9712 d. $927.66 e. none of the above 2) A bond with a ten percent coupon rate bond pays interest semi-annually. Par value is $1.000. The bond has three years to maturity. The investors' required rate of return is 12 percent. What is the present value of the bond? 126 a. $1,021 2-6 b. S1.000 c. $981 d. 1951 e. none of the above In Food by 3) Bond with a 12 percent quarterly coupon rate has a yield to maturity of 16 percent. The bond has a par value of $1,000 and matures in 20 years. Based on this information, a fair price of this bond iss FV a 1,302 b. 763 c. 761 d. 1,299 X1000 - M 4) Ezzell Enterprises' noncallable bonds currently sell for S1.165. They have a 15-year maturity, an annual coupon of 595, and a par value of $1,000. What is their yield to maturity? a 6,20% b. 6.53% c. 6.87%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts