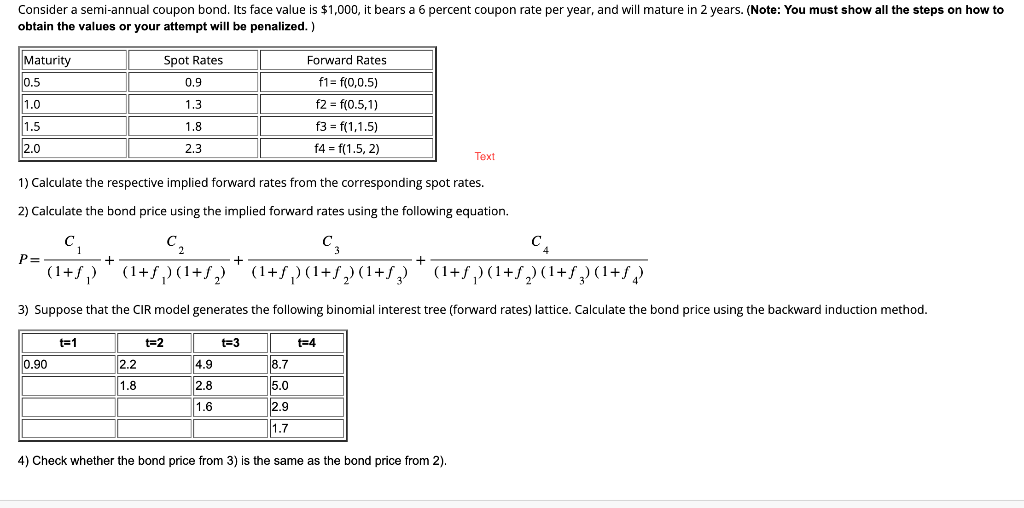

Question: 1) Calculate the respective implied forward rates from the corresponding spot rates. 2) Calculate the bond price using the implied forward rates using the following

1) Calculate the respective implied forward rates from the corresponding spot rates. 2) Calculate the bond price using the implied forward rates using the following equation. P=(1+f1)C1+(1+f1)(1+f2)C2+(1+f1)(1+f2)(1+f3)C3+(1+f1)(1+f2)(1+f3)(1+f4)C4 3) Suppose that the CIR model generates the following binomial interest tree (forward rates) lattice. Calculate the bont 4) Check whether the bond price from 3 ) is the same as the bond price from 2). 1) Calculate the respective implied forward rates from the corresponding spot rates. 2) Calculate the bond price using the implied forward rates using the following equation. P=(1+f1)C1+(1+f1)(1+f2)C2+(1+f1)(1+f2)(1+f3)C3+(1+f1)(1+f2)(1+f3)(1+f4)C4 3) Suppose that the CIR model generates the following binomial interest tree (forward rates) lattice. Calculate the bont 4) Check whether the bond price from 3 ) is the same as the bond price from 2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts