Question: 1. Calculate the leverage-adjusted duration gap (DGAP) for Bank One. Keep two decimal places Question 2 2. Using the DGAP model. if interest rates on

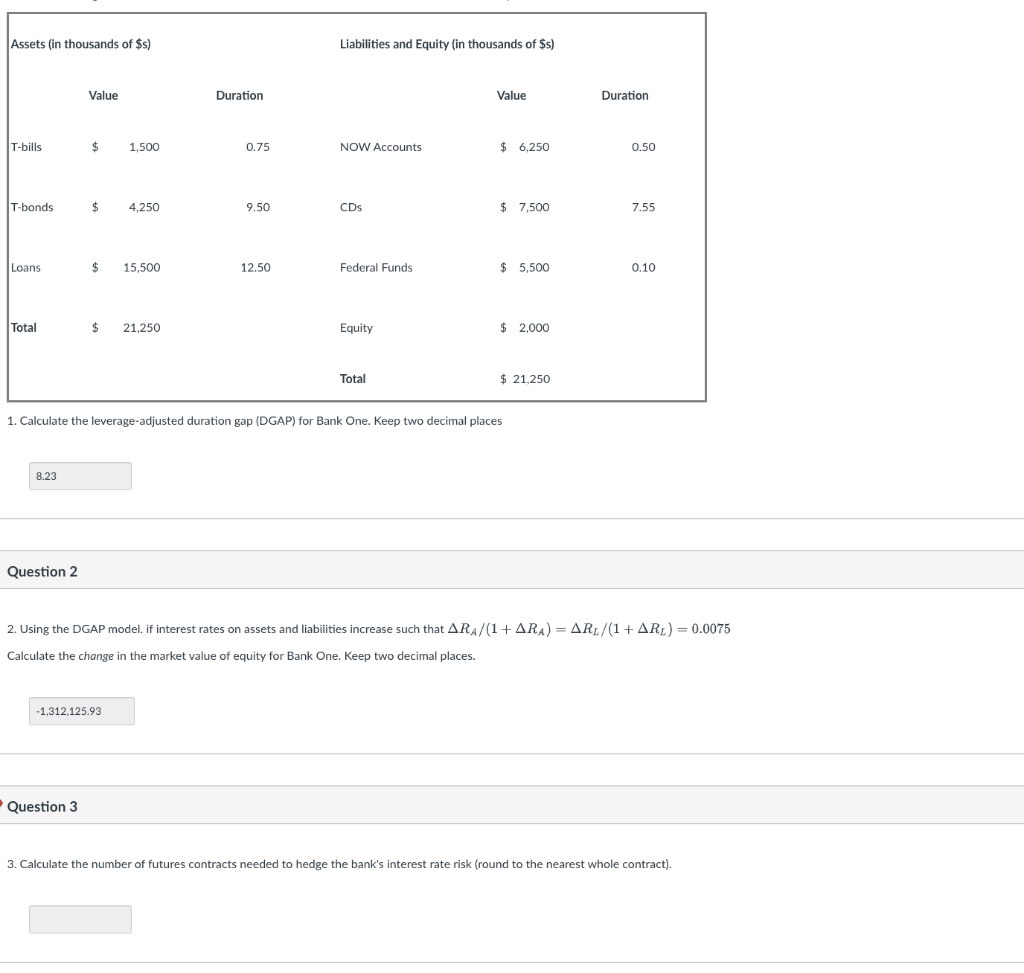

1. Calculate the leverage-adjusted duration gap (DGAP) for Bank One. Keep two decimal places Question 2 2. Using the DGAP model. if interest rates on assets and liabilities increase such that RA/(1+RA)=RL/(1+RL)=0.0075 Calculate the change in the market value of equity for Bank One. Keep two decimal places. Question 3 3. Calculate the number of futures contracts needed to hedge the bank's interest rate risk (round to the nearest whole contract). 1. Calculate the leverage-adjusted duration gap (DGAP) for Bank One. Keep two decimal places Question 2 2. Using the DGAP model. if interest rates on assets and liabilities increase such that RA/(1+RA)=RL/(1+RL)=0.0075 Calculate the change in the market value of equity for Bank One. Keep two decimal places. Question 3 3. Calculate the number of futures contracts needed to hedge the bank's interest rate risk (round to the nearest whole contract)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts