Question: 1) Calculated the excess/difference. 2) Calculate the goodwill/BPG PROBLEM #1: Equity Method Analysis (20 points) Refer to this data for questions 16-21 Poppy Corporation paid

1) Calculated the excess/difference.

2) Calculate the goodwill/BPG

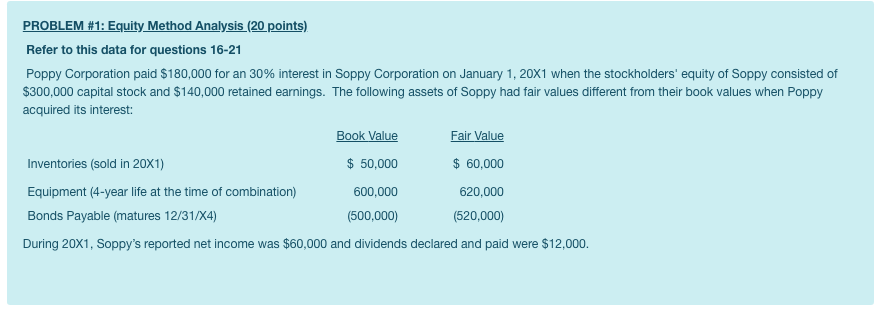

PROBLEM #1: Equity Method Analysis (20 points) Refer to this data for questions 16-21 Poppy Corporation paid $180,000 for an 30% interest in Soppy Corporation on January 1, 20x1 when the stockholders' equity of Soppy consisted of $300,000 capital stock and $140,000 retained earnings. The following assets of Soppy had fair values different from their book values when Poppy acquired its interest: Book Value Fair Value Inventories (sold in 20X1) $ 50,000 $ 60,000 Equipment (4-year life at the time of combination) 600,000 620,000 Bonds Payable (matures 12/31/X4) (500,000) (520,000) During 20X1, Soppy's reported net income was $60,000 and dividends declared and paid were $12,000. PROBLEM #1: Equity Method Analysis (20 points) Refer to this data for questions 16-21 Poppy Corporation paid $180,000 for an 30% interest in Soppy Corporation on January 1, 20x1 when the stockholders' equity of Soppy consisted of $300,000 capital stock and $140,000 retained earnings. The following assets of Soppy had fair values different from their book values when Poppy acquired its interest: Book Value Fair Value Inventories (sold in 20X1) $ 50,000 $ 60,000 Equipment (4-year life at the time of combination) 600,000 620,000 Bonds Payable (matures 12/31/X4) (500,000) (520,000) During 20X1, Soppy's reported net income was $60,000 and dividends declared and paid were $12,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts