Question: 1. Calculate the EPS, ROE and DFL based on the following data for the Rankin Co. Bonds (13%) $22 million Common Stock ($3 par) $15

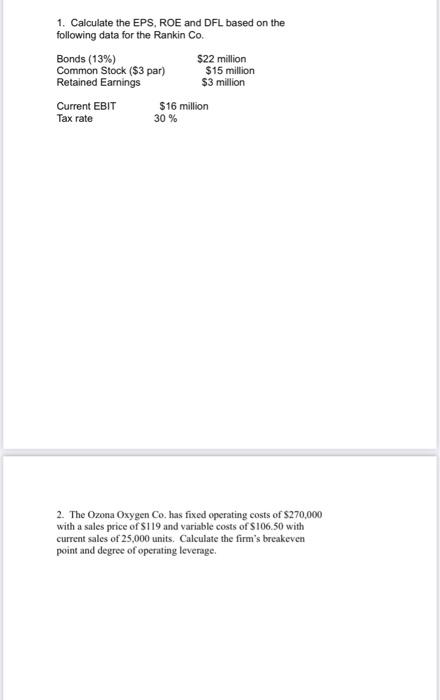

1. Calculate the EPS, ROE and DFL based on the following data for the Rankin Co. Bonds (13%) $22 million Common Stock ($3 par) $15 million Retained Earnings $3 million Current EBIT $16 million Tax rate 30% 2. The Ozona Oxygen Co. has fixed operating costs of $270,000 with a sales price of S119 and variable costs of S106.50 with current sales of 25,000 units. Calculate the firm's breakeven point and degree of operating leverage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock