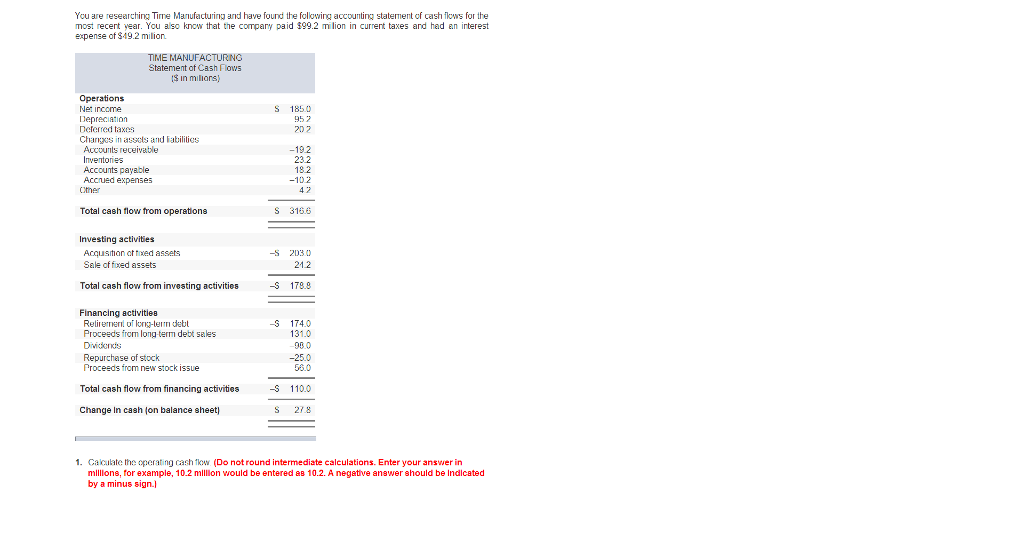

Question: 1. Calculate the operating cash flow. (Do not round intermediate calculations. Enter your answer in millions, for example, 10.2 million would be entered as 10.2.

| 1. Calculate the operating cash flow. (Do not round intermediate calculations. Enter your answer in millions, for example, 10.2 million would be entered as 10.2. A negative answer should be indicated by a minus sign.) 2. Calculate the capital spending. (Do not round intermediate calculations. Enter your answer in millions, for example, 10.2 million would be entered as 10.2. A negative answer should be indicated by a minus sign.) 3. Calculate the net working capital cash flow. (Do not round intermediate calculations. Enter your answer in millions, for example, 10.2 million would be entered as 10.2. A negative answer should be indicated by a minus sign.)

|

You are researching Tire Manufacturing and have found the following accounting statement of cash nows for the most recent year. You also know that the compary paid $99.2 mi lion in current taxes and had an interest expense of $49.2 milion TIME MANUFACTURNG Statement of Cash Flows is in milions Operations Ne: incame Depreciation Deferred taxns Chas in assols and Fatililics S 1850 952 20 2 Accounts receivable Inventories Accounts payable Accrued expenses 192 232 18.2 -10 2 4 2 Cither Total cash flow from operations s 3166 Investing aetivities Acqushan cttxed assets Sale of fixed assets -S 2D3 21.2 Total cash flow from investing activities -S 1799 Financing activities Relieere db Proceeds from long term debt sales - 174.0 131.0 980 -25.0 530 Repurchase of stock Proceeds frem new stock issue Total cash flow from financing activities 110.0 Change In cash (on balance sheet S 27.8 1. Cacuate the operating cash ow (Do not round intermediate calculations. Enter your answer in millons, for example, 10.2 mlliion would be entered as 10.2. A negative answer should be Indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts