Question: 1. Calculate (a) net present value, (b) payback period, (c) discounted paybackperiod, and (d) internal rate of return. Keeper Inc. is considering the purchase of

| 1. | Calculate (a) net present value, (b) payback period, (c) discounted paybackperiod, and (d) internal rate of return. |

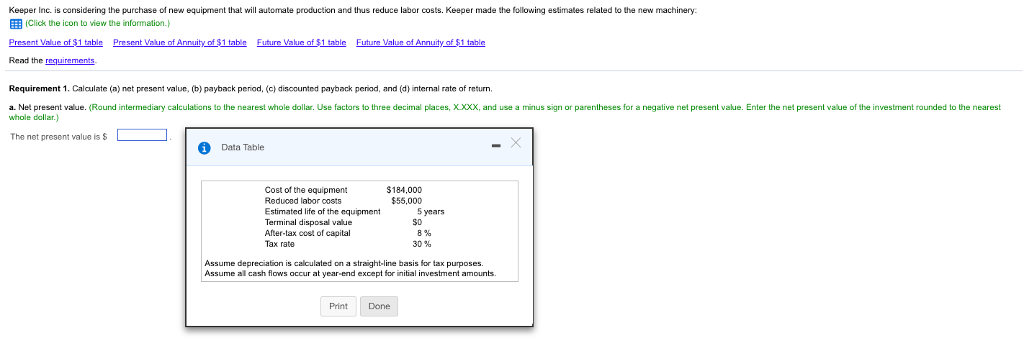

Keeper Inc. is considering the purchase of new equipment that will automate production and thus reduce labor costs. Keeper made the following estimates related to the new machinery Click the icon to view the information.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Valur of Annuity of $1 tabl Read the requirements Requirement 1. Calculate (a) net present value, (b)payback period, (c) discounted payback period, and (d) internal rate of return a. Nel present value. (Round intermediary calculations to the nearest whole dollar. Use factors to three decimal places, XXxx, and use a minus sign or parentheses for a negative nel present value. Enter he net present value of the investment rounded to the nearest whole dollar.) The net present value is $ Data Table $184,000 $55,000 Cost of the equipment Reduced labor costs Estimated life of the equipment Terminal disposal value After-tax cost of capital Tax rate 5 years 8% 30% Assume depreciation is calculated on a straight-line basis for tax purposes. Assume al cash flows occur at year-end except for initial investment amounits. PrintDone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts