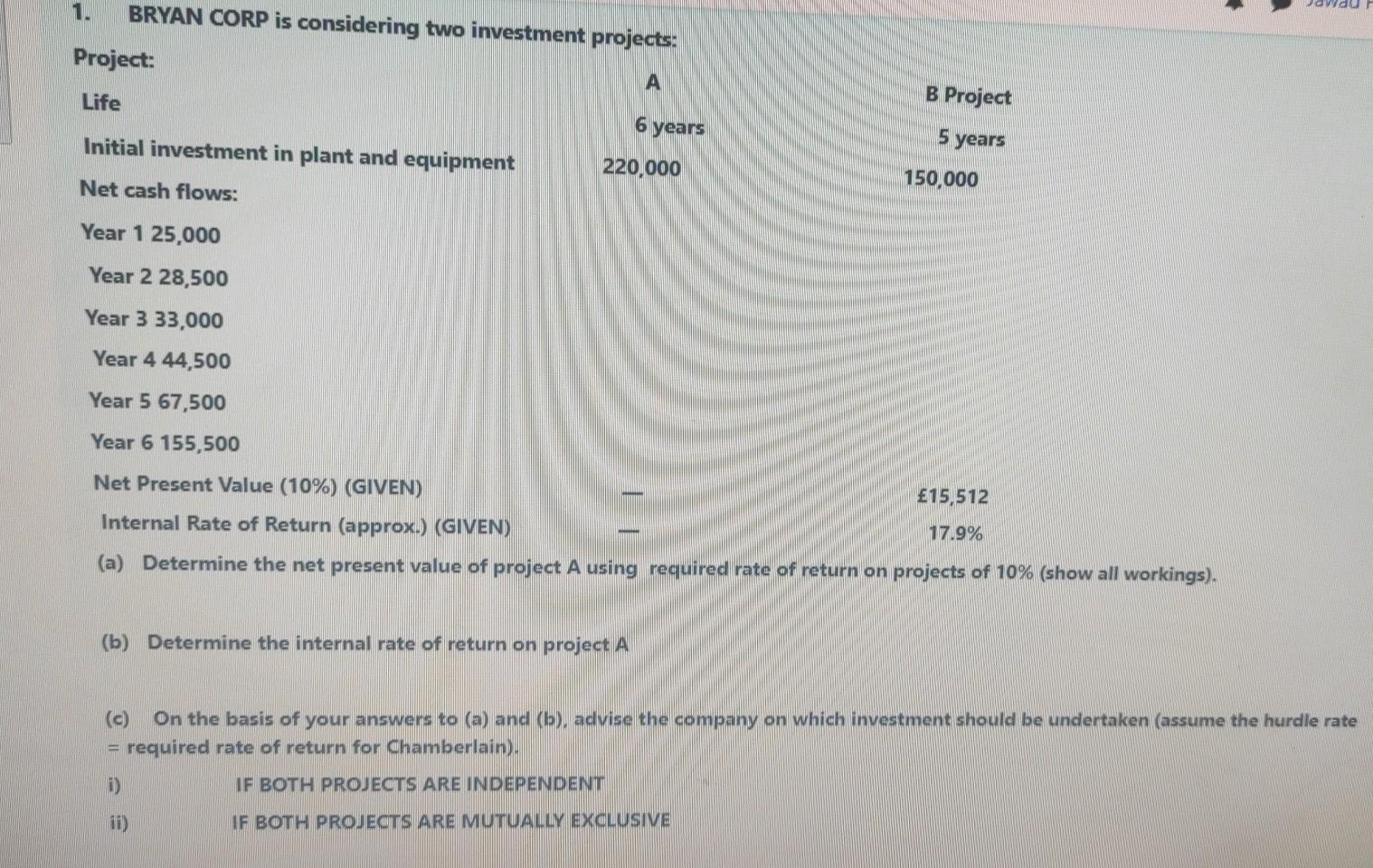

Question: 1. BRYAN CORP is considering two investment projects. Project: A Life B Project Initial investment in plant and equipment 6 years 220,000 5 years Net

1. BRYAN CORP is considering two investment projects. Project: A Life B Project Initial investment in plant and equipment 6 years 220,000 5 years Net cash flows: 150,000 Year 1 25,000 Year 2 28,500 Year 3 33,000 Year 4 44,500 Year 5 67,500 Year 6 155,500 Net Present Value (10%) (GIVEN) 15,512 17.9% Internal Rate of Return (approx.) (GIVEN) (a) Determine the net present value of project A using required rate of return on projects of 10% (show all workings). (b) Determine the internal rate of return on project A (c) On the basis of your answers to (a) and (b), advise the company on which investment should be undertaken (assume the hurdle rate required rate of return for Chamberlain). D) IF BOTH PROJECTS ARE INDEPENDENT IF BOTH PROJEOTS ARE MUTUALLY EXCLUSIVE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts