Question: 1. Capital allocation process The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries,

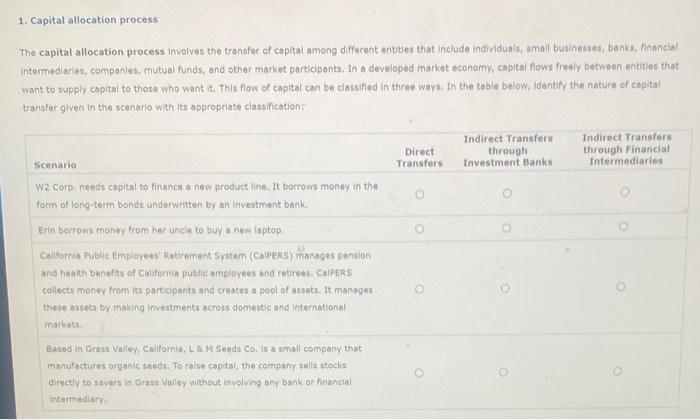

1. Capital allocation process The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries, companies, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be classified in three ways. In the table below, Identify the nature of capital transfer given in the scenario with its appropriate classification: Scenario W2 Corp. needs capital to finance a new product line. It borrows money in the form of long-term bonds underwritten by an investment bank. Erin borrows money from her uncle to buy a new laptop California Public Employees' Retirement System (CalPERS) manages pension and health benefits of California public employees and retirees. CalPERS collects money from its participants and creates a pool of assets. It manages these assets by making investments across domestic and International markets. Based in Grass Valley, California, L & M Seeds Co. is a small company that manufactures organic seeds. To raise capital, the company sells stocks directly to savers in Grass Valley without involving any bank or financial intermediary Direct Transfers. Indirect Transfers through Investment Banks Indirect Transfers through Financial Intermediaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts