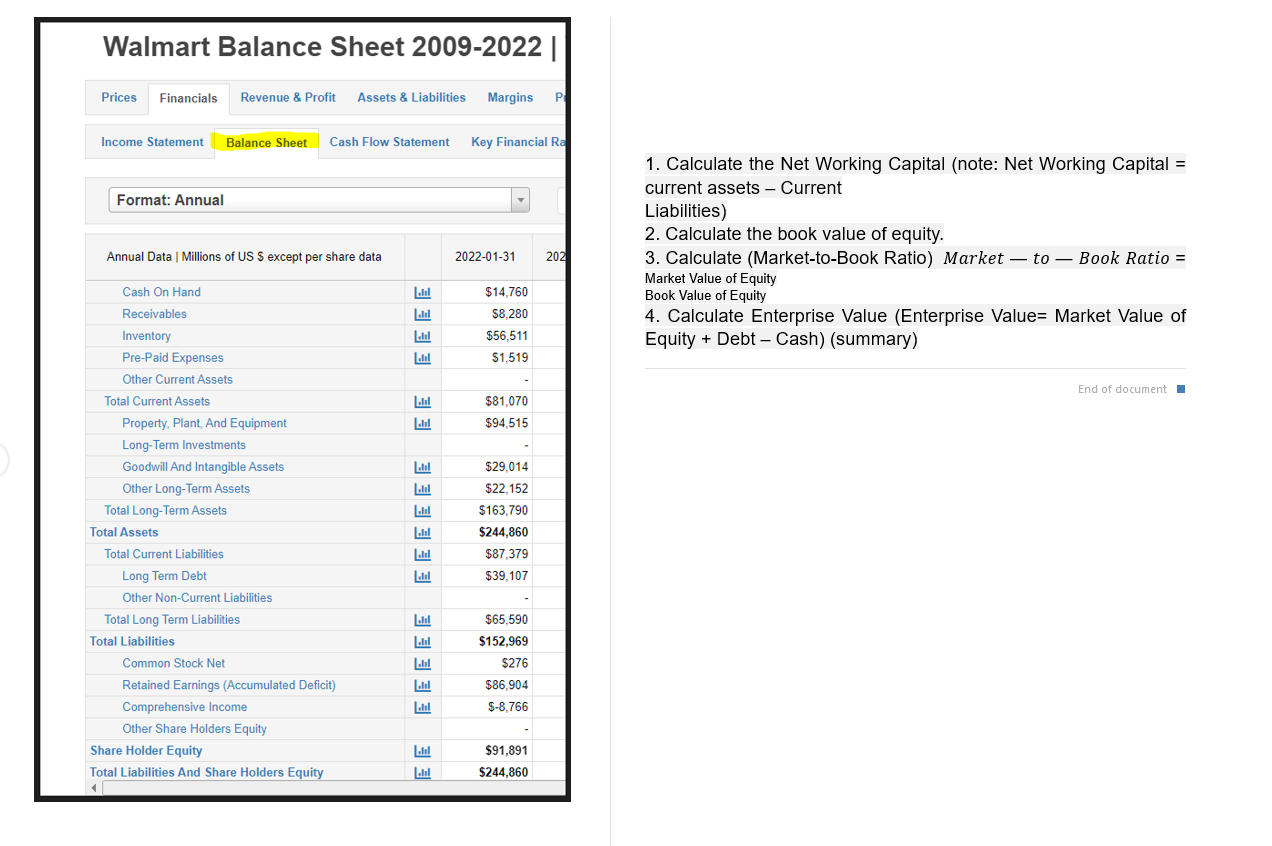

Question: 1. Calculate the Net Working Capital (note: Net Working Capital = current assets - Current Liabilities) 2. Calculate the book value of equity. 3. Calculate

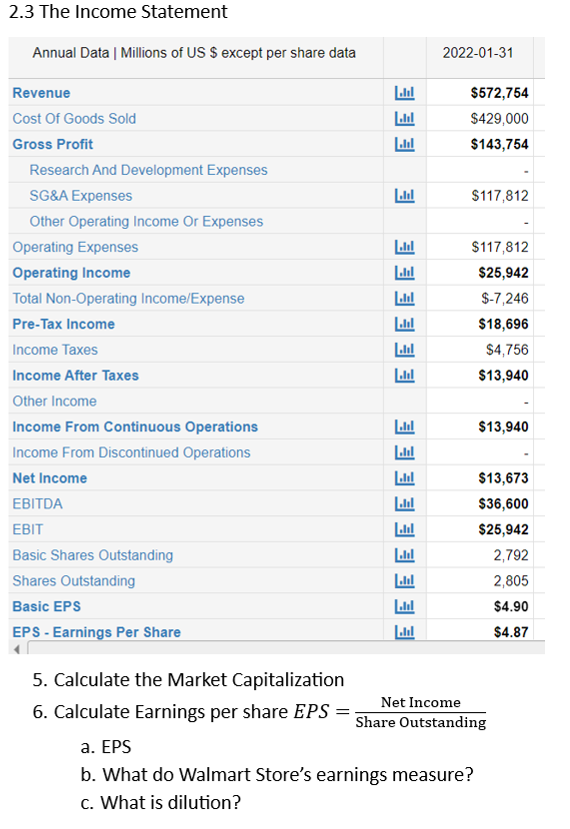

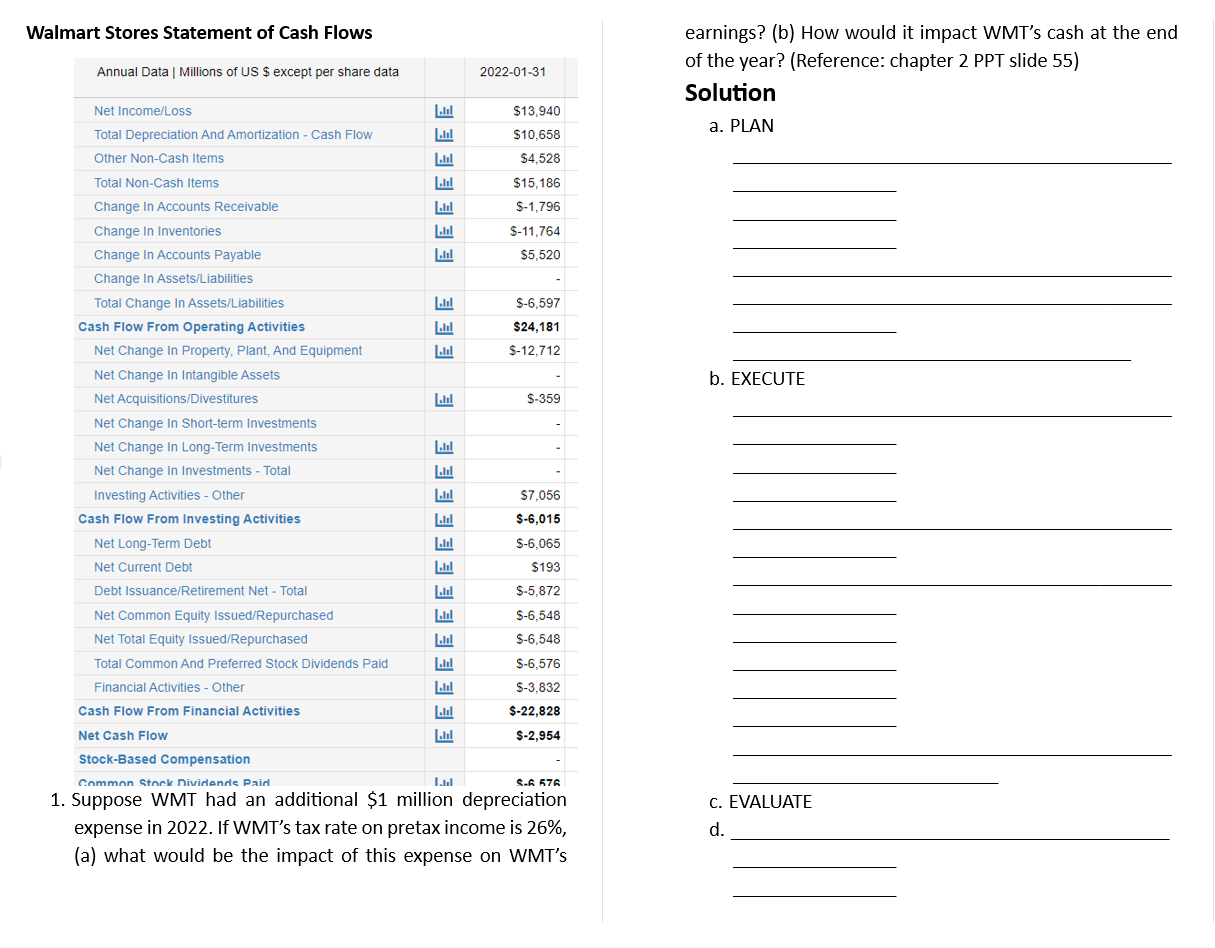

1. Calculate the Net Working Capital (note: Net Working Capital = current assets - Current Liabilities) 2. Calculate the book value of equity. 3. Calculate (Market-to-Book Ratio) Market - to - Book Ratio = Market Value of Equity Book Value of Equity 4. Calculate Enterprise Value (Enterprise Value= Market Value of Equity + Debt Cash) (summary) 6. Calculate Earnings per share EPS=ShareOutstandingNetIncome a. EPS b. What do Walmart Store's earnings measure? c. What is dilution? Walmart Stores Statement of Cash Flows ! 1. . . expense in 2022. If WMT's tax rate on pretax income is 26%, (a) what would be the impact of this expense on WMT's 1. Calculate the Net Working Capital (note: Net Working Capital = current assets - Current Liabilities) 2. Calculate the book value of equity. 3. Calculate (Market-to-Book Ratio) Market - to - Book Ratio = Market Value of Equity Book Value of Equity 4. Calculate Enterprise Value (Enterprise Value= Market Value of Equity + Debt Cash) (summary) 6. Calculate Earnings per share EPS=ShareOutstandingNetIncome a. EPS b. What do Walmart Store's earnings measure? c. What is dilution? Walmart Stores Statement of Cash Flows ! 1. . . expense in 2022. If WMT's tax rate on pretax income is 26%, (a) what would be the impact of this expense on WMT's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts