Question: 1 C. 9. A security that can be easily converted into cash with little to no loss in value is a liquid b. Very risky

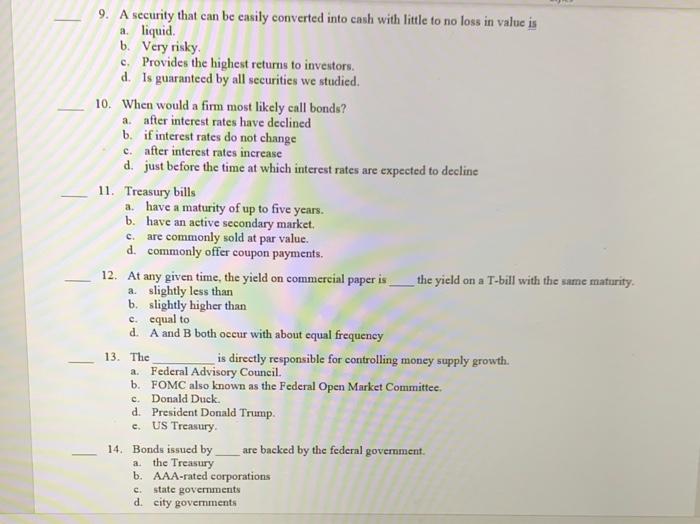

1 C. 9. A security that can be easily converted into cash with little to no loss in value is a liquid b. Very risky c. Provides the highest returns to investors. d. Is guaranteed by all securities we studied. 10. When would a firm most likely call bonds? a. after interest rates have declined b. if interest rates do not change c. after interest rates increase d. just before the time at which interest rates are expected to decline 11. Treasury bills a. have a maturity of up to five years. b. have an active secondary market. are commonly sold at par value. d. commonly offer coupon payments. 12. At any given time, the yield on commercial paper is __ the yield on a T-bill with the same maturity a slightly less than b. slightly higher than c. equal to d. A and B both occur with about equal frequency 13. The is directly responsible for controlling money supply growth. Federal Advisory Council. b. FOMC also known as the Federal Open Market Committee. c. Donald Duck. d. President Donald Trump c. US Treasury 14. Bonds issued by are backed by the federal government a. the Treasury b. AAA-rated corporations state governments d. city governments 2. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts