Question: 1. Build a spreadsheet using excel to show the value of the portfolio with options and without options. Follow the above format to create the

1. Build a spreadsheet using excel to show the value of the portfolio with options and without options. Follow the above format to create the parameters and the formulas for Model.

1. Build a spreadsheet using excel to show the value of the portfolio with options and without options. Follow the above format to create the parameters and the formulas for Model.

2. Use data tables to show the value of the portfolio with options and without options for a share price in six months between $15 and $35 per share in increments of $1.00.

3. Discuss the value of the portfolio with and without the European put options. Which one (with or without) is more profitable?

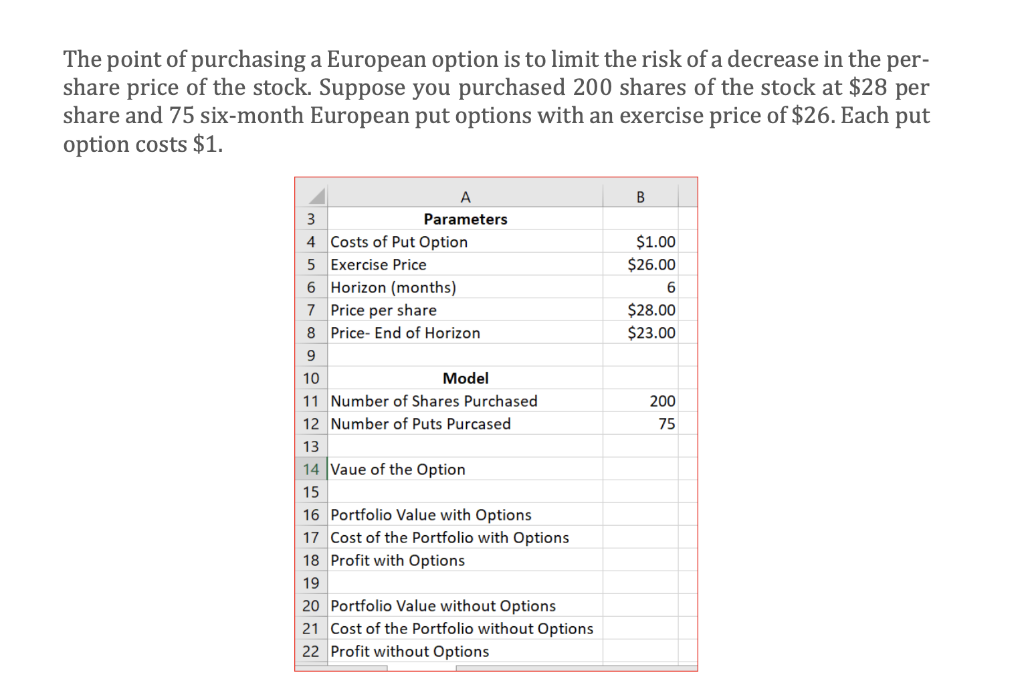

The point of purchasing a European option is to limit the risk of a decrease in the per- share price of the stock. Suppose you purchased 200 shares of the stock at $28 per share and 75 six-month European put options with an exercise price of $26. Each put option costs $1. B $1.00 $26.00 6 $28.00 $23.00 A 3 Parameters 4 Costs of Put Option 5 Exercise Price 6 Horizon (months) 7 Price per share 8 Price- End of Horizon 9 10 Model 11 Number of Shares Purchased 12 Number of Puts Purcased 13 14 Vaue of the Option 15 16 Portfolio Value with Options 17 Cost of the Portfolio with Options 18 Profit with Options 19 20 Portfolio Value without Options 21 Cost of the Portfolio without Options 22 Profit without Options 200 75Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts